PA DO 10 Form

What is the PA DO 10

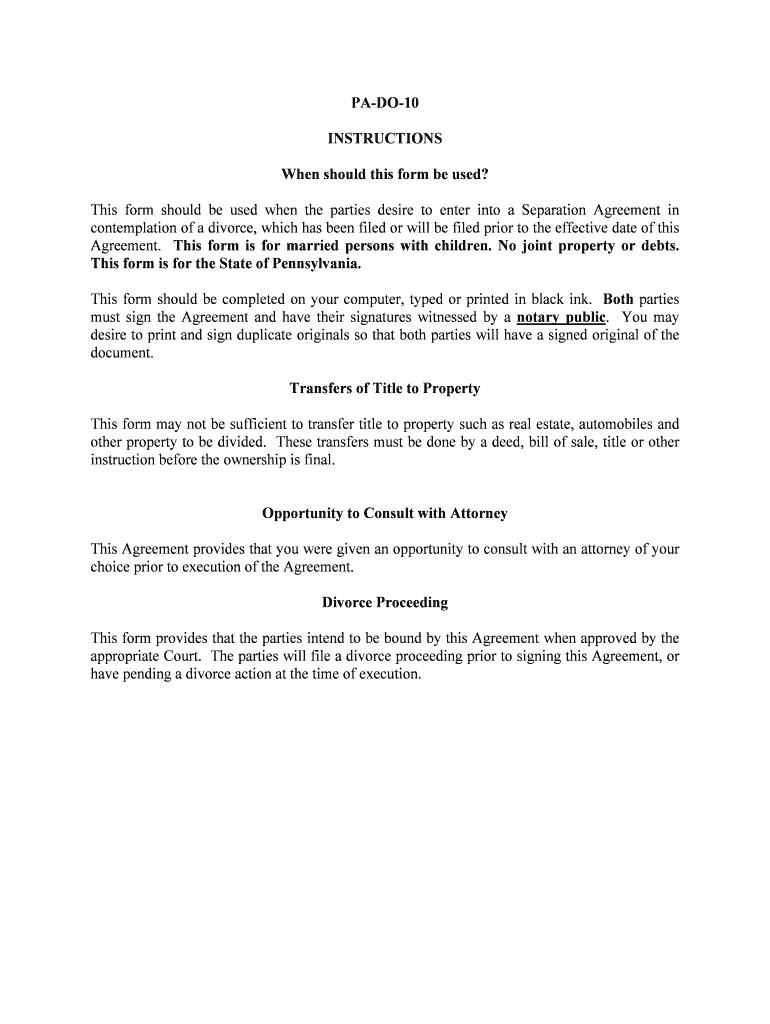

The PA DO 10 form is a document used in Pennsylvania for specific legal and administrative purposes. It serves as a declaration or application that may be required for various processes, including but not limited to business registrations, tax filings, or other official requests. Understanding the purpose of the PA DO 10 is essential for ensuring compliance with state regulations and for facilitating smooth transactions.

How to use the PA DO 10

Using the PA DO 10 form involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required for the form. This may include personal identification details, business information, and any relevant financial data. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors before submission. Depending on the requirements, you may need to submit the form online, by mail, or in person.

Steps to complete the PA DO 10

Completing the PA DO 10 form requires careful attention to detail. Here are the steps to follow:

- Gather required documents and information.

- Access the PA DO 10 form through official channels.

- Fill out the form, ensuring all sections are complete.

- Review the form for accuracy and completeness.

- Submit the form according to the specified method.

Legal use of the PA DO 10

The PA DO 10 form must be used in accordance with Pennsylvania state laws to be considered legally valid. This includes ensuring that the information provided is truthful and that the form is submitted within any applicable deadlines. Compliance with legal requirements not only protects the individual or business submitting the form but also ensures that the document can be used effectively in legal or administrative proceedings.

Required Documents

When completing the PA DO 10 form, certain documents may be required to support your application or declaration. Commonly required documents include:

- Identification documents, such as a driver's license or social security number.

- Business registration documents, if applicable.

- Financial statements or proof of income, depending on the purpose of the form.

- Any additional documentation specified in the form instructions.

Form Submission Methods

The PA DO 10 form can typically be submitted through various methods, depending on the specific requirements set forth by the issuing authority. Common submission methods include:

- Online submission through official state websites.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Who Issues the Form

The PA DO 10 form is issued by the Pennsylvania state government or relevant administrative agencies. It is important to ensure that you are using the most current version of the form, as updates or changes may occur. Always refer to official state resources for the most accurate and up-to-date information regarding the form and its requirements.

Quick guide on how to complete pa do 10

Effortlessly prepare PA DO 10 on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and smoothly. Handle PA DO 10 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign PA DO 10 with ease

- Locate PA DO 10 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign PA DO 10 and guarantee outstanding communication at every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is PA DO 10 and how does it relate to airSlate SignNow?

PA DO 10 refers to a specific document management process that can be optimized using airSlate SignNow. This solution allows users to automate the signing and sending of documents, streamlining workflows and ensuring compliance with regulatory standards.

-

How much does airSlate SignNow cost for PA DO 10 users?

airSlate SignNow offers flexible pricing plans tailored to the needs of PA DO 10 users. You can choose from a variety of subscription options based on your business size and document handling requirements, making it a cost-effective choice for all users.

-

What features does airSlate SignNow provide for managing PA DO 10 documents?

airSlate SignNow offers robust features to support PA DO 10, including document templates, electronic signatures, and real-time tracking. These tools ensure that all documents are managed efficiently and securely, enhancing the overall user experience.

-

Can airSlate SignNow integrate with other applications for PA DO 10?

Yes, airSlate SignNow seamlessly integrates with a range of applications that support PA DO 10 processes. This allows users to connect their existing tools and automate workflows, thereby increasing productivity and reducing manual errors.

-

What are the benefits of using airSlate SignNow for PA DO 10?

Using airSlate SignNow for PA DO 10 provides numerous benefits, such as faster turnaround times for document signing, enhanced security measures, and reduced operational costs. This comprehensive solution ensures that businesses can focus on growth while maintaining compliance.

-

Is airSlate SignNow user-friendly for PA DO 10 processes?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to manage PA DO 10 documents. The intuitive interface allows users of all technical levels to navigate the platform effortlessly.

-

What support options are available for PA DO 10 users of airSlate SignNow?

airSlate SignNow offers multiple support channels for PA DO 10 users, including live chat, email support, and an extensive knowledge base. This ensures that users can quickly find solutions to any issues or questions they may have.

Get more for PA DO 10

Find out other PA DO 10

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement