Agreement between Heirs and Third Party Claimant as to Division of Estate Form

What is the Agreement Between Heirs And Third Party Claimant As To Division Of Estate

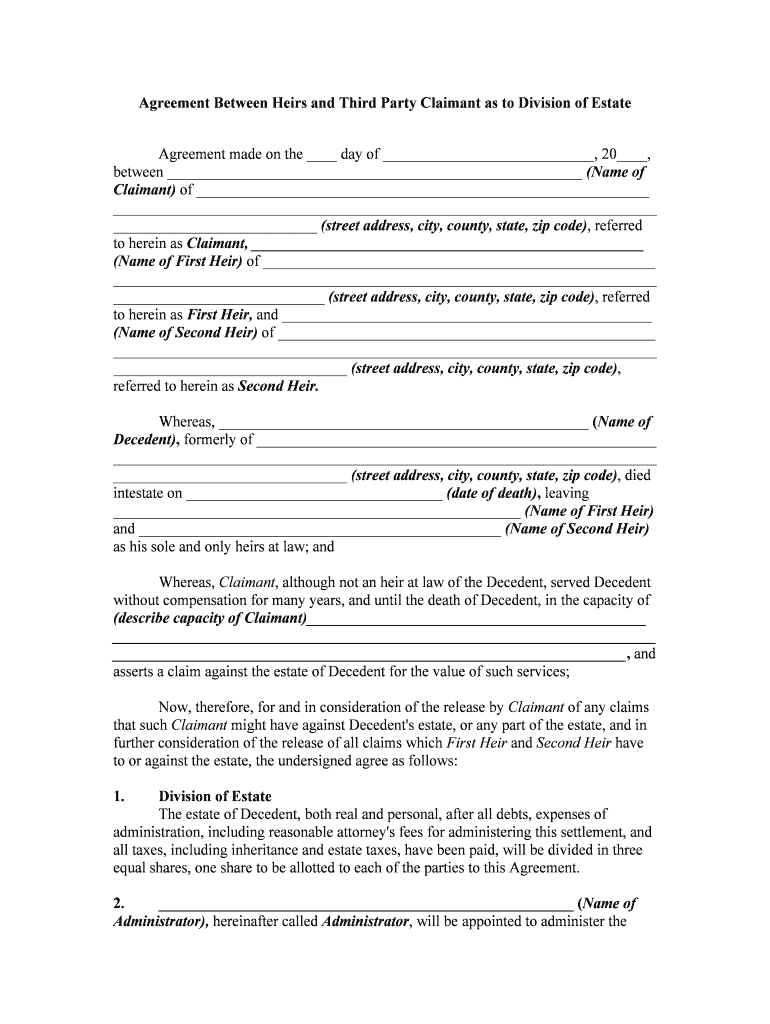

The Agreement Between Heirs And Third Party Claimant As To Division Of Estate is a legal document that outlines how an estate will be divided among heirs and any third-party claimants. This agreement is essential in situations where there are disputes or claims against the estate, ensuring that all parties involved understand their rights and obligations. It serves to clarify the distribution of assets, debts, and any other relevant matters pertaining to the estate, thereby preventing potential conflicts among heirs and claimants.

Key Elements of the Agreement Between Heirs And Third Party Claimant As To Division Of Estate

This agreement typically includes several key elements that must be clearly defined to ensure its effectiveness. These elements often consist of:

- Identification of Parties: Names and contact information of all heirs and claimants involved.

- Description of the Estate: Detailed information about the assets, liabilities, and any claims against the estate.

- Distribution Plan: A clear outline of how the estate will be divided among the heirs and any third-party claimants.

- Signatures: Signatures of all parties involved, indicating their agreement to the terms outlined.

- Date of Agreement: The date on which the agreement is executed, which is crucial for legal purposes.

Steps to Complete the Agreement Between Heirs And Third Party Claimant As To Division Of Estate

Completing the Agreement Between Heirs And Third Party Claimant As To Division Of Estate involves several important steps:

- Gather Information: Collect all necessary information about the estate, including assets, liabilities, and claims.

- Consult with Legal Advisors: It may be beneficial to consult with an attorney to ensure that the agreement complies with relevant laws.

- Draft the Agreement: Create a draft of the agreement, ensuring that all key elements are included and clearly articulated.

- Review and Revise: Have all parties review the draft and make any necessary revisions before finalizing.

- Sign the Agreement: Once all parties agree to the terms, they should sign the document, preferably in the presence of a notary public.

Legal Use of the Agreement Between Heirs And Third Party Claimant As To Division Of Estate

The legal use of this agreement is crucial in resolving disputes related to estate division. It is recognized by courts and can be presented as evidence of the agreed-upon distribution of assets. By formalizing the agreement, heirs and claimants can avoid lengthy and costly legal battles. Additionally, it provides a clear record of the intentions of the parties involved, which can be particularly important if disagreements arise in the future.

How to Obtain the Agreement Between Heirs And Third Party Claimant As To Division Of Estate

Obtaining the Agreement Between Heirs And Third Party Claimant As To Division Of Estate can be done through various means:

- Legal Templates: Many legal websites offer templates that can be customized to fit specific needs.

- Consultation with Attorneys: Engaging a lawyer who specializes in estate planning can provide tailored guidance and ensure compliance with local laws.

- Online Resources: Various online platforms provide resources and information on how to draft this agreement effectively.

Examples of Using the Agreement Between Heirs And Third Party Claimant As To Division Of Estate

Practical examples of using this agreement include situations where:

- One heir disputes the distribution of a specific asset, leading to a formal agreement on how to resolve the dispute.

- A third-party claimant, such as a creditor, has a valid claim against the estate, and the agreement outlines how the estate will address this claim.

- Heirs wish to establish a clear understanding of asset distribution to prevent future conflicts during the probate process.

Quick guide on how to complete agreement between heirs and third party claimant as to division of estate

Manage Agreement Between Heirs And Third Party Claimant As To Division Of Estate effortlessly on any platform

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Agreement Between Heirs And Third Party Claimant As To Division Of Estate on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

Steps to modify and electronically sign Agreement Between Heirs And Third Party Claimant As To Division Of Estate with ease

- Locate Agreement Between Heirs And Third Party Claimant As To Division Of Estate and select Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Agreement Between Heirs And Third Party Claimant As To Division Of Estate while ensuring excellent communication throughout each stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Agreement Between Heirs And Third Party Claimant As To Division Of Estate?

An Agreement Between Heirs And Third Party Claimant As To Division Of Estate is a legal document that establishes how the estate will be divided among heirs and any third-party claimants. This agreement helps to minimize disputes and ensures that all parties have a clear understanding of their rights and responsibilities regarding the estate.

-

How can airSlate SignNow help with creating an Agreement Between Heirs And Third Party Claimant As To Division Of Estate?

AirSlate SignNow provides an intuitive platform to easily create, edit, and send an Agreement Between Heirs And Third Party Claimant As To Division Of Estate. With our electronic signature capabilities, you can securely gather signatures from all involved parties, making the process efficient and hassle-free.

-

What are the pricing options for using airSlate SignNow for estate agreements?

AirSlate SignNow offers flexible pricing plans that cater to different needs, including those specifically for managing estate documents like an Agreement Between Heirs And Third Party Claimant As To Division Of Estate. Our cost-effective solutions are designed to provide maximum value while ensuring ease of use for all customers.

-

Are there any features specifically for estate agreements in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for estate agreements such as customizable templates, secure electronic signatures, and the ability to track document status in real-time. These features streamline the creation and execution of an Agreement Between Heirs And Third Party Claimant As To Division Of Estate.

-

Can I integrate airSlate SignNow with other software for estate management?

Absolutely! AirSlate SignNow allows for seamless integrations with various software solutions used in estate management. This enhances your ability to manage the Agreement Between Heirs And Third Party Claimant As To Division Of Estate and other related documents without switching between platforms.

-

Is there customer support available if I have questions about my agreement?

Yes, airSlate SignNow provides robust customer support to assist you with any queries related to your Agreement Between Heirs And Third Party Claimant As To Division Of Estate. Our team is dedicated to ensuring that you have all the resources necessary for successful document management.

-

What benefits does eSigning provide for estate agreements?

eSigning offers numerous benefits for estate agreements, including faster turnaround times, enhanced security, and reduced paperwork. Using airSlate SignNow for your Agreement Between Heirs And Third Party Claimant As To Division Of Estate simplifies the process, allowing for quick and efficient execution.

Get more for Agreement Between Heirs And Third Party Claimant As To Division Of Estate

- Owi specialized inc broker shipper agreement form

- Loi single valve segregation1 handytankerscom form

- Jacksonville jaxorderstremron form

- Tjx packing list form

- Fedex watch worksheet form

- Shipper credit application amp profile form

- Commercial invoice ampamp packing list tjx logistics form

- Fleet ship management pte ltd departure checklist container vessels m form

Find out other Agreement Between Heirs And Third Party Claimant As To Division Of Estate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors