Tax Error Letter Templates to Challenge Your Tax Demand the Form

Understanding Tax Error Letter Templates to Challenge Your Tax Demand

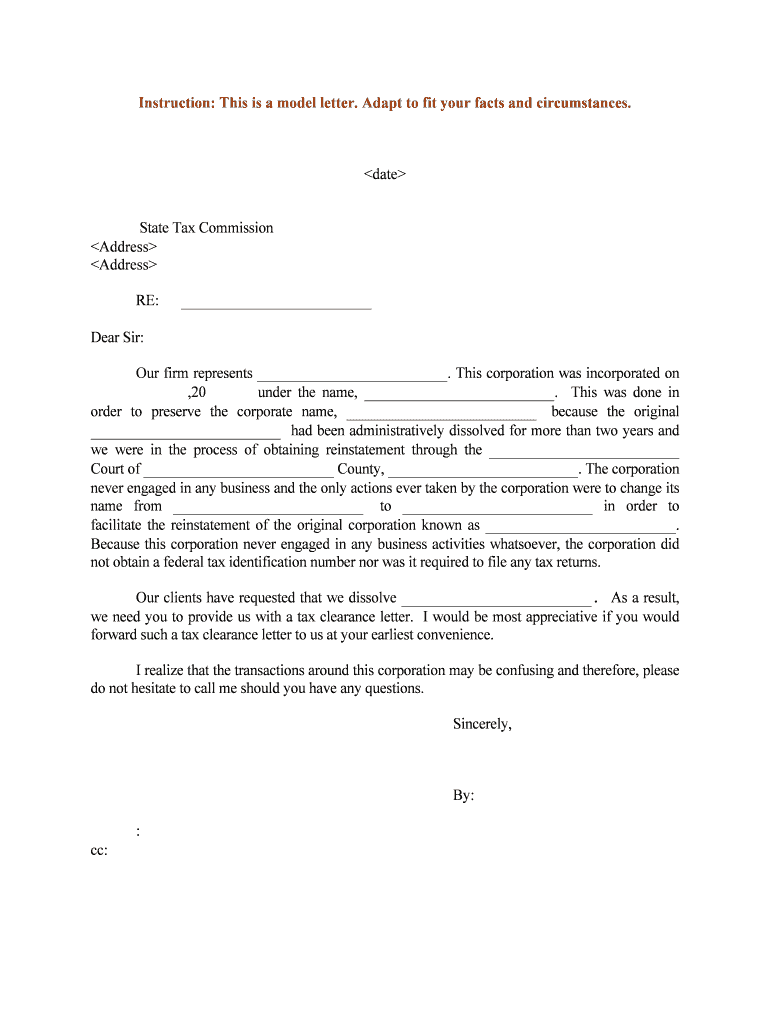

The Tax Error Letter Templates to Challenge Your Tax Demand serve as essential tools for taxpayers who believe they have received an incorrect tax assessment. These templates allow individuals to formally address discrepancies with tax authorities, ensuring that their concerns are documented and communicated effectively. Utilizing these templates can help clarify misunderstandings and potentially lead to a favorable resolution.

Steps to Complete the Tax Error Letter Templates to Challenge Your Tax Demand

Completing the Tax Error Letter Templates involves several key steps:

- Gather Documentation: Collect all relevant documents, including tax returns, notices from the IRS, and any supporting evidence that substantiates your claim.

- Fill Out the Template: Carefully complete the template, ensuring that all fields are filled accurately. Clearly state the reason for the challenge and include any pertinent details.

- Review for Accuracy: Double-check the information provided to avoid any errors that could delay the process.

- Sign and Date: Ensure that the letter is signed and dated, as this adds legitimacy to your submission.

Key Elements of the Tax Error Letter Templates to Challenge Your Tax Demand

When using a Tax Error Letter Template, it is crucial to include specific key elements to ensure clarity and effectiveness:

- Your Contact Information: Include your full name, address, and contact number at the top of the letter.

- Tax Authority Details: Address the letter to the appropriate department or individual within the tax authority.

- Subject Line: Clearly state the purpose of the letter, such as "Challenge to Tax Demand."

- Detailed Explanation: Provide a concise yet thorough explanation of the error and why you believe it is incorrect.

- Supporting Documents: Mention any attached documents that support your claim.

Legal Use of the Tax Error Letter Templates to Challenge Your Tax Demand

The legal validity of the Tax Error Letter Templates is supported by various regulations governing tax disputes. These templates must comply with the IRS guidelines and provide a clear basis for the challenge. It is important to ensure that the letter is submitted within the stipulated time frame to maintain its legal standing. Additionally, keeping copies of all correspondence is advisable for future reference.

IRS Guidelines for Tax Error Challenges

The IRS provides specific guidelines regarding how to challenge tax demands. Taxpayers are encouraged to refer to these guidelines to ensure that their letters are compliant. The IRS outlines the necessary information to include, such as the taxpayer’s identification number, the tax year in question, and a detailed account of the dispute. Following these guidelines can enhance the likelihood of a successful resolution.

Examples of Using the Tax Error Letter Templates to Challenge Your Tax Demand

Examples can provide clarity on how to effectively use the Tax Error Letter Templates. For instance, if a taxpayer receives a notice indicating an underreported income, they can use the template to explain the discrepancy, citing specific documentation that supports their reported income. Another example includes challenging a penalty due to a misunderstanding regarding tax deductions. In both cases, the template serves as a formal method to present the argument to the tax authority.

Quick guide on how to complete tax error letter templates to challenge your tax demand the

Effortlessly prepare Tax Error Letter Templates To Challenge Your Tax Demand The on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without complications. Manage Tax Error Letter Templates To Challenge Your Tax Demand The on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related tasks today.

The most efficient way to modify and electronically sign Tax Error Letter Templates To Challenge Your Tax Demand The effortlessly

- Obtain Tax Error Letter Templates To Challenge Your Tax Demand The and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Error Letter Templates To Challenge Your Tax Demand The to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Tax Error Letter Templates To Challenge Your Tax Demand The?

Tax Error Letter Templates To Challenge Your Tax Demand The are pre-designed documents that help you formally dispute inaccuracies in tax assessments. These templates streamline the process of articulating your case to tax authorities, thereby enhancing your chances of a successful challenge. Utilizing these templates can save you time and ensure that your response is professionally formatted.

-

How can Tax Error Letter Templates To Challenge Your Tax Demand The benefit my business?

Using Tax Error Letter Templates To Challenge Your Tax Demand The can signNowly reduce the stress associated with tax disputes. They provide clear and structured guidance, which can lead to quicker resolutions and potentially lower tax liabilities. By systematically addressing tax errors, your business can ensure compliance and better financial management.

-

Are Tax Error Letter Templates To Challenge Your Tax Demand The customizable?

Yes, the Tax Error Letter Templates To Challenge Your Tax Demand The can be easily customized to fit your specific situation. This adaptability allows you to include unique details relevant to your tax challenge, making your communication more effective and personal. By tailoring these templates, you can better represent your circumstances to the tax authorities.

-

What is the pricing structure for Tax Error Letter Templates To Challenge Your Tax Demand The?

The pricing for Tax Error Letter Templates To Challenge Your Tax Demand The varies based on your subscription plan. Users can choose from various packages that offer access to additional features such as e-signing capabilities and document management. This allows businesses to find a suitable option that meets their needs and budget.

-

Can I integrate Tax Error Letter Templates To Challenge Your Tax Demand The with other tools?

Absolutely! Tax Error Letter Templates To Challenge Your Tax Demand The can be seamlessly integrated with various business tools and platforms. This includes accounting software, cloud storage solutions, and productivity applications, allowing for a more cohesive workflow. Integrating these templates ensures you have everything you need to handle tax issues from one convenient interface.

-

Are there tutorials available for using Tax Error Letter Templates To Challenge Your Tax Demand The?

Yes, there are comprehensive tutorials available to help you effectively utilize Tax Error Letter Templates To Challenge Your Tax Demand The. These resources include step-by-step guidelines and video demonstrations that simplify the process. Whether you are a beginner or have some experience, you can find support to get the most out of these templates.

-

How secure are the Tax Error Letter Templates To Challenge Your Tax Demand The?

The security of your documents is a top priority, and Tax Error Letter Templates To Challenge Your Tax Demand The are built with robust security protocols. Your data is protected through encryption, ensuring that your sensitive information remains confidential while you work on your tax challenges. This level of security fosters peace of mind as you navigate tax disputes.

Get more for Tax Error Letter Templates To Challenge Your Tax Demand The

- Transfer ownership in singapore form

- Change of ownership tenancy utilities account transfer form 210392959

- Bulgaria visa application form

- Claim form civil dispute resolution studocu

- Maudsley addiction profile pdf form

- Vload login form

- Ethogram template form

- Application to add a power of attorney to an account natwest form

Find out other Tax Error Letter Templates To Challenge Your Tax Demand The

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online