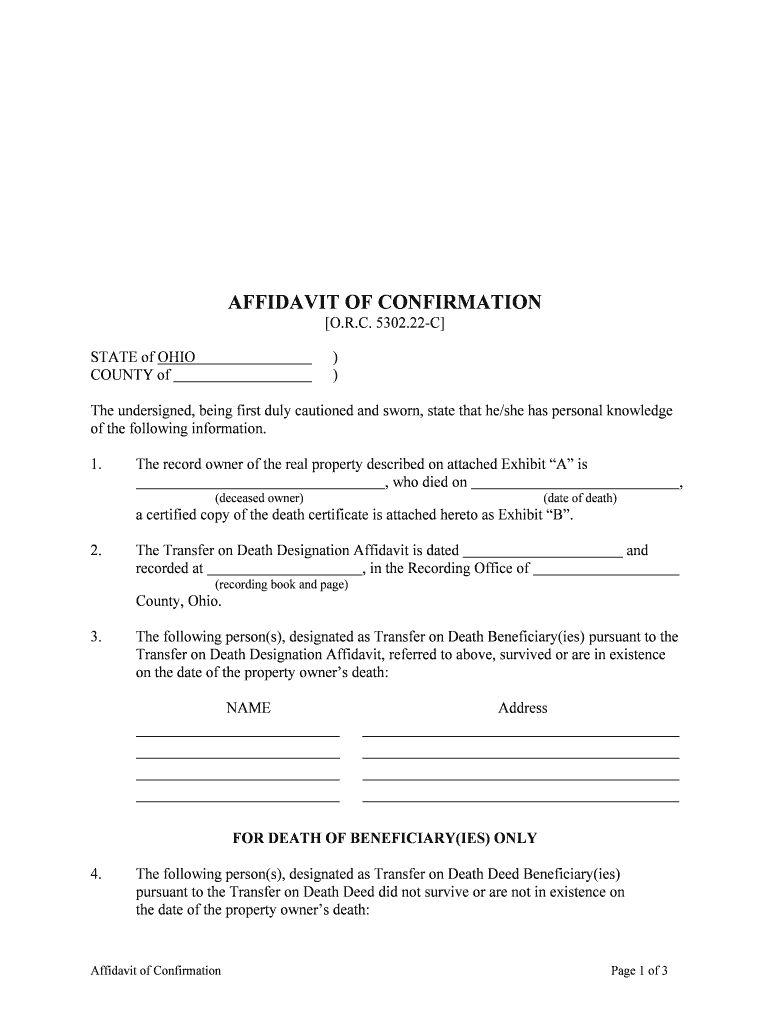

22 C Form

What is the 22 C

The 22 C form is a tax document used primarily for reporting income and deductions for specific types of businesses in the United States. This form is essential for entities such as partnerships and corporations, as it provides the IRS with detailed information about the financial activities of the business. Understanding the purpose and requirements of the 22 C form is crucial for accurate tax reporting and compliance.

How to use the 22 C

Using the 22 C form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form accurately, ensuring that all figures are correct and reflect the business's financial status. Once completed, review the form for any errors before submitting it to the IRS. Utilizing electronic tools can simplify this process, allowing for easier editing and secure submission.

Steps to complete the 22 C

Completing the 22 C form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income and expense reports.

- Fill out the form, ensuring accurate reporting of all income sources and deductions.

- Double-check all entries for accuracy, including calculations.

- Sign and date the form to validate your submission.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the 22 C

The 22 C form is legally binding when completed correctly and submitted in accordance with IRS regulations. It is essential to comply with all legal requirements to avoid penalties or issues with the IRS. This includes ensuring that all information provided is truthful and accurate, as any discrepancies can lead to audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the 22 C form vary depending on the business structure and tax year. Typically, partnerships and corporations must submit their forms by the 15th day of the third month following the end of their tax year. It is crucial to keep track of these dates to ensure timely submission and avoid any late fees or penalties.

Required Documents

To complete the 22 C form, several documents are necessary. These may include:

- Income statements detailing all revenue sources.

- Expense reports that outline all business-related costs.

- Previous tax returns for reference.

- Any supporting documentation for deductions claimed.

Who Issues the Form

The 22 C form is issued by the Internal Revenue Service (IRS). It is important to obtain the most current version of the form directly from the IRS website or authorized tax professionals to ensure compliance with the latest regulations and guidelines.

Quick guide on how to complete 22 c

Complete 22 C effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for standard printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 22 C on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign 22 C without effort

- Locate 22 C and click Get Form to begin.

- Utilize the tools we offer to complete your documentation.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click the Done button to save your alterations.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you select. Edit and eSign 22 C and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 22 C. in the context of airSlate SignNow?

22 C. refers to the cost-effective and user-friendly electronic signature solution offered by airSlate SignNow. This solution enables businesses to securely send and eSign documents, enhancing workflow efficiency and reducing turnaround times.

-

What pricing options are available for 22 C. on airSlate SignNow?

AirSlate SignNow provides various pricing plans tailored to meet different business needs, starting from the basic 22 C. plan to more comprehensive options. Each plan includes features aimed at improving document management efficiencies, with transparent pricing to fit budgets of all sizes.

-

What key features does the 22 C. plan offer?

The 22 C. plan includes essential features such as unlimited electronic signatures, document templates, and mobile access. Additionally, it offers integration capabilities with popular applications, making it a powerful tool for streamlining document workflows.

-

How does 22 C. benefit small businesses?

For small businesses, 22 C. offers an affordable solution that streamlines document signing processes and saves time. With this plan, small companies can enhance their professionalism and efficiency, allowing them to focus more on growth and less on paperwork.

-

Are there integrations available with 22 C. on airSlate SignNow?

Yes, the 22 C. plan includes integration with various applications like Google Drive, Dropbox, and Salesforce. These integrations allow users to seamlessly manage documents and streamline their workflow within the tools they already use.

-

Is customer support included with the 22 C. plan?

Absolutely! The 22 C. plan comes with dedicated customer support to assist users with any queries or issues they may face. Whether it's a technical question or a need for guidance on features, our support team is here to help.

-

What are the security features included in the 22 C. plan?

The 22 C. plan offers robust security features including data encryption, secure audit trails, and compliance with regulations like GDPR and HIPAA. This ensures that all document transactions areSafe and confidential, providing peace of mind for users.

Get more for 22 C

- Zeta phi beta sorority inc state of maryland zeta day zphibmaryland form

- Form 27 condominium resale certificate rev 710

- Health evaluation pre placement history and physical screening beaumont form

- Appendix 6009a our lady of grace school 3427 somerset olgschool form

- Emr psychomotor examination verification form vdh virginia

- Non invasive prenatal testing nipt arup lab test directory form

- Customer acceptance form bmybbvirtualtonebbnetb my virtualtone

- Welcome to the tompkins county public library form

Find out other 22 C

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free