Fa Form 3 2000-2026

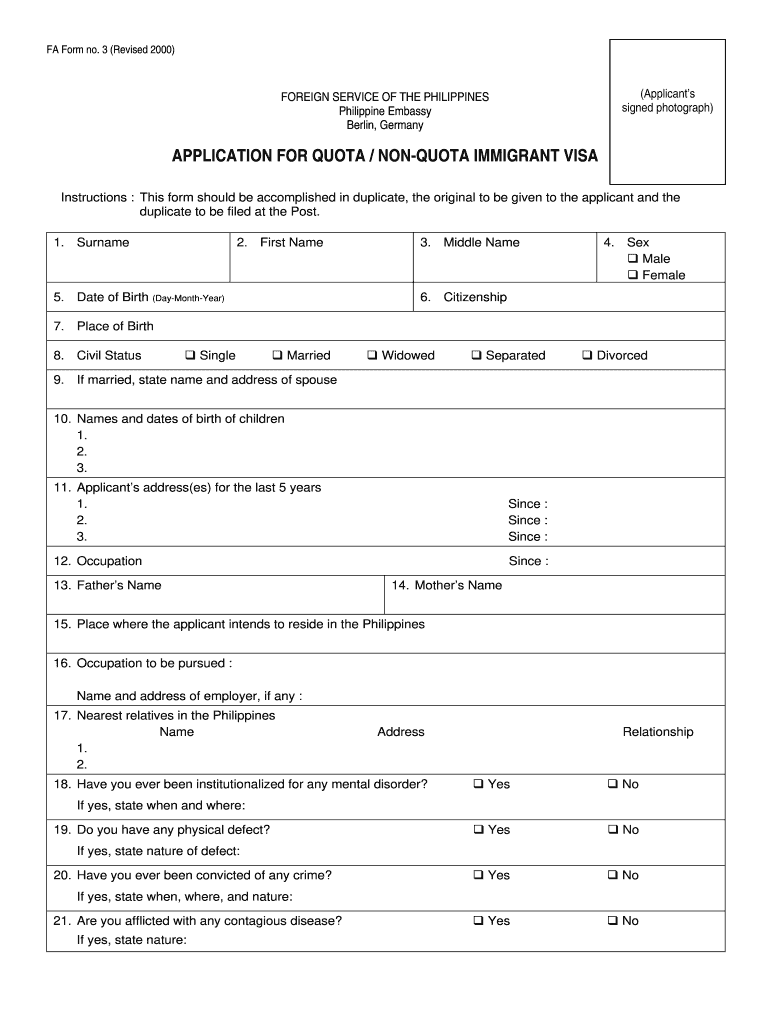

What is the Philippines Form 3 Visa?

The Philippines Form 3 Visa, also known as the FA Form 3, is a crucial document for individuals seeking to enter the Philippines for various purposes, including work, study, or family reunification. This visa type is essential for those who meet specific eligibility criteria and wish to ensure compliance with Philippine immigration laws. Understanding the purpose and requirements of the Form 3 Visa is vital for a smooth application process.

Steps to Complete the Philippines Form 3 Visa

Completing the Philippines Form 3 Visa involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including identification and proof of eligibility. Next, fill out the form with precise information, ensuring that all required fields are completed. It is crucial to double-check for any errors or omissions, as incomplete applications may lead to delays or rejections. After completing the form, submit it through the appropriate channels, whether online or in person, as specified by the Philippine consulate or embassy.

Required Documents for the Philippines Form 3 Visa

When applying for the Philippines Form 3 Visa, specific documents are required to support your application. These typically include:

- A valid passport with at least six months of validity remaining.

- Recent passport-sized photographs that meet official specifications.

- Proof of financial capacity, such as bank statements or sponsorship letters.

- Documentation supporting the purpose of your visit, such as employment letters or school enrollment confirmations.

Ensure that all documents are current and accurately reflect your situation to avoid complications during the application process.

Legal Use of the Philippines Form 3 Visa

The Philippines Form 3 Visa serves as a legal entry permit for individuals meeting the necessary criteria. It is essential to understand that using the visa for purposes other than those stated in the application can lead to legal consequences, including revocation of the visa or deportation. Adhering to the terms and conditions associated with the visa is crucial for maintaining legal status while in the Philippines.

Application Process & Approval Time for the Philippines Form 3 Visa

The application process for the Philippines Form 3 Visa involves submitting the completed form along with the required documents to the appropriate Philippine embassy or consulate. The processing time can vary based on several factors, including the volume of applications and the specific circumstances of each case. Generally, applicants should allow for several weeks for processing, so it is advisable to apply well in advance of any planned travel dates.

Eligibility Criteria for the Philippines Form 3 Visa

To qualify for the Philippines Form 3 Visa, applicants must meet specific eligibility criteria. These may include:

- Having a valid reason for entering the Philippines, such as employment, education, or family ties.

- Demonstrating sufficient financial resources to support oneself during the stay.

- Possessing a clean legal record without prior immigration violations.

Understanding these criteria is essential for a successful application and to ensure compliance with Philippine immigration regulations.

Quick guide on how to complete fa form 3

A brief manual on how to assemble your Fa Form 3

Finding the appropriate template can be difficult when you need to produce formal international documentation. Even if you possess the form required, it might be cumbersome to promptly fill it out according to all the stipulations if you rely on printed versions instead of handling everything digitally. airSlate SignNow is the web-based eSignature platform that assists you in navigating through that. It allows you to select your Fa Form 3 and swiftly complete and endorse it on-site without needing to reprint documents in case of any typos.

Here are the actions you must undertake to set up your Fa Form 3 with airSlate SignNow:

- Hit the Get Form button to instantly incorporate your document into our editor.

- Begin with the first available space, input your information, and move on with the Next tool.

- Complete the empty fields using the Cross and Check options from the upper panel.

- Choose the Highlight or Line features to emphasize the most essential details.

- Click on Image and upload one if your Fa Form 3 necessitates it.

- Utilize the right-side panel to add additional fields for you or others to fill in if necessary.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and selecting your file-sharing preferences.

Once your Fa Form 3 is ready, you can distribute it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also safely store all your completed documents in your account, organized in folders based on your preferences. Don’t squander time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How should I start preparing for USMLE step 1?

It is okay to loose touch. It is okay even though it is not supposed to happen. It is okay that you have forgotten that the root values of Axillary nerve is C5, C6, C7, C8, T1 but ulnar nerve has root value of C8, T1. You know you will have to read again and it is perfectly alright. But if only you knew why Axillary nerve and ulnar nerve has the said specific roots, you will remember them in future without having to go through the entire thing. You should read in a way such that you understand why things are the way they are. There is always a reason. And, there is always an answer. ~Dr.House That's what you should be doing in the final year of MBBS if you haven't applied this technique so far. If you can understand what you are reading, you will be adding that to your USMLE prep. Follow your medicine along with Pathoma and Goljan; Pharmacology; if possible physiology ( must for Cardio and renal ) Follow your Surgery along with Anatomy Do your entire Gynecology with focus on ovarian tumors and physiology Try to get the developmental milestones perfectly out of your peads study. Do your clinical rounds. Don't bump them. And, start your First Aid read for the systemic chapters. By the end of the year, if you can get these done, you will be on a safe side. Don't try to touch MicrobiologyBiochemistryBehavioural Sciences These are volatile and will require steady last minute prep solidly. Apart from that, try to get involved in research, case and paper presentations, volunteer work. They will add to your CV and help you during your residency. I wish I had someone to tell me all this when I was in my final year. Good luck!

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

Create this form in 5 minutes!

How to create an eSignature for the fa form 3

How to generate an eSignature for your Fa Form 3 online

How to generate an eSignature for your Fa Form 3 in Chrome

How to create an electronic signature for signing the Fa Form 3 in Gmail

How to generate an electronic signature for the Fa Form 3 right from your smartphone

How to make an eSignature for the Fa Form 3 on iOS devices

How to create an electronic signature for the Fa Form 3 on Android OS

People also ask

-

What is the Fa Form 3 and how is it used?

The Fa Form 3 is a document used for various administrative purposes, often requiring signatures for validation. With airSlate SignNow, you can easily eSign the Fa Form 3, ensuring a streamlined process for approvals. This helps businesses reduce time spent on paperwork and enhance efficiency.

-

How can airSlate SignNow assist with the completion of the Fa Form 3?

airSlate SignNow offers a user-friendly platform that simplifies the completion of the Fa Form 3. You can fill out the form electronically, add signatures, and send it for approvals all in one place. This reduces the hassle of manual paperwork and speeds up the entire process.

-

What are the pricing options for using airSlate SignNow for the Fa Form 3?

airSlate SignNow provides flexible pricing plans that cater to different business needs, making it affordable to manage the Fa Form 3. Whether you're a small business or a large enterprise, you can find a plan that fits your budget. Additionally, you can take advantage of a free trial to explore the features before committing.

-

Are there any integrations available for managing the Fa Form 3 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to help you manage the Fa Form 3 effectively. You can connect with popular tools like Google Drive, Salesforce, and Dropbox, allowing for easy access and management of your documents. This integration enhances your workflow and makes it easier to handle multiple documents.

-

What security features does airSlate SignNow offer for the Fa Form 3?

Security is a top priority for airSlate SignNow, especially when dealing with important documents like the Fa Form 3. The platform employs robust encryption, secure cloud storage, and compliance with industry standards to protect your data. This ensures that your documents are safe and secure during the signing process.

-

Can I track the status of the Fa Form 3 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Fa Form 3 in real time. You will receive notifications when the document is viewed, signed, or completed, giving you complete visibility and control over your documents. This feature is crucial for managing deadlines and ensuring timely approvals.

-

What are the benefits of using airSlate SignNow for the Fa Form 3 compared to traditional methods?

Using airSlate SignNow for the Fa Form 3 offers numerous benefits over traditional methods, including faster processing times and reduced paper usage. The platform allows for easy editing and signing from any device, streamlining your workflow. This not only saves time but also improves overall productivity.

Get more for Fa Form 3

- 26 printable free small estate affidavit form templates fillable

- Construction pricing and contracting form

- How to form a corporation in ohionolo

- Affidavit of current balance due on garnishment order judgment debtors form

- Filing garn the municipal court of montgomery county ohio form

- Collecting a judgment franklin county small claims division form

- Decedents estatestark county government form

- 131106 affidavit time period for filing contents ohio revised code form

Find out other Fa Form 3

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online