RI DO 10A Form

What is the RI DO 10A

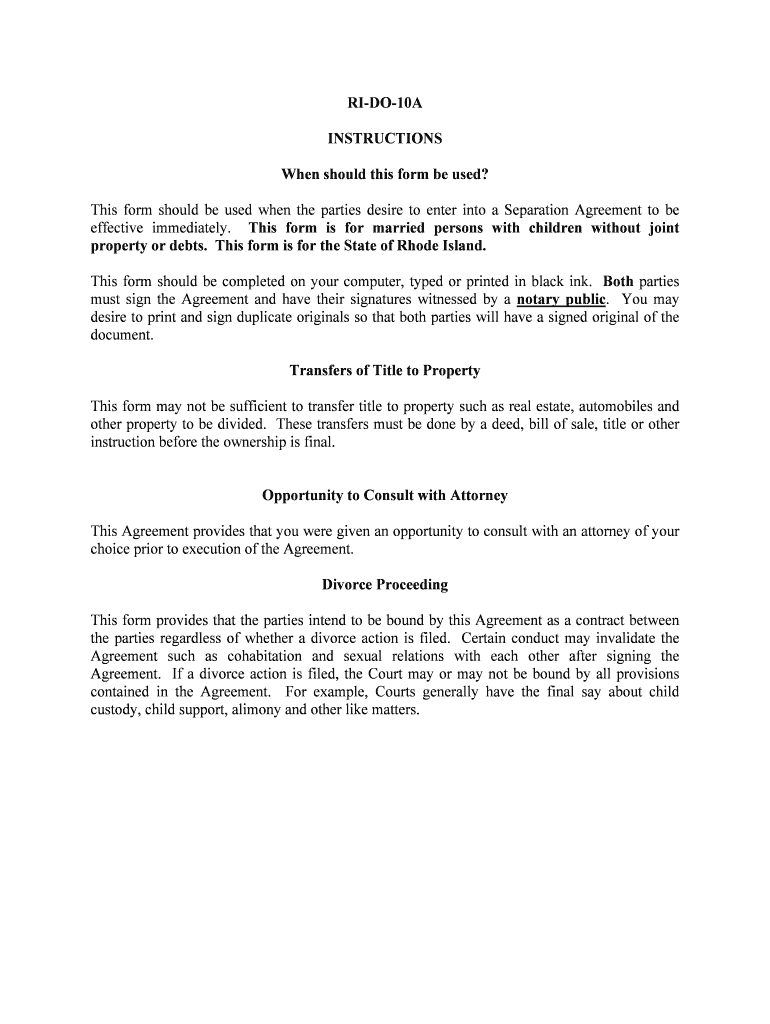

The RI DO 10A form is a document used in the state of Rhode Island, primarily for the purpose of documenting certain legal and financial transactions. This form may be required for various applications, including those related to business registrations or compliance with state regulations. Understanding the specific use of the RI DO 10A is essential for ensuring proper completion and submission.

How to use the RI DO 10A

Using the RI DO 10A form involves several steps to ensure that all required information is accurately provided. First, gather all necessary documents and information that pertain to the transaction or application. Next, fill out the form carefully, ensuring that all sections are completed as required. It is important to review the form for accuracy before submission, as errors can lead to delays or rejections.

Steps to complete the RI DO 10A

Completing the RI DO 10A form requires attention to detail. Follow these steps:

- Begin by downloading the form from the appropriate state website or obtaining a physical copy.

- Fill in your personal or business information as requested, including names, addresses, and contact details.

- Provide any additional information required by the form, such as financial details or supporting documentation.

- Review all entries for accuracy and completeness.

- Sign and date the form where indicated.

Legal use of the RI DO 10A

The RI DO 10A form must be used in accordance with state laws and regulations. This includes ensuring that the information provided is truthful and accurate. Legal use also involves submitting the form to the appropriate state agency or authority, as failure to do so may result in penalties or legal repercussions. It is advisable to consult legal counsel if there are any uncertainties regarding the form's use.

Who Issues the Form

The RI DO 10A form is typically issued by a state agency in Rhode Island, which oversees the specific area of law or regulation that the form pertains to. This may include departments related to business regulation, taxation, or other governmental functions. It is important to verify that you are using the most current version of the form, as updates may occur.

Required Documents

When completing the RI DO 10A form, certain supporting documents may be required. These documents can include:

- Proof of identity, such as a driver's license or state ID.

- Financial statements or tax documents relevant to the application.

- Any prior correspondence with state agencies regarding the matter.

Gathering these documents in advance can streamline the completion process and help avoid delays.

Quick guide on how to complete ri do 10a

Finalize RI DO 10A effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage RI DO 10A on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign RI DO 10A with ease

- Obtain RI DO 10A and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Identify key sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from the device of your choice. Alter and electronically sign RI DO 10A while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is RI DO 10A and how does it work?

RI DO 10A is a crucial component of the airSlate SignNow platform, designed to facilitate efficient eSigning and document management. It offers users a seamless way to create, send, and sign documents electronically, ensuring a streamlined workflow. With RI DO 10A, businesses can save time and reduce costs associated with traditional signing methods.

-

What are the pricing options for RI DO 10A?

The pricing for RI DO 10A is competitive and tailored to meet various business needs. airSlate SignNow offers flexible plans, including monthly and annual subscriptions, making it easy to choose the best option for your organization. Pricing scales with usage, ensuring that businesses pay only for what they need.

-

What features does RI DO 10A include?

RI DO 10A comes equipped with a range of powerful features designed to enhance document management. Key features include customizable templates, bulk sending, and advanced security options like password protection and user authentication. These tools enable businesses to streamline their operations and maintain compliance.

-

How does RI DO 10A benefit my business?

Utilizing RI DO 10A can signNowly improve your business's efficiency by reducing turnaround times for document signing. It allows for quicker decision-making and enhances collaboration between teams and clients. Moreover, the cost-effective nature of RI DO 10A helps lower operational costs while maintaining high productivity.

-

Can RI DO 10A integrate with other software?

Yes, RI DO 10A offers robust integration capabilities with popular applications such as Salesforce, Google Drive, and Microsoft Office. This ensures that your existing workflows can be enhanced without disruption. The integrations provided by RI DO 10A are designed to maximize productivity and improve information sharing.

-

Is RI DO 10A secure for sensitive documents?

Absolutely, RI DO 10A prioritizes security with features such as encryption, secure access controls, and audit trails. This ensures that sensitive information remains protected throughout the signing process. Companies can feel confident using RI DO 10A for their most confidential documents.

-

How user-friendly is RI DO 10A for new users?

RI DO 10A is designed with user experience in mind, making it easy for new users to get started. The intuitive interface and guided setup help users navigate the platform effortlessly. Training resources and customer support further enhance the user experience, allowing teams to become proficient quickly.

Get more for RI DO 10A

Find out other RI DO 10A

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online