Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property Form

What is the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

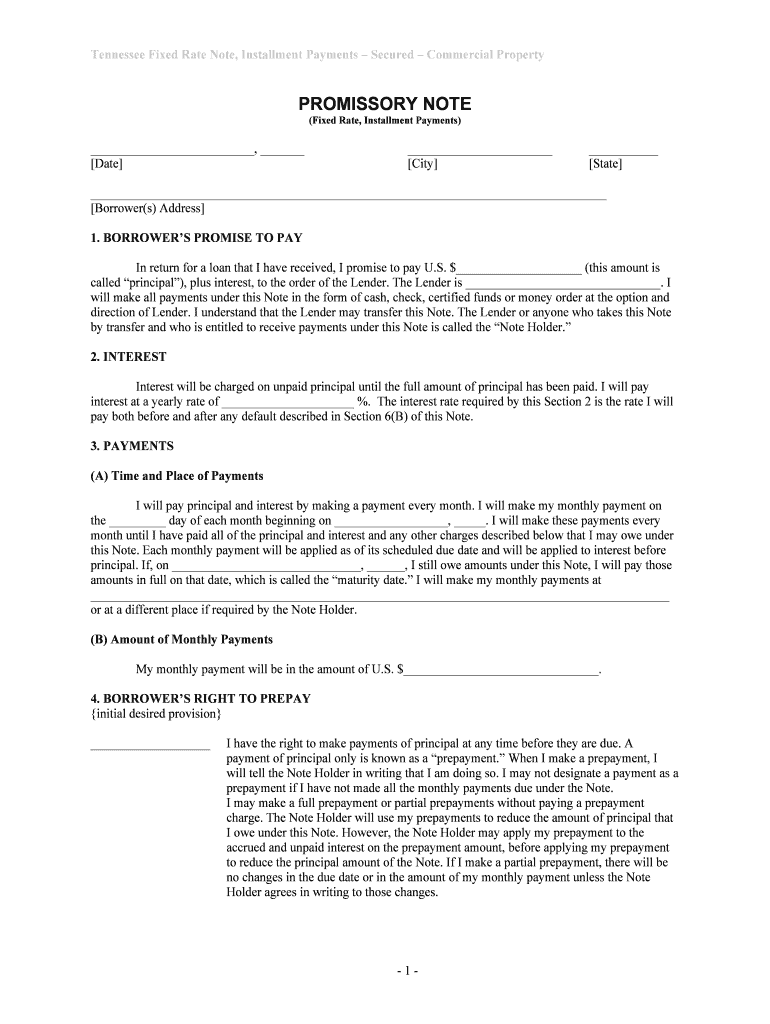

The Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property is a legal document used in commercial real estate transactions. It outlines the terms of a loan secured by commercial property, specifying a fixed interest rate and installment payment schedule. This note serves as a promise to repay the borrowed amount over a set period, providing lenders with a security interest in the property. It is essential for both borrowers and lenders to understand the implications of this note, as it governs the financial relationship between the parties involved.

Key elements of the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

Several critical components define the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property. These include:

- Principal Amount: The total amount borrowed, which is to be repaid.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Payment Schedule: The timeline for making installment payments, detailing frequency and due dates.

- Security Clause: A provision that secures the loan with the commercial property, allowing the lender to reclaim the property in case of default.

- Default Terms: Conditions under which the borrower may be considered in default, including the consequences of such a status.

Steps to complete the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

Completing the Tennessee Fixed Rate Note involves several important steps to ensure accuracy and legality:

- Gather Information: Collect all necessary details, including the names of the parties, property description, and financial terms.

- Draft the Document: Use a template or legal software to create the note, ensuring all key elements are included.

- Review Terms: Both parties should carefully review the terms to ensure mutual understanding and agreement.

- Sign the Document: Each party must sign the note, ideally in the presence of a notary public to enhance its legal validity.

- Store Safely: Keep the signed document in a secure location, as it may be needed for future reference or in case of disputes.

Legal use of the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

The legal use of the Tennessee Fixed Rate Note is crucial for ensuring that the document is enforceable in court. For the note to be legally binding, it must comply with state laws governing contracts and secured transactions. This includes adhering to the Uniform Commercial Code (UCC) provisions relevant to secured loans. Proper execution, including signatures and notarization, is essential to uphold the document's validity. Additionally, understanding the legal ramifications of default and foreclosure is vital for both lenders and borrowers.

How to use the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

Using the Tennessee Fixed Rate Note effectively involves understanding its purpose and application in commercial transactions. Borrowers can utilize this note to secure financing for purchasing or refinancing commercial property. Lenders, on the other hand, use it to formalize the loan agreement and establish their rights to the property in case of non-payment. It is important for both parties to keep a copy of the signed note, as it serves as a reference for payment obligations and legal rights throughout the life of the loan.

State-specific rules for the Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

In Tennessee, specific rules govern the execution and enforcement of the Fixed Rate Note. These include requirements for written agreements, proper identification of the parties, and compliance with state laws regarding secured transactions. The note must also adhere to any local regulations that may affect commercial lending practices. Understanding these state-specific rules helps ensure that the document is enforceable and protects the interests of both borrowers and lenders.

Quick guide on how to complete tennessee fixed rate note installment payments secured commercial property

Complete Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property without hassle

- Find Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from your preferred device. Edit and eSign Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property?

A Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property is a financial instrument that allows you to secure a loan against a commercial property, with fixed repayment terms. This type of note is ideal for businesses looking to stabilize their payment structure while investing in real estate.

-

What are the benefits of using a Tennessee Fixed Rate Note for commercial property financing?

Using a Tennessee Fixed Rate Note ensures predictable monthly payments and protects you from fluctuating interest rates. This financial stability can help you plan long-term investments and manage your cash flow more effectively in conjunction with your commercial property.

-

How do installment payments work with the Tennessee Fixed Rate Note?

Installment payments for a Tennessee Fixed Rate Note are scheduled payments made over the term of the loan, typically monthly. This structure allows borrowers to manage their budget better and ensures that the loan is paid off in a structured manner while fully securing the commercial property.

-

Are there any fees associated with obtaining a Tennessee Fixed Rate Note?

Yes, there may be fees involved in obtaining a Tennessee Fixed Rate Note, including origination fees and closing costs. It’s important to review these costs early in the process to understand the total expense associated with financing your secured commercial property.

-

What types of commercial properties can utilize a Tennessee Fixed Rate Note?

A Tennessee Fixed Rate Note can be used for various types of commercial properties, such as office buildings, retail spaces, and industrial facilities. Each property type may have different underwriting criteria, so consult with your lender to ensure compliance.

-

Can I eSign the documents for a Tennessee Fixed Rate Note with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily eSign documents related to your Tennessee Fixed Rate Note, streamlining the paperwork process. Our user-friendly platform ensures you can complete transactions quickly and securely, enhancing your overall experience.

-

How does airSlate SignNow support my financing needs with Tennessee Fixed Rate Notes?

airSlate SignNow provides a cost-effective solution for creating, sending, and signing documents related to your Tennessee Fixed Rate Notes. Our software integrates with various tools to enhance your workflow, allowing you to focus more on managing your commercial property.

Get more for Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

- Blue shield wellmark w2 box form

- Form 186 ecfmg 240593

- Fidelity amp guaranty life insurance non qualified annuities disbursement form

- Authorization to disclose protected health information mayo clinic mayoclinic

- Eye claim form

- Continuing medical education tracking form seattlechildrens

- Capital blue cross medication prior authorization form

- Medical office registration form hosa

Find out other Tennessee Fixed Rate Note, Installment Payments Secured Commercial Property

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors