Identity of Interest Form

What is the identity of interest?

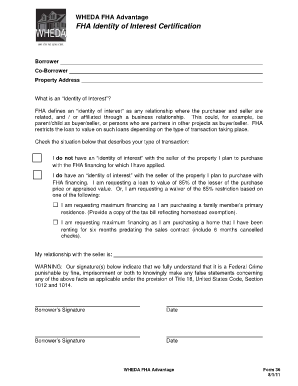

The FHA identity of interest form is a crucial document in the context of Federal Housing Administration (FHA) loans. It is designed to disclose any relationships between the borrower and the parties involved in the transaction, such as lenders or real estate agents. This form ensures transparency and helps prevent potential conflicts of interest, which could affect the integrity of the loan process. Understanding this form is essential for both borrowers and lenders to maintain compliance with FHA regulations.

How to use the identity of interest form

Using the FHA identity of interest form involves several key steps. First, borrowers must accurately fill out the form, providing details about their relationship with any involved parties. This includes identifying if they have a familial, business, or other significant connection. Once completed, the form should be submitted alongside the loan application to the lender. It is important to ensure that all information is truthful and complete, as inaccuracies can lead to delays or complications in the loan approval process.

Steps to complete the identity of interest form

Completing the FHA identity of interest form requires careful attention to detail. Here are the steps to follow:

- Obtain the form, typically available as a PDF from your lender or online resources.

- Fill in your personal information, including your name, address, and loan details.

- Clearly state your relationship with any parties involved in the transaction.

- Review the completed form for accuracy and completeness.

- Submit the form along with your loan application to the lender.

Legal use of the identity of interest form

The legal use of the FHA identity of interest form is paramount in ensuring compliance with FHA guidelines. This form serves as a declaration of any potential conflicts of interest, which is essential for maintaining the integrity of the lending process. By disclosing relationships, borrowers help lenders assess the risk involved in the transaction. Failure to properly use this form can lead to legal repercussions, including loan denial or issues with future financing.

Key elements of the identity of interest form

Several key elements must be included in the FHA identity of interest form to ensure its validity:

- Borrower Information: Full name, address, and contact details.

- Relationship Disclosure: Clear explanation of the relationship with involved parties.

- Signature: The borrower’s signature to validate the information provided.

- Date: The date on which the form is completed and signed.

Required documents for submission

Along with the FHA identity of interest form, borrowers may need to submit additional documentation to support their loan application. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Credit history reports.

- Identification, including a driver's license or Social Security card.

- Property information, including purchase agreements or appraisals.

Quick guide on how to complete identity of interest

Complete Identity Of Interest seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the right form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Identity Of Interest on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Identity Of Interest effortlessly

- Obtain Identity Of Interest and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Identity Of Interest and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the identity of interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the identity of interest in relation to electronic signatures?

The identity of interest refers to the legitimate stakeholders involved in the signing process of electronic documents. airSlate SignNow ensures that the identity of interest is verified through various security features, enhancing trust and compliance in document transactions.

-

How does airSlate SignNow verify the identity of interest?

airSlate SignNow employs several methods to verify the identity of interest, including email verification, SMS codes, and advanced authentication options. This multi-layered security approach helps ensure that the individual signing the document is indeed who they claim to be, protecting sensitive information.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet the needs of different businesses while considering the identity of interest. Options include monthly and annual subscriptions, allowing teams to choose a plan that best fits their document signing volume and feature requirements.

-

What features does airSlate SignNow offer for managing the identity of interest?

With airSlate SignNow, users can take advantage of features such as team management, document tracking, and customizable workflows that focus on maintaining the identity of interest. These features ensure seamless collaboration and accountability in the signing process.

-

How does airSlate SignNow enhance compliance concerning the identity of interest?

airSlate SignNow is designed to meet various compliance standards related to the identity of interest, such as eIDAS and ESIGN Act. By incorporating robust authentication measures, the platform ensures that all electronic signatures are legally binding and protect the integrity of signers' identities.

-

Can airSlate SignNow integrate with other platforms to enhance the identity of interest?

Yes, airSlate SignNow offers seamless integrations with numerous platforms such as CRM tools, cloud storage services, and business applications. These integrations enhance the workflow and streamline operations, ensuring that the identity of interest is securely managed through all digital interactions.

-

What benefits does airSlate SignNow provide in ensuring the identity of interest during document signing?

The primary benefit of airSlate SignNow is its ability to improve security and trustworthiness in document transactions by confirming the identity of interest. With features like audit trails and encrypted signatures, the platform safeguards against fraud and unauthorized alterations.

Get more for Identity Of Interest

- Form 8264 rev march 2004 fill in capable application for registration of a tax shelter

- Form 8717 rev june 2006 fill in capable user fee for employee plan determination opinion and advisory letter request

- Printable official form 107

- Irs publication 733 form

- Form 1120 2005

- Irs form 2031

- Form 5305a sep 2002

- 2005 form 8839 pdf filler

Find out other Identity Of Interest

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template