Prorated between Grantors and Grantee as of the Date Form

What is the Prorated Between Grantors And Grantee As Of The Date

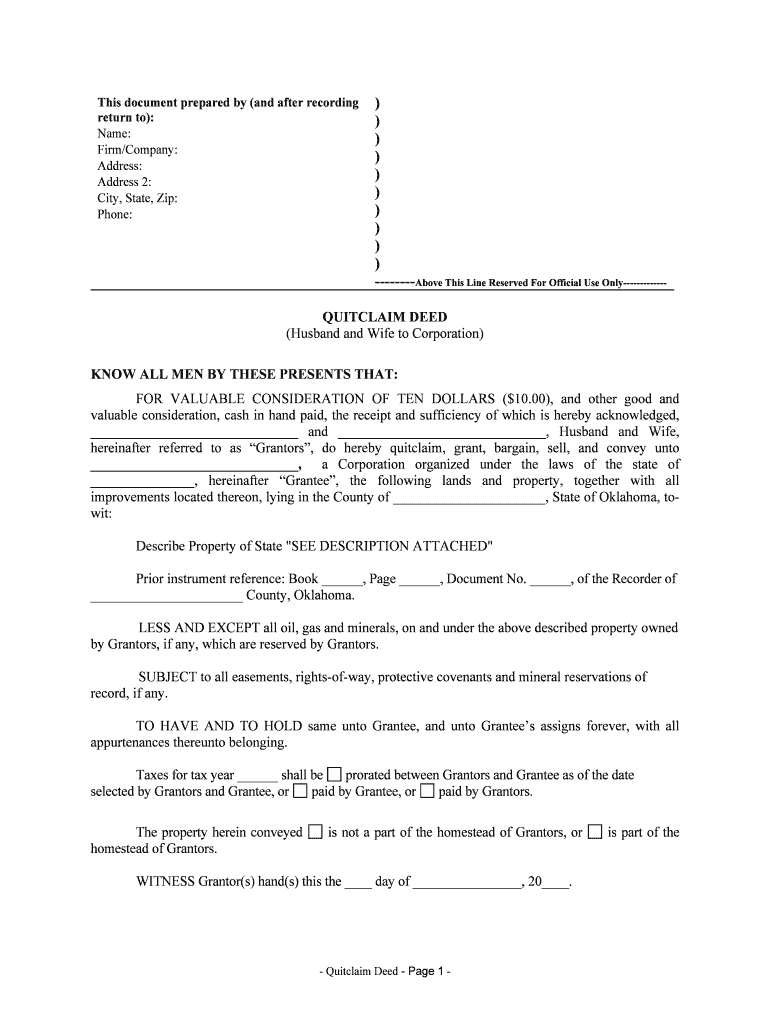

The prorated between grantors and grantee as of the date form is a legal document used in real estate transactions. It outlines the allocation of costs, such as property taxes or homeowners association fees, between the seller (grantor) and the buyer (grantee) based on the date of the property transfer. This ensures that each party pays their fair share of expenses incurred during the ownership period. Understanding this form is crucial for both parties to avoid disputes regarding financial responsibilities after the transaction is completed.

Key Elements of the Prorated Between Grantors And Grantee As Of The Date

This form typically includes several essential components:

- Property Description: Details about the property being transferred, including its address and legal description.

- Transaction Date: The specific date when the property transfer occurs, which is critical for determining prorated amounts.

- Expense Breakdown: A detailed list of expenses being prorated, such as taxes, insurance, and fees.

- Calculation Method: The formula used to determine how costs are divided between the grantor and grantee.

- Signatures: Signatures of both parties, indicating their agreement to the terms outlined in the form.

Steps to Complete the Prorated Between Grantors And Grantee As Of The Date

Completing the prorated between grantors and grantee as of the date form involves several steps:

- Gather Information: Collect necessary details about the property, including the transaction date and relevant expenses.

- Calculate Prorated Amounts: Use the agreed-upon method to determine how costs will be divided based on the transaction date.

- Fill Out the Form: Enter all required information accurately, ensuring clarity in expense breakdowns and calculations.

- Review with Both Parties: Discuss the completed form with both the grantor and grantee to confirm agreement on the terms.

- Sign the Document: Both parties should sign the form to finalize the agreement.

Legal Use of the Prorated Between Grantors And Grantee As Of The Date

The prorated between grantors and grantee as of the date form serves a crucial legal function in real estate transactions. It provides a clear record of how costs are shared, which can help prevent future disputes. In many jurisdictions, having a signed and completed form is essential for ensuring that both parties are held accountable for their financial obligations. Additionally, this form may be required by lenders or title companies during the closing process to ensure all expenses are accurately accounted for.

How to Use the Prorated Between Grantors And Grantee As Of The Date

Using the prorated between grantors and grantee as of the date form is straightforward. After gathering the necessary information and completing the form, both parties should review it carefully. It is advisable to consult with a real estate professional or attorney to ensure all aspects are covered and comply with local laws. Once both parties are satisfied, they can sign and date the document. This completed form should then be kept with other transaction records for future reference.

Examples of Using the Prorated Between Grantors And Grantee As Of The Date

Consider a scenario where a property is sold on June 15. The property tax for the year is $1,200, due in full on December 1. The prorated amount for the seller would be calculated based on the number of days they owned the property in that tax year. In this case, the seller would be responsible for the tax amount from January 1 to June 15, while the buyer would cover the remaining period. This example illustrates how the prorated between grantors and grantee as of the date form facilitates fair financial arrangements in real estate transactions.

Quick guide on how to complete prorated between grantors and grantee as of the date

Complete Prorated Between Grantors And Grantee As Of The Date effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to produce, modify, and eSign your documents swiftly without delays. Handle Prorated Between Grantors And Grantee As Of The Date on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Prorated Between Grantors And Grantee As Of The Date with ease

- Find Prorated Between Grantors And Grantee As Of The Date and then click Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you prefer. Modify and eSign Prorated Between Grantors And Grantee As Of The Date and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Prorated Between Grantors And Grantee As Of The Date' mean in the context of digital documents?

The term 'Prorated Between Grantors And Grantee As Of The Date' refers to the allocation of costs or benefits between the parties involved in an agreement as of a specific date. Understanding this can help ensure clear expectations regarding financial responsibilities when using airSlate SignNow for document eSigning.

-

How can airSlate SignNow help manage prorated agreements?

With airSlate SignNow, you can easily create, send, and eSign documents that involve prorated terms. The platform allows for customizable templates, ensuring that specific details regarding 'Prorated Between Grantors And Grantee As Of The Date' are clearly outlined, improving clarity and reducing disputes.

-

What pricing plans does airSlate SignNow offer for businesses handling prorated contracts?

airSlate SignNow provides several pricing plans designed to suit businesses of different sizes, particularly those that manage prorated contracts. Our plans include various features that accommodate document signing and management needs, thus allowing efficient handling of terms like 'Prorated Between Grantors And Grantee As Of The Date.'

-

What features does airSlate SignNow offer for tracking document status?

airSlate SignNow offers comprehensive tracking features that allow you to monitor the status of documents as they are signed. This includes notifications when a document reflecting 'Prorated Between Grantors And Grantee As Of The Date' is opened, signed, or completed, granting transparency and peace of mind for all parties involved.

-

How does airSlate SignNow ensure the legality of prorated agreements?

airSlate SignNow employs advanced security measures to ensure that all eSigned documents, including those detailing 'Prorated Between Grantors And Grantee As Of The Date,' are legally binding. This includes encryption and compliance with global electronic signature regulations, assuring users that their agreements are protected.

-

Can I integrate airSlate SignNow with other tools for managing prorated agreements?

Yes, airSlate SignNow integrates seamlessly with various applications and tools commonly used for managing agreements, including customer relationship management (CRM) systems. This allows for streamlined processes when dealing with terms like 'Prorated Between Grantors And Grantee As Of The Date,' ensuring a more efficient workflow.

-

What benefits does airSlate SignNow provide for businesses using prorated terms in contracts?

Using airSlate SignNow offers numerous benefits for businesses dealing with prorated terms, such as reduced turnaround time for document completion. The ability to easily define and re-evaluate conditions like 'Prorated Between Grantors And Grantee As Of The Date' streamlines negotiations, making it easier to close deals faster.

Get more for Prorated Between Grantors And Grantee As Of The Date

Find out other Prorated Between Grantors And Grantee As Of The Date

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online