Form 1041 K 1t for State of Ct

What is the Form 1041 K-1t For State Of Ct

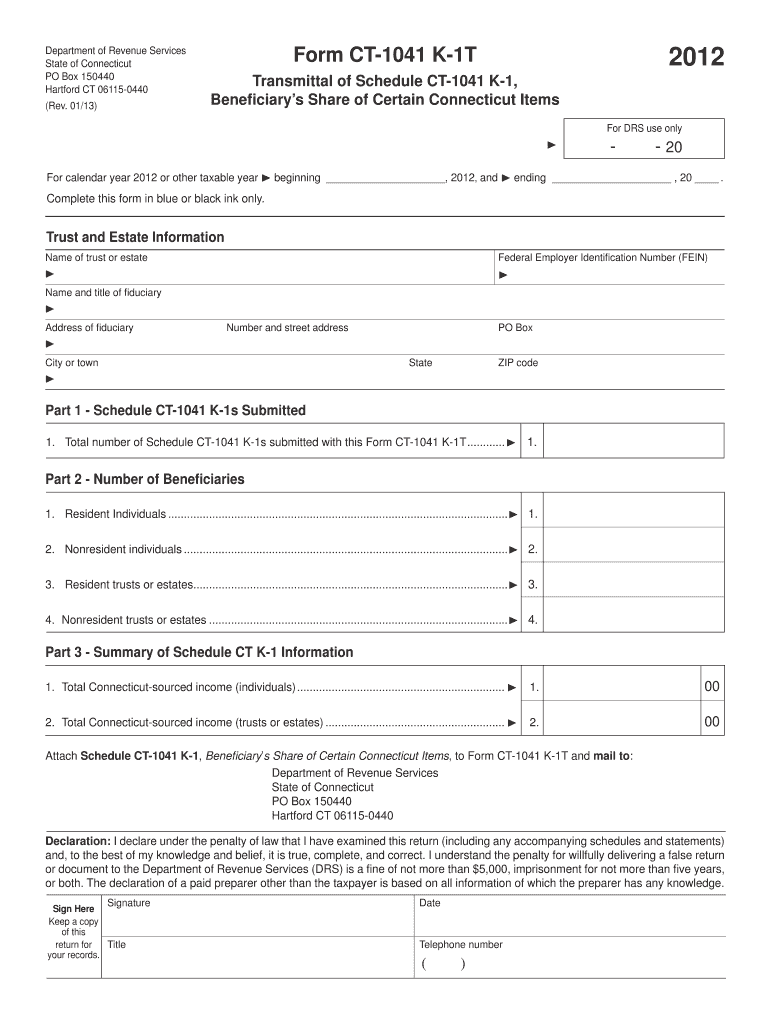

The Form 1041 K-1t is a tax document used in the state of Connecticut to report income, deductions, and credits from estates and trusts. This form is essential for beneficiaries who receive distributions from an estate or trust, as it provides them with the necessary information to report their share of the entity's income on their personal tax returns. The form outlines the specific amounts allocated to each beneficiary, ensuring compliance with state tax regulations.

How to use the Form 1041 K-1t For State Of Ct

Using the Form 1041 K-1t involves several steps to ensure accurate reporting of income. Beneficiaries should first receive the completed form from the estate or trust administrator. It is crucial to review the information provided, including the amounts of income, deductions, and credits. Beneficiaries must then incorporate this information into their individual tax returns, ensuring that they report their allocated share correctly. This process helps maintain transparency and compliance with Connecticut tax laws.

Steps to complete the Form 1041 K-1t For State Of Ct

Completing the Form 1041 K-1t requires careful attention to detail. Here are the essential steps:

- Gather all necessary information about the estate or trust, including its income and expenses.

- Fill out the form with accurate details regarding the beneficiary's share of income, deductions, and credits.

- Ensure that all calculations are correct to avoid discrepancies.

- Review the completed form for accuracy and completeness before submission.

- Provide copies to all relevant beneficiaries and retain a copy for your records.

Key elements of the Form 1041 K-1t For State Of Ct

The Form 1041 K-1t includes several critical elements that beneficiaries must understand:

- Beneficiary Information: This section identifies the beneficiary receiving the distribution.

- Income Details: It outlines the specific types of income allocated to the beneficiary, such as dividends, interest, and capital gains.

- Deductions and Credits: This part details any deductions or credits that the beneficiary can claim based on their share of the estate or trust.

- Signature and Date: The form must be signed and dated by the trustee or executor to validate the information provided.

Legal use of the Form 1041 K-1t For State Of Ct

The legal use of the Form 1041 K-1t is governed by Connecticut tax laws. This form serves as an official record of the income and distributions made to beneficiaries. For the form to be legally binding, it must be completed accurately and submitted within the required timeframe. Beneficiaries are responsible for reporting the information on their individual tax returns, ensuring compliance with both state and federal tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 K-1t are crucial for compliance. Generally, the form must be provided to beneficiaries by the due date of the estate or trust's income tax return. It is essential to stay informed about specific deadlines, as they may vary based on the fiscal year of the estate or trust. Missing these deadlines can result in penalties or complications in the tax reporting process.

Quick guide on how to complete form 1041 k 1t for state of ct

Complete Form 1041 K 1t For State Of Ct effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Handle Form 1041 K 1t For State Of Ct on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 1041 K 1t For State Of Ct with ease

- Locate Form 1041 K 1t For State Of Ct and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 1041 K 1t For State Of Ct and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the form 1041 k 1t for state of ct

How to create an eSignature for the Form 1041 K 1t For State Of Ct online

How to generate an electronic signature for the Form 1041 K 1t For State Of Ct in Google Chrome

How to generate an eSignature for signing the Form 1041 K 1t For State Of Ct in Gmail

How to make an eSignature for the Form 1041 K 1t For State Of Ct from your smartphone

How to make an eSignature for the Form 1041 K 1t For State Of Ct on iOS

How to create an eSignature for the Form 1041 K 1t For State Of Ct on Android OS

People also ask

-

What is 1041k and how does it relate to airSlate SignNow?

1041k refers to a specific form often used in tax filings. airSlate SignNow streamlines the process of completing and signing your 1041k documents electronically, ensuring that you can manage important paperwork efficiently.

-

How does airSlate SignNow help with the 1041k document signing process?

airSlate SignNow simplifies the signing process for your 1041k forms by allowing you to electronically sign documents from anywhere, at any time. With its user-friendly interface, you can easily send, receive, and store your signed 1041k documents securely.

-

Are there any costs associated with using airSlate SignNow for 1041k documentation?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effectiveness of these plans makes it an ideal solution for handling 1041k forms without breaking the bank.

-

What features does airSlate SignNow offer for managing 1041k forms?

airSlate SignNow includes features such as customizable templates, cloud storage, and multi-party signing to manage your 1041k forms effectively. These functionalities make it easier to track the status of your documents and ensure compliance.

-

Can airSlate SignNow integrate with other software for 1041k filing?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your 1041k filing alongside your existing workflows. This enhances efficiency and ensures that all relevant data is consolidated.

-

What are the benefits of using airSlate SignNow for 1041k documents?

Using airSlate SignNow for 1041k documents provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security for sensitive information. This digital approach saves you time and increases productivity.

-

Is airSlate SignNow suitable for businesses of all sizes handling 1041k?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, making it a versatile option for handling 1041k forms. Whether you're a small business or a large corporation, you can benefit from its scalable solutions.

Get more for Form 1041 K 1t For State Of Ct

- Vehicle ampamp equipment purchase agreement free download form

- Agreementforsaleof automobile form

- 411021 iowa department of transportation power of attorney form

- I have received a rough draft of a warranty deed and a bill form

- Do these presents grant bargain sell and deliver unto purchaser the following described form

- The legal forms kit homestead schools inc

- Innovative industrial properties inc form 8 k received 11

- Get the minnesota flood zone statement and authorization form

Find out other Form 1041 K 1t For State Of Ct

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple