TaxHow Arizona Tax Forms

Understanding Arizona Tax Forms

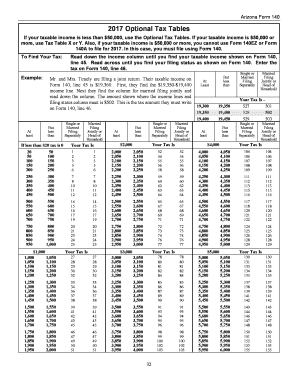

The Arizona tax form is essential for residents and businesses to report their income and calculate their tax obligations. In 2017, the forms included various schedules and tables that detail the specific tax rates applicable to different income brackets. Understanding these forms ensures compliance with state tax laws and helps avoid potential penalties.

Steps to Complete the Arizona Tax Form

Filling out the Arizona tax form involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, determine your filing status, as this will affect your tax rate. Then, use the Arizona tax tables to find the appropriate tax rate based on your income. Carefully fill out the form, ensuring all calculations are accurate. Finally, review the form for completeness before submitting it.

Legal Use of Arizona Tax Forms

Arizona tax forms are legally binding documents that must be filled out accurately and submitted on time. Compliance with state tax laws is crucial to avoid penalties. The forms must be signed and dated, and electronic submissions must meet specific legal standards to be considered valid. Utilizing a reliable eSignature solution can enhance the security and legality of your submission.

Filing Deadlines and Important Dates

For the 2017 tax year, the deadline for filing Arizona tax forms was typically April 15 of the following year. However, extensions may be available under certain circumstances. It's important to keep track of these deadlines to ensure timely submissions and avoid late fees or penalties.

Required Documents for Arizona Tax Filing

When preparing to fill out the Arizona tax form, gather the necessary documents. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for other income

- Records of any deductions or credits claimed

- Previous year's tax return for reference

Having these documents ready will streamline the process and help ensure accuracy.

Form Submission Methods

Arizona tax forms can be submitted in various ways. Taxpayers have the option to file electronically through approved e-filing systems, which can expedite processing times. Alternatively, forms can be mailed to the appropriate state tax office or submitted in person. Each method has its own requirements and timelines, so it is essential to choose the one that best fits your needs.

Examples of Using Arizona Tax Forms

Understanding how to use Arizona tax forms can vary based on individual circumstances. For instance, a self-employed individual may need to complete additional schedules to report business income, while a retiree may have different reporting requirements. Familiarizing yourself with the specific forms applicable to your situation can help ensure compliance and optimize your tax outcomes.

Quick guide on how to complete arizona tax tables

Complete arizona tax tables effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly and without any delays. Manage instrutures to fill out arizona 2017 tax form on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to edit and electronically sign arizona tax brackets without any hassle

- Obtain arizona tax form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you select. Edit and electronically sign arizona tax table 2017 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs arizona use tax form

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

Related searches to az tax forms 2017

Create this form in 5 minutes!

How to create an eSignature for the arizona tax form 2017

How to make an electronic signature for the Taxhow Arizona Tax Forms 2017 in the online mode

How to make an eSignature for the Taxhow Arizona Tax Forms 2017 in Google Chrome

How to make an eSignature for putting it on the Taxhow Arizona Tax Forms 2017 in Gmail

How to create an eSignature for the Taxhow Arizona Tax Forms 2017 straight from your smartphone

How to generate an electronic signature for the Taxhow Arizona Tax Forms 2017 on iOS

How to create an electronic signature for the Taxhow Arizona Tax Forms 2017 on Android OS

People also ask income tax arizona

-

What are the basic instrutures to fill out arizona 2017 tax form?

The basic instrutures to fill out arizona 2017 tax form include providing your personal information, income details, and deductions. Make sure to reference the specific schedules relevant to your tax situation. It's important to thoroughly review each section to ensure accuracy and compliance with state regulations.

-

Are there any costs associated with using airSlate SignNow for tax forms?

AirSlate SignNow offers a variety of pricing plans tailored to businesses of all sizes. Depending on the features and level of service, you can find a plan that suits your budget while still providing you with the necessary tools to manage instrutures to fill out arizona 2017 tax form efficiently.

-

How can airSlate SignNow simplify the completion of arizona 2017 tax forms?

AirSlate SignNow streamlines the process of completing arizona 2017 tax forms by providing a user-friendly interface. You can easily fill out, eSign, and send your tax documents securely, ensuring all instrutures to fill out arizona 2017 tax form are followed accurately.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers features such as document templates, eSignature capabilities, and real-time collaboration. These tools help ensure that the instrutures to fill out arizona 2017 tax form are adhered to, making it easier to manage your tax filings efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow can be integrated with various tax preparation software. This will help you easily access the instrutures to fill out arizona 2017 tax form and ensure that all necessary documentation is in one place for a seamless filing experience.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms provides numerous benefits, such as increased efficiency and reduced errors in document handling. By following the instrutures to fill out arizona 2017 tax form, you can save time and avoid potential penalties associated with incorrect filings.

-

Is airSlate SignNow suitable for both individuals and businesses for filing taxes?

Absolutely! AirSlate SignNow is suitable for both individuals and businesses looking to streamline their tax filing process. With simple instrutures to fill out arizona 2017 tax form, it caters to a wide range of users, ensuring everyone can submit their forms effortlessly.

Get more for tax rate in arizona

- Foreigners wedding malaysia form

- Philippines affidavit legal form

- County of imperial marriage license application and information co imperial ca

- Vi marriage form

- Metis pedigree charts form

- Comnavmarianas instruction form

- Verified petition new york form

- Diocese of dallas petitioners questionnaire form

Find out other arizona tax rate

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter