Or Conventional Lender Reflects Our Current Financial Form

What is the Or Conventional Lender Reflects Our Current Financial

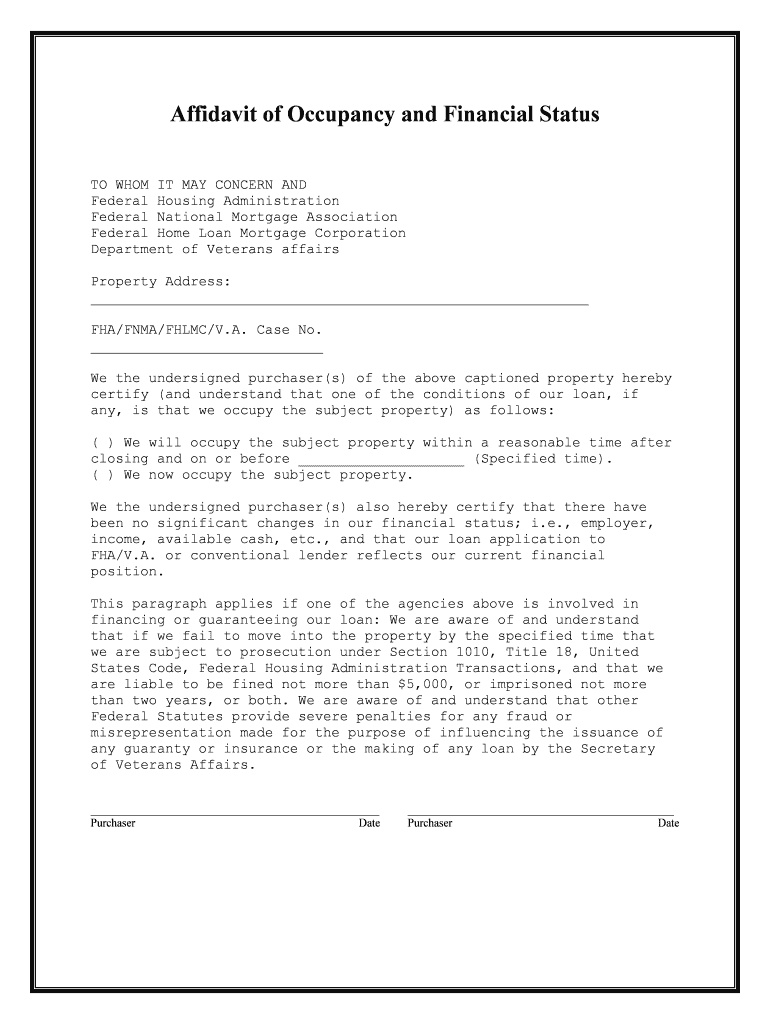

The Or Conventional Lender Reflects Our Current Financial form is a crucial document used in various financial transactions, particularly when applying for loans or mortgages. This form captures essential financial information that lenders use to assess an applicant's creditworthiness and financial stability. It typically includes details about income, assets, liabilities, and other financial obligations. Understanding this form is vital for anyone seeking to engage with conventional lenders, as it directly influences lending decisions.

How to use the Or Conventional Lender Reflects Our Current Financial

Using the Or Conventional Lender Reflects Our Current Financial form involves several steps that ensure all necessary information is accurately provided. Begin by gathering relevant financial documents, such as pay stubs, bank statements, and tax returns. Fill out the form with precise details about your financial situation, ensuring clarity and honesty. Once completed, review the form for any errors before submitting it to the lender. This careful approach helps facilitate a smoother lending process.

Key elements of the Or Conventional Lender Reflects Our Current Financial

Several key elements are essential to the Or Conventional Lender Reflects Our Current Financial form. These include:

- Personal Information: Name, address, and contact details.

- Income Details: Monthly or annual income from all sources.

- Asset Information: Bank accounts, investments, and property ownership.

- Liabilities: Existing debts, including loans and credit card balances.

- Employment History: Current and previous employment details, including job titles and durations.

These elements provide lenders with a comprehensive view of an applicant's financial health, aiding in their decision-making process.

Steps to complete the Or Conventional Lender Reflects Our Current Financial

Completing the Or Conventional Lender Reflects Our Current Financial form requires attention to detail. Follow these steps:

- Gather Documentation: Collect all necessary financial documents.

- Fill Out Personal Information: Enter your name, address, and contact information.

- Detail Income: Provide accurate figures for all sources of income.

- List Assets: Include all valuable assets and their current values.

- Disclose Liabilities: Clearly outline all debts and financial obligations.

- Review for Accuracy: Check all entries for completeness and correctness.

- Submit the Form: Send the completed form to the lender as instructed.

Legal use of the Or Conventional Lender Reflects Our Current Financial

The legal use of the Or Conventional Lender Reflects Our Current Financial form is governed by various regulations that ensure its validity. For the form to be legally binding, it must be completed accurately and honestly. Misrepresentation of information can lead to serious legal consequences, including loan denial or fraud charges. Additionally, lenders must comply with federal and state laws regarding the handling of personal financial information, ensuring that all data is kept confidential and secure.

Eligibility Criteria

Eligibility for using the Or Conventional Lender Reflects Our Current Financial form typically depends on several factors. These include:

- Credit Score: A minimum credit score may be required by lenders.

- Income Level: Applicants must demonstrate sufficient income to support loan repayments.

- Debt-to-Income Ratio: A favorable ratio is often necessary for approval.

- Employment Status: Stable employment history can enhance eligibility.

Understanding these criteria can help applicants prepare better before submitting the form to a lender.

Quick guide on how to complete or conventional lender reflects our current financial

Effortlessly complete Or Conventional Lender Reflects Our Current Financial on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents rapidly, without any holdups. Manage Or Conventional Lender Reflects Our Current Financial across any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The most effective method to modify and eSign Or Conventional Lender Reflects Our Current Financial effortlessly

- Find Or Conventional Lender Reflects Our Current Financial and click on Get Form to commence.

- Utilize the tools we provide to submit your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or errors requiring new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Or Conventional Lender Reflects Our Current Financial while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What makes airSlate SignNow different from a traditional or conventional lender?

airSlate SignNow offers an innovative approach to document handling that is more flexible than what a traditional or conventional lender reflects in their processes. With our platform, you can eSign documents quickly and securely, enhancing efficiency beyond conventional methods.

-

How does airSlate SignNow ensure the security of my documents compared to a conventional lender?

We prioritize your document security by employing advanced encryption technologies and compliance with industry standards. Unlike a conventional lender, which may face standard vulnerabilities, airSlate SignNow consistently reflects our current financial focus on cutting-edge security measures.

-

What are the pricing options for businesses in need of eSigning solutions?

Our pricing is designed to be accessible for businesses of all sizes and budgets. By choosing airSlate SignNow, you can avoid the high fees typically associated with a traditional or conventional lender, reflecting our commitment to delivering cost-effective solutions.

-

What features are included in airSlate SignNow’s eSigning solution?

airSlate SignNow provides a range of features including real-time collaboration, customizable templates, and mobile access. These features stand in contrast to the more rigid offerings of a traditional or conventional lender, reflecting our current financial commitment to user-centric innovation.

-

Can I use airSlate SignNow for international transactions?

Absolutely! airSlate SignNow supports international eSigning, making it easy to conduct business globally. This international capability sets us apart from many conventional lenders that may restrict transactions based on geographical limitations, reflecting our current financial flexibility.

-

How does airSlate SignNow integrate with other business applications?

airSlate SignNow can seamlessly integrate with numerous business applications like Salesforce, Google Drive, and others. These integrations enhance operational efficiency and connect your workflows, reflecting our current financial approach as a holistic solution rather than a conventional lender’s segmented services.

-

Is there customer support available if I encounter issues?

Yes, airSlate SignNow provides dedicated customer support to assist users during their eSigning experience. Unlike conventional lenders, who may limit support availability, our team reflects our current financial commitment to providing consistent customer assistance.

Get more for Or Conventional Lender Reflects Our Current Financial

Find out other Or Conventional Lender Reflects Our Current Financial

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement