Transfer Title, to Any Interest in Real or Personal Property, Except as Limited by the Form

What is the Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

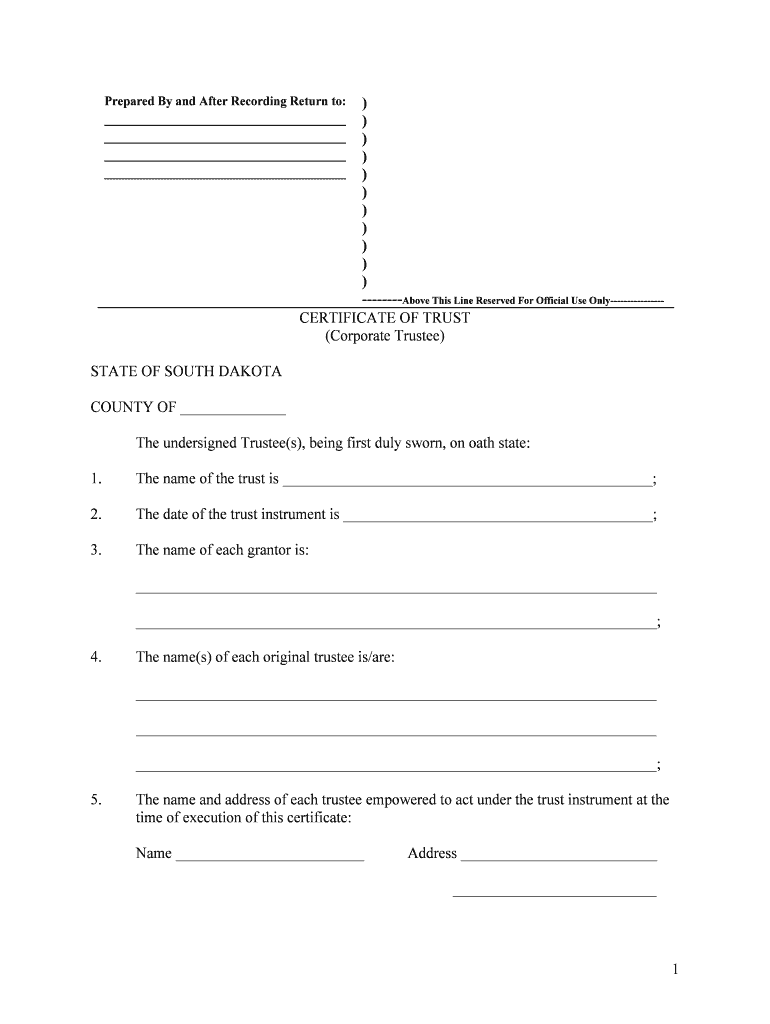

The transfer title to any interest in real or personal property, except as limited by the form, is a legal document that facilitates the transfer of ownership rights. This form is essential for individuals or entities looking to convey property interests, whether they are real estate or personal property. It outlines the specifics of the transfer, including the parties involved, the nature of the property, and any limitations that may apply. Understanding this form is crucial for ensuring that the transfer is executed correctly and legally binding.

Steps to complete the Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

Completing the transfer title requires careful attention to detail. The following steps outline the process:

- Gather necessary information about the property and the parties involved.

- Fill out the form accurately, ensuring all required fields are completed.

- Include any specific limitations or conditions that apply to the transfer.

- Obtain signatures from all parties involved, ensuring compliance with eSignature laws if using digital methods.

- Submit the completed form to the appropriate authority, whether online, by mail, or in person.

Legal use of the Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

This form serves as a legally binding document when executed properly. It is recognized under U.S. law, provided that it meets certain criteria, such as proper signatures and adherence to state-specific regulations. The transfer title must be clear in its intent and free of ambiguities to avoid disputes in the future. Legal use also involves ensuring compliance with relevant laws, such as the Uniform Commercial Code (UCC) for personal property transfers and local real estate laws for real property.

Key elements of the Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

Several key elements must be included in the transfer title to ensure its validity:

- Identification of the parties: Clearly state the names and addresses of the transferor and transferee.

- Description of the property: Provide a detailed description of the property being transferred, including any relevant identifiers like parcel numbers for real estate.

- Transfer terms: Outline the terms of the transfer, including any conditions or limitations that may apply.

- Signatures: Ensure that all parties sign the document, which is essential for its enforceability.

State-specific rules for the Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

Each state in the U.S. may have specific rules and regulations governing the transfer of property interests. It is important to consult state laws to understand any additional requirements, such as notarization or specific language that must be included in the transfer title. Familiarizing oneself with these state-specific rules can help prevent legal issues and ensure a smooth transfer process.

How to obtain the Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

Obtaining the transfer title can be done through various means. Typically, forms can be accessed through state or local government websites, legal document services, or directly from legal professionals. If using an electronic method, platforms like signNow can facilitate the completion and signing of the document, ensuring compliance with eSignature laws. It is advisable to ensure that the version of the form used is up-to-date and compliant with current regulations.

Quick guide on how to complete transfer title to any interest in real or personal property except as limited by the

Finalize Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The seamlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents quickly without interruptions. Manage Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The with ease

- Obtain Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that aim.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to transfer title to any interest in real or personal property?

To transfer title to any interest in real or personal property means legally changing the ownership of a property or asset. With airSlate SignNow, you can easily manage this process while ensuring all necessary documentation is signed efficiently. Our platform is designed to simplify the complexity of this transfer process.

-

How does airSlate SignNow facilitate the transfer title process?

airSlate SignNow facilitates the transfer title process by providing a streamlined eSignature solution that allows users to quickly sign and manage documents. This helps avoid delays that often occur with traditional paper methods. Our solution empowers you to transfer title to any interest in real or personal property, except as limited by the specific legal requirements.

-

Is airSlate SignNow a cost-effective solution for transferring title?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to transfer title to any interest in real or personal property, except as limited by the law. Our pricing plans are designed to fit different business needs, helping you save money while increasing efficiency in document management. You can choose a plan that aligns with your volume of transactions and usage.

-

What features does airSlate SignNow offer to assist with title transfers?

airSlate SignNow offers features like customizable templates, bulk sending, and real-time tracking, which are essential for title transfers. Our platform allows for easy collaboration among parties involved in the transfer, ensuring all documents are accurate and legally binding. Moreover, users can automate reminders to keep the process moving smoothly.

-

Can I integrate airSlate SignNow with other applications for title transfers?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of applications that facilitate the transfer title to any interest in real or personal property, except as limited by the requirements of your industry. This allows for a more cohesive workflow, eliminating data silos and enhancing operational efficiency.

-

What are the benefits of using airSlate SignNow for transferring titles?

The benefits of using airSlate SignNow for transferring titles include speeding up the process, reducing paperwork, and ensuring compliance with legal standards. Our eSignature solution not only saves time but also enhances security and accessibility of documents. This is crucial when you need to transfer title to any interest in real or personal property efficiently.

-

How can airSlate SignNow help ensure compliance when transferring titles?

airSlate SignNow helps ensure compliance during title transfers by providing legally binding eSignatures and a secure document storage system. Our platform keeps track of all document changes and signatures, which is vital for audits and verification. Every transfer title to any interest in real or personal property transaction is stored securely, protecting both parties' interests.

Get more for Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

Find out other Transfer Title, To Any Interest In Real Or Personal Property, Except As Limited By The

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal