Hong Kong Form Transfer

What is the Hong Kong Form Transfer

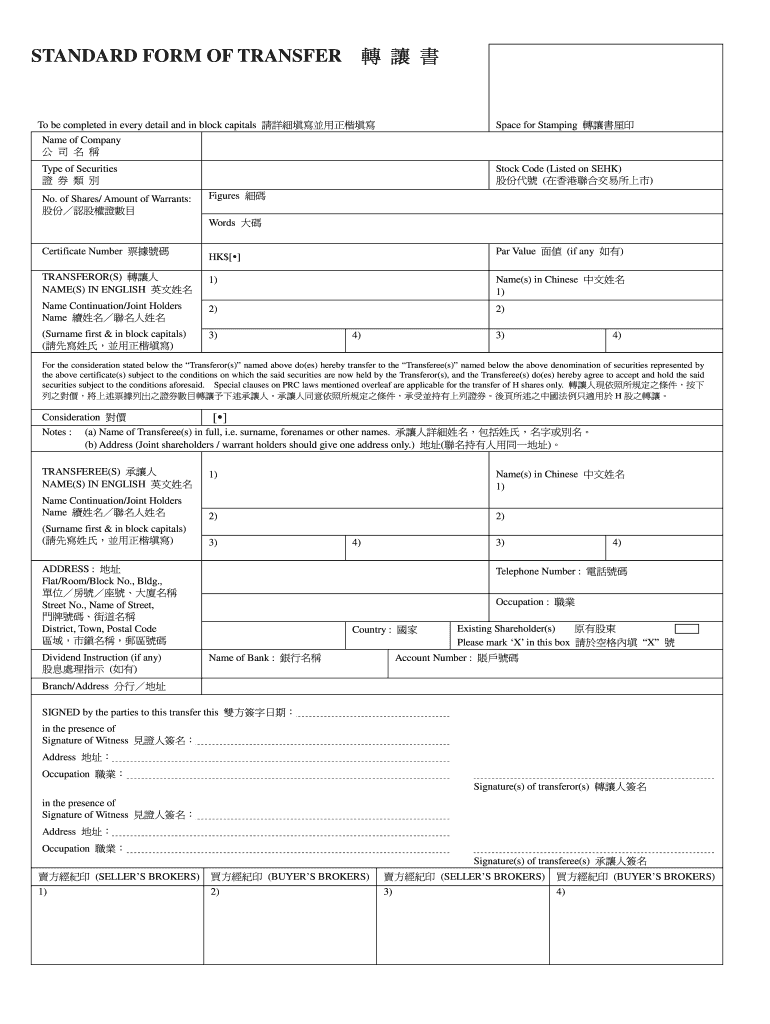

The Hong Kong Form Transfer is a legal document used to facilitate the transfer of ownership of assets, such as shares or property, within the jurisdiction of Hong Kong. This form serves as an official record of the transaction, ensuring that the transfer is recognized by relevant authorities. It typically includes essential details such as the names of the transferor and transferee, a description of the asset being transferred, and any applicable terms and conditions. Understanding this form is crucial for individuals and businesses involved in asset transactions in Hong Kong.

How to use the Hong Kong Form Transfer

Using the Hong Kong Form Transfer involves several straightforward steps. First, gather all necessary information about the asset being transferred, including its current ownership details and any relevant identification numbers. Next, fill out the form accurately, ensuring that all sections are completed, including the names and signatures of both parties involved in the transfer. After completing the form, it may need to be submitted to the appropriate regulatory body or authority to finalize the transfer process. It is essential to keep a copy of the completed form for your records.

Steps to complete the Hong Kong Form Transfer

Completing the Hong Kong Form Transfer requires careful attention to detail. Follow these steps for a successful submission:

- Gather all necessary documentation related to the asset.

- Provide accurate details of the transferor and transferee, including full names and addresses.

- Describe the asset being transferred, including any unique identifiers.

- Ensure all required fields are filled out completely.

- Sign the form in the designated areas, ensuring both parties have signed.

- Submit the form to the relevant authority, if required, and retain a copy for your records.

Legal use of the Hong Kong Form Transfer

The legal use of the Hong Kong Form Transfer is vital for ensuring that asset transfers are recognized and enforceable under local law. This form must be completed in accordance with relevant regulations to prevent disputes or legal challenges. It is essential to verify that the form complies with the specific requirements outlined by the Hong Kong Companies Registry or other applicable authorities. Failure to adhere to these legal standards may result in the transfer being deemed invalid.

Key elements of the Hong Kong Form Transfer

Several key elements must be included in the Hong Kong Form Transfer to ensure its validity:

- Transferor and transferee information: Full names and contact details.

- Description of the asset: Detailed information about the shares or property being transferred.

- Consideration: The value or payment involved in the transfer.

- Signatures: Required signatures from both parties to validate the transaction.

- Date of transfer: The date on which the transfer takes effect.

Required Documents

To complete the Hong Kong Form Transfer, certain documents may be required. These typically include:

- Proof of identity for both the transferor and transferee.

- Original share certificates or title deeds, if applicable.

- Any prior agreements related to the transfer.

- Additional forms or documentation as specified by the relevant authority.

Quick guide on how to complete how to fill standard form

A concise manual on how to create your Hong Kong Form Transfer

Locating the right template can be a daunting task when you’re required to submit official international documentation. Even if you possess the necessary form, it might be tedious to swiftly fill it out in accordance with all the specifications if you rely on paper copies instead of handling everything digitally. airSlate SignNow serves as the online eSignature platform that enables you to navigate through these challenges. It empowers you to obtain your Hong Kong Form Transfer and easily fill it out and sign it on-site without having to reprint documents whenever you make a typo.

Follow these steps to create your Hong Kong Form Transfer with airSlate SignNow:

- Press the Get Form button to upload your document to our editor immediately.

- Begin with the first blank section, enter the details, and continue with the Next feature.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important information.

- Click on Image and upload one if your Hong Kong Form Transfer requires it.

- Use the right-side panel to add more fields for you or others to fill in if needed.

- Review your responses and authorize the form by clicking Date, Initials, and Sign.

- Create, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing the form by clicking the Done button and choosing your file-sharing preferences.

After your Hong Kong Form Transfer is ready, you can distribute it however you choose - send it to your recipients through email, SMS, fax, or even print it directly from the editor. You can also securely save all your completed documents in your account, arranged in folders according to your liking. Don’t squander time on manual document filling; opt for airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

How do I prepare for the UPSC exams after 12th?

First of all, if you have made up your mind to go for civil services exam, stay determined and stand for your decision. Stay away from all negativity or pessimism.Now coming to how you should prepare. Get syllabus of the exam and read it thoroughly. Then do the following.Firstly, the golden rule to the IAS exam is to start with the basics and this is really very important. Start reading NCERT books of the prescribed syllabus such as History (old ncert), Geography, Civics etc. These will help you develop a basic understanding and clarity of the concepts. It will also lay a foundation for the advanced study. NEVER skip NCERTs, never!!!Secondly, develop a habit of reading newspaper. Any one good newspaper like The Hindu or Indian Express would do. This will help you get an overview of daily happenings and you would be able to relate things with your syllabus and exam pattern. Don't stress out on current affairs as most probably you would be appearing three years from now on. Just try to understand how things work in day to day life when it comes to Polity, Environment, Economics etc.Third, keep in mind the syllabus and exam pattern. Never study unnecessary stuff. It's more important what not to study than what to study. Don't just create a library at your home. Use study material wisely, and since it's your beginning, don't jump the gun. In enthusiasm to gather more knowledge, many freshers just buy books by tons. Avoid this.Fourth, use social media efficiently. Believe me from social media you can learn a lot provided you follow right track. “Like” pages of genuine newspapers like The Hindu, Down to Earth, preparation portals like Insights on India and Unacademy (avoid Zee News, Republic TV like non-informative pages). We open Facebook (assuming you didn't deactivate it after Cambridge Analytica scandal) many times in a day but we won't open the above mentioned sources more than twice a day to be honest. But on Facebook you can read things on the go and learn as well.This is enough for now. Many things will follow as you will go through the preparation.Best of luck. In case you follow this suggestion and crack IAS exam, mention me in your speech :)

-

While filling out all MBA forms, what should I write for my Standard X percentage?

What do you want to know about: Percentile (which your question says) or percentage (which is mentioned in detail) ?Since MBA forms don’t ask for percentile of X, I’m answering about percentage.If your mark sheet has percentage mentioned over it, the same needs to be written for your MBA forms, no matter how is it calculated.If subjects and your exam score is mentioned, take best 5 as per the rules of your school board e.g. for I.S.C. English is to be compulsorily added for best 5.A percentage or two here and there won’t make a difference to your admission process and later in life (unless you are on border of 60% or 75% or 80% as few companies have a cut-off which comes into picture when they come for recruitment). All you need to make sure is you get a great percentile in the competitive exam for MBA.

-

Would it be all right to name your kid Yahweh? I’m not religious but find the name to be beautiful.

NO!Yahweh is not a good name for a child.Why not? I can guarantee, unless you live in an incredibly remote area of the world, your child will meet at least one Jew in his/her lifetime. Jews, even the most reformed ones, will be offended when people write or say the name of their god aloud. They use all sorts of euphemisms.The second reason is, even if there are no Jewish people where you live, children will taunt your child. And your little one will have to fill out all kinds of forms when they are older. If your child says at his/her job interview that his/her name is Yahweh, would people take him/her seriously? No.My school name is Amanda, and I get taunted for it. That is such a normal English name. Imagine how worse it would be if the name was something outrageous.Thirdly, how would you like to be called ‘God’?Notes:Some people have asked me why I get taunted for the name Amanda. My name is pronounced in fake accents. It rhymes with panda. And it's not my official birth name.Others have asked me, if it's not acceptable to call your kid Yahweh, then why are some Hispanic people named Jesus? Well, if it's pronounced ‘hay-zoos', it's a standardized and traditional name, so it's acceptable. Yahweh, and a name pronounced ‘jee-zus', is not.

Create this form in 5 minutes!

How to create an eSignature for the how to fill standard form

How to generate an electronic signature for the How To Fill Standard Form online

How to create an electronic signature for your How To Fill Standard Form in Chrome

How to make an electronic signature for signing the How To Fill Standard Form in Gmail

How to generate an eSignature for the How To Fill Standard Form from your mobile device

How to generate an eSignature for the How To Fill Standard Form on iOS

How to make an eSignature for the How To Fill Standard Form on Android

People also ask

-

What is airSlate SignNow and how does it relate to Hong Kong transfer?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents efficiently. For those involved in a Hong Kong transfer, it offers a streamlined way to handle documentation, ensuring that all legal requirements are met quickly and efficiently.

-

How much does airSlate SignNow cost for a Hong Kong transfer business?

The pricing for airSlate SignNow varies based on subscription plans, which are designed to be cost-effective. For businesses involved in a Hong Kong transfer, it's important to explore these plans as they can cater to different needs and volumes of document handling.

-

What features does airSlate SignNow offer for Hong Kong transfer processes?

airSlate SignNow provides features like secure e-signatures, document templates, and advanced tracking. These features are essential for businesses managing Hong Kong transfer, allowing for compliance and security in every transaction.

-

Can I integrate airSlate SignNow with other tools for Hong Kong transfer management?

Yes, airSlate SignNow offers integrations with various tools such as CRM systems, cloud storage solutions, and payment processors. This is particularly beneficial for companies managing Hong Kong transfer documents, as it helps in maintaining smooth workflows.

-

How does airSlate SignNow ensure the security of documents for Hong Kong transfers?

airSlate SignNow employs industry-standard encryption and compliance with global regulations to protect your documents. For Hong Kong transfer users, this level of security ensures that sensitive information remains confidential throughout the signing process.

-

Is airSlate SignNow easy to use for beginners in Hong Kong transfer?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for beginners to master. This is particularly advantageous for newcomers to Hong Kong transfer, simplifying the process of eSigning without extensive training.

-

What are the benefits of using airSlate SignNow for my Hong Kong transfer needs?

Using airSlate SignNow for Hong Kong transfer provides numerous benefits including reduced turnaround times, cost savings on printing and mailing, and enhanced compliance. These advantages help businesses operate more efficiently and effectively in the competitive market.

Get more for Hong Kong Form Transfer

- This office lease agreement is made entered into and executed this the day of form

- Amended and restated bylaws of netflix inc secgov form

- Pursuant to the operating agreement of a form

- Employee agreement guidelegalzoomcom form

- Non solicitation everything you need to know upcounsel form

- Notice of filing of a proposed rule change to amend the certificate of form

- Proxy statements strategy amp form

- Convertible note agreement legal formalllaw

Find out other Hong Kong Form Transfer

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document