RESOLUTION to REDUCE CAPITAL Form

What is the resolution to reduce capital

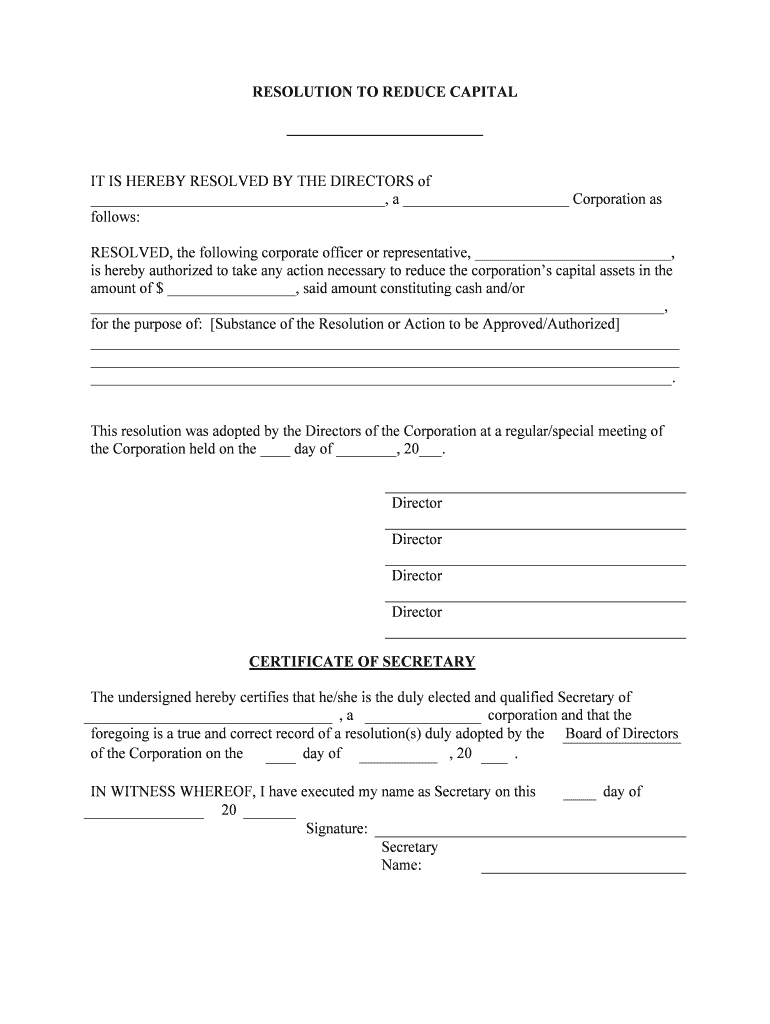

The resolution to reduce capital is a formal document used by corporations and limited liability companies (LLCs) to decrease their capital structure. This process often involves reducing the number of shares or the value of shares issued. It is a critical step for businesses seeking to adjust their financial strategies, manage debts, or redistribute assets. This resolution must be documented properly to ensure compliance with state laws and corporate governance standards.

Key elements of the resolution to reduce capital

When preparing a resolution to reduce capital, several key elements must be included to ensure its validity:

- Company Name: Clearly state the legal name of the business.

- Date of Resolution: Indicate the date on which the resolution is adopted.

- Details of Reduction: Specify the amount by which capital is being reduced and the method of reduction.

- Reason for Reduction: Provide a rationale for the capital reduction, such as improving financial health or returning value to shareholders.

- Approval Signatures: Include signatures from authorized representatives or board members to validate the resolution.

Steps to complete the resolution to reduce capital

Completing a resolution to reduce capital involves several systematic steps:

- Draft the Resolution: Create a document that outlines all necessary details, including the elements mentioned above.

- Board Approval: Present the resolution to the board of directors or members for approval during a formal meeting.

- Document the Decision: Record the meeting minutes that reflect the discussion and approval of the resolution.

- File with State Authorities: Submit the resolution to the appropriate state agency, if required by state law.

- Notify Stakeholders: Inform shareholders and other stakeholders about the capital reduction and its implications.

Legal use of the resolution to reduce capital

The legal use of a resolution to reduce capital is governed by state laws and corporate bylaws. It is essential to ensure that the resolution complies with the relevant regulations to avoid potential legal issues. The resolution must be executed in accordance with the company's governing documents, and it may require specific voting thresholds for approval. Additionally, proper documentation helps protect the company and its officers from liability.

Who issues the resolution to reduce capital

The resolution to reduce capital is typically issued by the board of directors or the members of an LLC. This internal governing body is responsible for making significant decisions affecting the company’s financial structure. The resolution must be formally adopted during a meeting and recorded in the company's official records.

Examples of using the resolution to reduce capital

There are various scenarios in which a resolution to reduce capital may be utilized:

- Debt Management: A company may reduce its capital to manage outstanding debts more effectively.

- Shareholder Returns: Businesses may opt for a capital reduction to distribute excess cash to shareholders.

- Financial Restructuring: Companies facing financial difficulties might reduce capital to streamline operations and improve liquidity.

Quick guide on how to complete resolution to reduce capital

Effortlessly prepare RESOLUTION TO REDUCE CAPITAL on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Manage RESOLUTION TO REDUCE CAPITAL on any device with the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and electronically sign RESOLUTION TO REDUCE CAPITAL seamlessly

- Obtain RESOLUTION TO REDUCE CAPITAL and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of the paperwork or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select how you wish to send your document, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign RESOLUTION TO REDUCE CAPITAL and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the RESOLUTION TO REDUCE CAPITAL in the context of airSlate SignNow?

The RESOLUTION TO REDUCE CAPITAL refers to strategic agreements made by businesses to minimize their financial expenditure while maintaining operational efficiency. With airSlate SignNow, companies can streamline their document management processes, leading to signNow savings.

-

How does airSlate SignNow help in achieving a RESOLUTION TO REDUCE CAPITAL?

airSlate SignNow helps businesses achieve a RESOLUTION TO REDUCE CAPITAL by providing a cost-effective eSignature solution that reduces paper use and printing costs. It automates workflows and accelerates document turnaround times, enabling companies to save resources.

-

What features does airSlate SignNow offer that support a RESOLUTION TO REDUCE CAPITAL?

Key features of airSlate SignNow that support a RESOLUTION TO REDUCE CAPITAL include customizable templates, real-time collaboration, and secure cloud storage. These features boost productivity and reduce overhead costs associated with traditional document handling.

-

Is airSlate SignNow pricing flexible to support a RESOLUTION TO REDUCE CAPITAL?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit various business sizes and needs, making it easier to implement a RESOLUTION TO REDUCE CAPITAL. This adaptability allows businesses to choose a plan that aligns with their budget and operational requirements.

-

What are the benefits of using airSlate SignNow for a RESOLUTION TO REDUCE CAPITAL?

Using airSlate SignNow for a RESOLUTION TO REDUCE CAPITAL yields several benefits, including enhanced efficiency, better compliance, and increased security. Companies can also enjoy faster processing times, allowing them to focus resources on core business functions.

-

Does airSlate SignNow integrate with other software to support a RESOLUTION TO REDUCE CAPITAL?

Absolutely, airSlate SignNow seamlessly integrates with various platforms like CRM systems and cloud storage to support a RESOLUTION TO REDUCE CAPITAL. These integrations facilitate smoother workflows and further minimize operational costs.

-

Can airSlate SignNow help small businesses with their RESOLUTION TO REDUCE CAPITAL?

Yes, airSlate SignNow is particularly beneficial for small businesses looking to implement a RESOLUTION TO REDUCE CAPITAL. Its user-friendly interface and competitive pricing make it accessible, enabling smaller enterprises to compete effectively by minimizing costs.

Get more for RESOLUTION TO REDUCE CAPITAL

Find out other RESOLUTION TO REDUCE CAPITAL

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document