Encumbrances and Pay All Taxes Levied with Respect to the Horses When Due Form

What is the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due

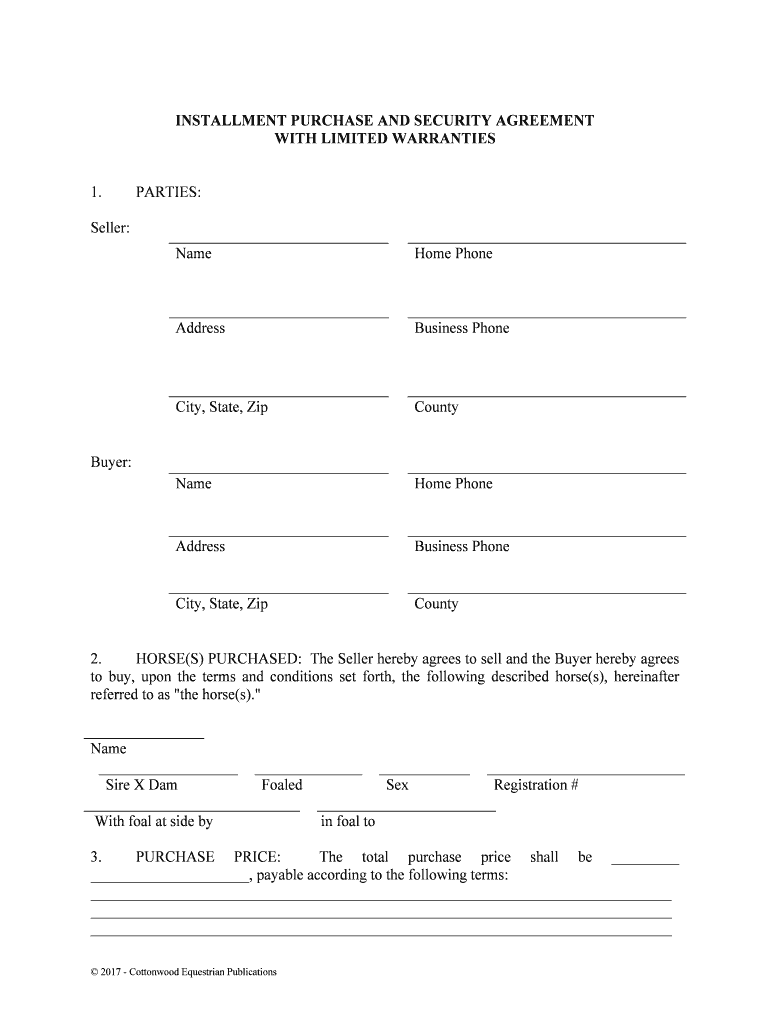

The Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due form is a legal document that outlines the obligations related to the ownership and taxation of horses. This form is essential for horse owners to ensure compliance with state and local regulations regarding taxes and any encumbrances that may affect the ownership status of the horses. Understanding this form is crucial for maintaining legal ownership and fulfilling tax responsibilities.

Steps to complete the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due

Completing the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due form involves several key steps:

- Gather necessary information about the horses, including identification details and ownership history.

- Determine the tax obligations based on the applicable local and state regulations.

- Complete the form accurately, ensuring all required fields are filled out correctly.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due

The legal use of the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due form is governed by various state laws and regulations. This form serves as a formal declaration of ownership and tax obligations, which can be crucial in legal disputes or when transferring ownership. Proper completion and submission of this form can protect the owner's rights and ensure compliance with tax laws.

Required Documents

To complete the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due form, several documents may be required, including:

- Proof of ownership, such as a bill of sale or registration papers.

- Previous tax documents related to the horses.

- Identification information for the owner, including a driver's license or tax identification number.

Penalties for Non-Compliance

Failure to complete and submit the Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due form can result in significant penalties. These may include:

- Fines imposed by state or local authorities.

- Legal action to recover unpaid taxes.

- Potential loss of ownership rights if encumbrances are not disclosed.

Who Issues the Form

The Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due form is typically issued by state or local tax authorities. These agencies are responsible for overseeing tax compliance and ensuring that horse owners fulfill their obligations. It is important for owners to check with their specific jurisdiction to obtain the correct version of the form and understand the submission process.

Quick guide on how to complete encumbrances and pay all taxes levied with respect to the horses when due

Complete Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due with ease

- Locate Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due and facilitate seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help with encumbrances and taxes related to horses?

airSlate SignNow streamlines the process of managing encumbrances and ensures you can pay all taxes levied with respect to the horses when due. Our intuitive platform allows users to track necessary documents, ensuring everything is in order and compliant with local regulations. By digitizing workflows, you can easily stay ahead of your tax obligations and encumbrances.

-

What features does airSlate SignNow offer for managing horse-related documentation?

With airSlate SignNow, you can eSign documents, track their status, and manage templates specifically for horse-related content. This is especially helpful for ensuring all encumbrances and taxes levied with respect to the horses when due are properly documented and filed. Our platform simplifies the entire process and minimizes paperwork hassles.

-

Is airSlate SignNow cost-effective for managing horse encumbrances and taxes?

Yes, airSlate SignNow is a cost-effective solution designed to meet the needs of businesses managing horse-related documents. By using our service, you can efficiently handle encumbrances and pay all taxes levied with respect to the horses when due without incurring excessive costs. Explore our pricing plans to find one that fits your budget.

-

Can I integrate airSlate SignNow with other applications to manage horse taxes?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your document management processes. This allows for smooth handling of encumbrances and helps ensure you pay all taxes levied with respect to the horses when due through the platforms you already use. Check our integration options for a complete list.

-

What are the benefits of using airSlate SignNow for horse tax management?

Using airSlate SignNow provides multiple benefits, such as faster document turnaround times and enhanced compliance. By ensuring you handle encumbrances and pay all taxes levied with respect to the horses when due, you can focus on what matters most—your horses and your business. Our platform's user-friendly interface makes it easy for anyone to adopt.

-

How secure is the information I manage regarding horse encumbrances and taxes?

Security is a top priority at airSlate SignNow. We use industry-leading encryption and security protocols to safeguard your information regarding encumbrances and taxes levied with respect to the horses when due. Rest assured, your data is protected while you manage your documents efficiently.

-

Can I access my documents related to horses from any device?

Yes, airSlate SignNow is designed to be accessible from any device, be it a smartphone, tablet, or desktop. This flexibility ensures you can manage encumbrances and pay all taxes levied with respect to the horses when due, anywhere and anytime. Our responsive design allows for a seamless user experience across all devices.

Get more for Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due

- Staff records checklist nj for children 2015 2019 form

- Background information disclosure bid f 82064 wisconsin

- Clearance letter from college 2014 2019 form

- Plan first medicaid 2015 2019 form

- 10 336 form 2007 2019

- Community service certificate 2014 2019 form

- Ahcccs form 2014 2019

- Arizona form fa 100pdffillercom 2018 2019

Find out other Encumbrances And Pay All Taxes Levied With Respect To The Horses When Due

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document