Sole ProprietorPartner Selection Form I 4 TN Gov

What is the Sole ProprietorPartner Selection Form I 4 TN gov

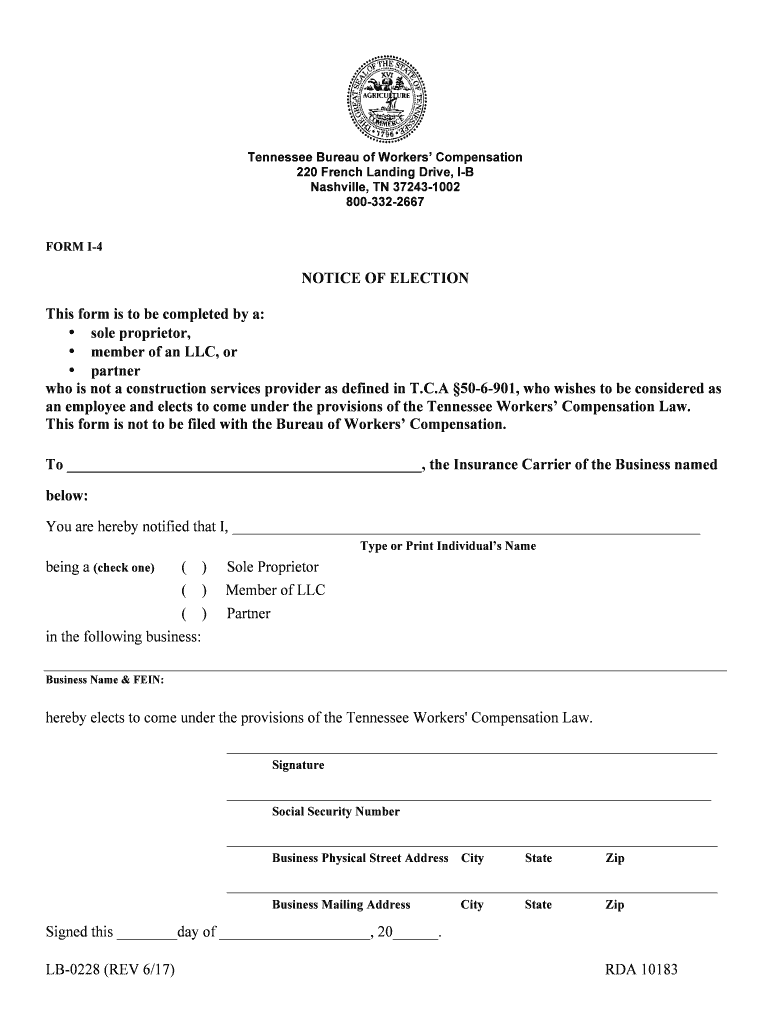

The Sole ProprietorPartner Selection Form I 4 TN gov is a legal document used by sole proprietors in Tennessee to select a partner for their business. This form is essential for establishing partnerships and ensuring compliance with state regulations. It outlines the responsibilities and rights of each partner and serves as a formal agreement that can be referenced in the future. Understanding this form is crucial for anyone looking to formalize their business relationships in Tennessee.

How to use the Sole ProprietorPartner Selection Form I 4 TN gov

Using the Sole ProprietorPartner Selection Form I 4 TN gov involves several straightforward steps. First, obtain the form from the appropriate state agency or online resource. Next, fill out the required information, including the names of the partners and the nature of the partnership. Ensure that all details are accurate and complete. Once filled out, the form must be signed by all parties involved to validate the agreement. After signing, submit the form according to the specified submission methods.

Steps to complete the Sole ProprietorPartner Selection Form I 4 TN gov

Completing the Sole ProprietorPartner Selection Form I 4 TN gov requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form.

- Provide your name and contact information as the sole proprietor.

- List the name and contact information of the selected partner.

- Clearly define the partnership terms, including responsibilities and profit-sharing arrangements.

- Review the form for accuracy and completeness.

- Sign and date the form, ensuring all partners do the same.

- Submit the completed form as directed.

Legal use of the Sole ProprietorPartner Selection Form I 4 TN gov

The Sole ProprietorPartner Selection Form I 4 TN gov is legally binding when completed correctly. It must meet specific requirements to be enforceable, such as proper signatures from all parties involved. The form serves as a formal agreement that can be used in legal contexts, should disputes arise. Understanding the legal implications of this document is vital for sole proprietors and their partners to protect their interests.

Key elements of the Sole ProprietorPartner Selection Form I 4 TN gov

Several key elements must be included in the Sole ProprietorPartner Selection Form I 4 TN gov to ensure its validity:

- Names and contact information of all partners.

- Description of the business and its operations.

- Details regarding the roles and responsibilities of each partner.

- Terms of profit-sharing and decision-making processes.

- Signatures of all parties involved, along with the date of signing.

State-specific rules for the Sole ProprietorPartner Selection Form I 4 TN gov

In Tennessee, specific rules govern the use of the Sole ProprietorPartner Selection Form I 4 TN gov. These rules include compliance with state business regulations and ensuring that the form is filed with the appropriate state agency. It is essential to be aware of any additional requirements or changes in legislation that may affect the use of this form. Consulting with a legal professional can provide clarity on state-specific requirements.

Quick guide on how to complete sole proprietorpartner selection form i 4 tngov

Complete Sole ProprietorPartner Selection Form I 4 TN gov seamlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Sole ProprietorPartner Selection Form I 4 TN gov on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Sole ProprietorPartner Selection Form I 4 TN gov effortlessly

- Acquire Sole ProprietorPartner Selection Form I 4 TN gov and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you would like to share your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management requirements in a few clicks from any device of your choosing. Edit and eSign Sole ProprietorPartner Selection Form I 4 TN gov and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Sole ProprietorPartner Selection Form I 4 TN gov.?

The Sole ProprietorPartner Selection Form I 4 TN gov. is a specific form required for sole proprietors in Tennessee to select their business partner officially. This form ensures compliance with state regulations and helps establish clear business relationships. airSlate SignNow simplifies the process of completing and signing this form electronically.

-

How can airSlate SignNow help me with the Sole ProprietorPartner Selection Form I 4 TN gov.?

airSlate SignNow allows you to easily fill out and eSign the Sole ProprietorPartner Selection Form I 4 TN gov. in a secure, digital environment. With its user-friendly interface, you can quickly navigate through form fields, reducing the time spent on paperwork. Plus, your signed documents are saved securely for future reference.

-

Is airSlate SignNow affordable for small businesses needing the Sole ProprietorPartner Selection Form I 4 TN gov.?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. Whether you need to complete the Sole ProprietorPartner Selection Form I 4 TN gov. or other documentation, you’ll find a plan that suits your budget without compromising on features. This affordability makes it an attractive choice for many entrepreneurs.

-

What features does airSlate SignNow offer for managing the Sole ProprietorPartner Selection Form I 4 TN gov.?

airSlate SignNow provides several features specifically designed for managing documents like the Sole ProprietorPartner Selection Form I 4 TN gov. These include customizable templates, secure eSigning, automatic reminders, and cloud storage, all aimed at streamlining your document workflow. You'll find these features indispensable in efficiently handling your business documents.

-

Can I integrate airSlate SignNow with other applications for the Sole ProprietorPartner Selection Form I 4 TN gov.?

Absolutely! airSlate SignNow easily integrates with various applications such as Google Drive, Dropbox, and Salesforce, which can help you manage the Sole ProprietorPartner Selection Form I 4 TN gov. alongside your other business tools. This flexibility ensures you can incorporate eSigning into your existing workflow seamlessly.

-

What are the benefits of using airSlate SignNow for the Sole ProprietorPartner Selection Form I 4 TN gov.?

Using airSlate SignNow for the Sole ProprietorPartner Selection Form I 4 TN gov. provides numerous benefits, including time efficiency, enhanced security, and easier collaboration. You can complete the form faster, store documents securely, and share them with partners instantly, resulting in streamlined communication and improved business operations.

-

Is it easy to use airSlate SignNow for beginners working with the Sole ProprietorPartner Selection Form I 4 TN gov.?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it suitable for beginners. The step-by-step guidance and intuitive interface allow users to efficiently complete the Sole ProprietorPartner Selection Form I 4 TN gov. without requiring extensive technical skills. You'll be able to navigate the platform with ease.

Get more for Sole ProprietorPartner Selection Form I 4 TN gov

Find out other Sole ProprietorPartner Selection Form I 4 TN gov

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request