Form S

What is the Form S

The Form S, commonly referred to as the S-1 form, is a registration statement used in the United States by companies planning to go public. This form is filed with the Securities and Exchange Commission (SEC) and provides essential information about the company, including its business model, financial statements, and risks associated with the investment. The primary purpose of the Form S is to ensure that potential investors have access to all necessary information to make informed decisions regarding their investments.

How to use the Form S

To effectively use the Form S, companies must complete it accurately and comprehensively. This involves detailing the company's financial health, management structure, and market risks. After preparing the form, it should be submitted electronically through the SEC's EDGAR system. Investors can then access the filed Form S to evaluate the company’s potential for growth and profitability. It is crucial for companies to ensure that all information is up-to-date and compliant with SEC regulations to avoid any legal repercussions.

Steps to complete the Form S

Completing the Form S involves several key steps:

- Gather necessary information: Collect financial statements, business descriptions, and risk factors.

- Prepare the document: Fill out the form accurately, ensuring all sections are complete.

- Review for compliance: Verify that the form adheres to SEC guidelines and regulations.

- Submit electronically: File the completed Form S through the SEC’s EDGAR system.

- Monitor for updates: Keep the form updated with any significant changes in the company's status or financials.

Legal use of the Form S

The legal use of the Form S is governed by the Securities Act of 1933, which mandates that all material information must be disclosed to potential investors. This ensures transparency and protects investors from fraudulent activities. The information provided in the Form S must be truthful and not misleading, as any inaccuracies can lead to severe legal consequences for the company and its executives.

Key elements of the Form S

Key elements of the Form S include:

- Company information: Details about the company’s history, structure, and management team.

- Financial statements: Comprehensive financial data, including income statements, balance sheets, and cash flow statements.

- Risk factors: A thorough analysis of potential risks that could impact the company’s performance.

- Use of proceeds: Explanation of how the funds raised from the public offering will be utilized.

- Management discussion: Insights from management regarding the company's future strategies and objectives.

Filing Deadlines / Important Dates

Filing deadlines for the Form S can vary based on the company's specific circumstances and the SEC's requirements. Generally, companies must file the Form S at least 15 days before the public offering. It is essential for companies to stay informed about any changes to filing deadlines to ensure compliance and avoid penalties. Additionally, companies should be aware of any ongoing reporting obligations after the initial filing.

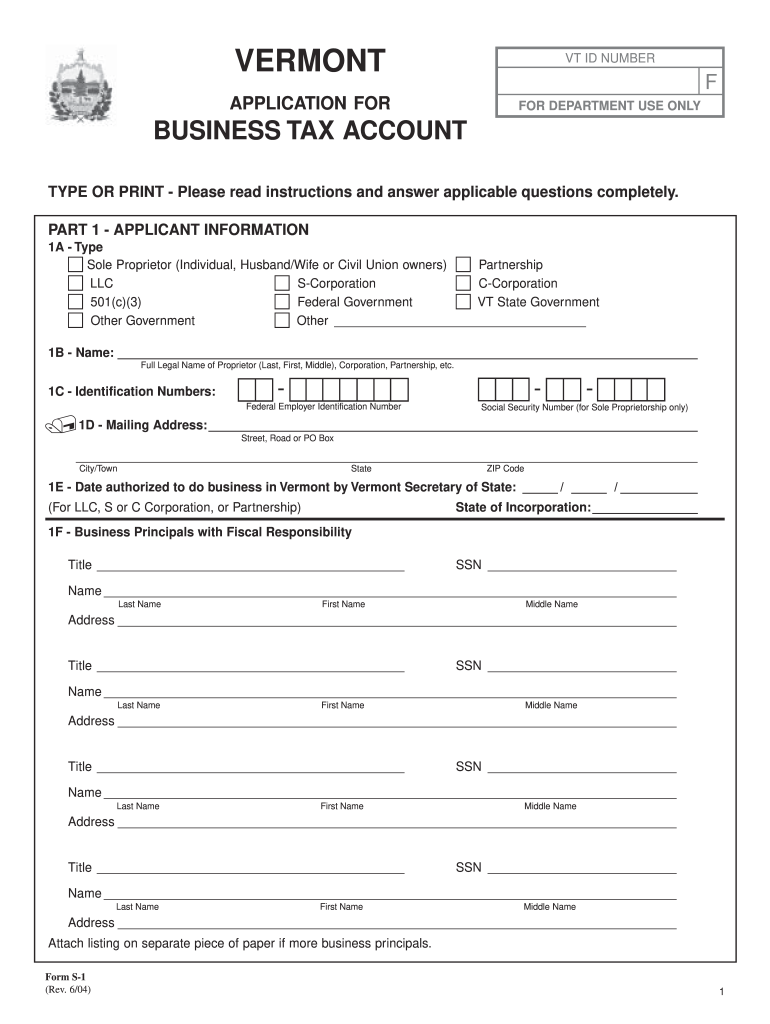

Quick guide on how to complete vermont form s 1

Complete Form S effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, since you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form S on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form S with ease

- Obtain Form S and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Form S and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the vermont form s 1

How to make an eSignature for your Vermont Form S 1 in the online mode

How to generate an eSignature for your Vermont Form S 1 in Google Chrome

How to generate an electronic signature for signing the Vermont Form S 1 in Gmail

How to create an electronic signature for the Vermont Form S 1 right from your smartphone

How to create an electronic signature for the Vermont Form S 1 on iOS devices

How to make an eSignature for the Vermont Form S 1 on Android OS

People also ask

-

What is Form S 1 and how does it work?

Form S 1 is a registration statement used by companies to register securities with the SEC. With airSlate SignNow, you can easily create, send, and eSign this form securely. Our platform simplifies the entire process, ensuring compliance and reducing administrative burdens.

-

How can airSlate SignNow help streamline my Form S 1 filing process?

airSlate SignNow offers features like document templates and eSigning capabilities that streamline the Form S 1 filing process. Users can pre-fill required fields, collect signatures, and track the status of documents in real-time. This efficiency helps ensure timely submissions and reduces the likelihood of errors.

-

What are the costs associated with using airSlate SignNow for Form S 1?

airSlate SignNow offers flexible pricing plans designed to suit various business needs, including options for users who need to file Form S 1. The cost is competitive, providing businesses with a cost-effective solution to manage document workflows efficiently. You can choose a plan that aligns with your usage requirements.

-

Does airSlate SignNow offer integrations for managing Form S 1 documents?

Yes, airSlate SignNow supports integrations with various applications that make managing Form S 1 documents more seamless. You can integrate with tools like Google Drive, Salesforce, and others to enhance collaboration and document management. This ensures your workflow is as efficient as possible.

-

What features does airSlate SignNow include that are beneficial for Form S 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows, all of which are beneficial for handling Form S 1. These features ensure that you can complete your filings quickly and accurately while maintaining high security standards for your documents. Efficiency is maximized for your team.

-

Is airSlate SignNow compliant with regulations for filing Form S 1?

Yes, airSlate SignNow is fully compliant with regulations necessary for filing Form S 1 and handling sensitive information. Our platform adheres to industry-standard security practices, ensuring that your documents are safe and compliant throughout the signing process. You can trust us to help you meet the required standards.

-

Can airSlate SignNow assist with document storage for completed Form S 1 filings?

Absolutely, airSlate SignNow offers secure cloud storage for your completed Form S 1 filings. This feature allows you to easily access, organize, and retrieve your documents whenever needed, reducing the risk of loss. With our platform, you can keep your important documents organized and secure.

Get more for Form S

- Ex parte motion to vacate jail jail report date and fines form

- Get the fillable online fax email print pdffiller form

- Cr 320 venue motionorder 913 pdf fill in state of alaska form

- Fillable online courts alaska exempt from vra while sealed form

- Fillable online nyc tri party agreement nyc fax email print form

- Can my drivers license be permanently revoked for a dui in form

- Form cr 755 fugitive from justice waiver of extradition alaska

- Cr 770 request and order alaska form

Find out other Form S

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online