Notice of Denial of Credit for Personal, Family, or Household PurposesBased on Information Received from Person Other Than Consu

What is the Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency

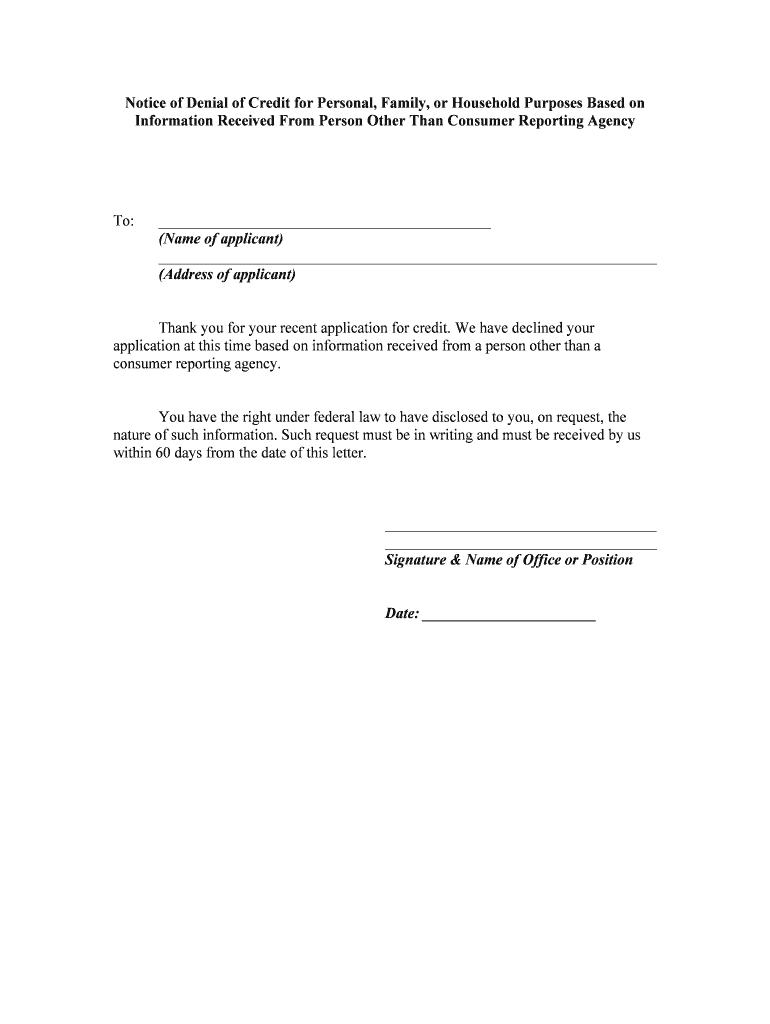

The Notice Of Denial Of Credit For Personal, Family, Or Household Purposes is a formal document issued when a credit application is denied based on information obtained from a source other than a consumer reporting agency. This notice is crucial for consumers, as it outlines the reasons for denial and provides transparency in the credit evaluation process. It ensures that individuals are informed about the factors influencing their credit decisions, which may include personal references, income verification, or other relevant data.

How to use the Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency

Using the Notice Of Denial Of Credit involves several steps to ensure that the information is accurately processed and understood. First, review the notice carefully to identify the specific reasons for the denial. Next, gather any necessary documentation that may support your case or clarify misunderstandings. If you believe the denial was unjustified, you can respond to the issuer with additional information or request a reconsideration of your application. Keeping a copy of the notice for your records is also advisable, as it may be useful for future reference or disputes.

Steps to complete the Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency

Completing the Notice Of Denial Of Credit requires attention to detail and accuracy. Begin by filling in your personal information, including your name, address, and contact details. Clearly state the date of the notice and the name of the credit issuer. Next, outline the reasons for the denial as provided in the notice, ensuring that you address each point. If applicable, include any additional information or documentation that supports your case. Finally, sign and date the notice to validate your response.

Legal use of the Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency

The legal use of the Notice Of Denial Of Credit is governed by various consumer protection laws, which require lenders to provide clear reasons for credit denials. This ensures that consumers have the opportunity to understand and address any issues that may affect their creditworthiness. The notice serves as a formal record that can be referenced in case of disputes or if further action is needed, such as filing a complaint with a regulatory agency.

Key elements of the Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency

Key elements of the Notice Of Denial Of Credit include the consumer's personal information, the name and contact details of the credit issuer, the specific reasons for the denial, and any relevant dates. Additionally, the notice should provide information on how consumers can obtain a copy of their credit report, as well as instructions for disputing inaccuracies. Understanding these elements is essential for consumers to navigate the credit process effectively.

Examples of using the Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency

Examples of using the Notice Of Denial Of Credit include scenarios where an individual applies for a personal loan and receives a denial based on income verification from a family member. In such cases, the consumer can use the notice to understand the specific reasons for the denial and gather additional documentation to support their application. Another example is when a consumer is denied a credit card due to information from a personal reference, allowing them to address the issue directly with the credit issuer.

Quick guide on how to complete notice of denial of credit for personal family or household purposesbased on information received from person other than

Effortlessly Prepare Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu on Any Device

The management of documents online has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly and without delays. Manage Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu without any hassle

- Obtain Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency'?

The 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency' is a legal communication that informs consumers when their credit application is denied due to information not provided by traditional consumer reporting agencies. Understanding this notice is crucial for consumers to know their rights and the factors affecting their creditworthiness.

-

How can airSlate SignNow help with creating the 'Notice Of Denial Of Credit'?

With airSlate SignNow, users can easily generate and customize the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency'. Our platform streamlines the document creation process, allowing businesses to quickly prepare compliant notices while reducing the time spent on paperwork.

-

Is airSlate SignNow cost-effective for small businesses?

Absolutely! airSlate SignNow offers flexible pricing plans tailored for small businesses looking to manage documents efficiently. The solution provides robust features for creating, signing, and sending critical documents, such as the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency', at a competitive price.

-

What features does airSlate SignNow offer for managing denial notices?

airSlate SignNow offers a range of features for managing denial notices, including customizable templates, automated workflows, and secure electronic signatures. These features ensure that businesses can efficiently handle the documentation and communication process related to the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency'.

-

Can airSlate SignNow integrate with existing business systems?

Yes, airSlate SignNow offers integrations with popular business systems like CRM platforms and cloud storage services. This means you can easily incorporate workflows for the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency' into your existing processes, making document handling seamless.

-

What are the benefits of using airSlate SignNow for electronic signatures?

Using airSlate SignNow for electronic signatures provides users with enhanced security, faster turnaround times, and improved transactional transparency. Businesses can ensure that documents, including the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency', are signed quickly and safely, helping to expedite their processes.

-

Is there customer support available for using airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support for all its users. Whether you have questions about generating the 'Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency' or need assistance with any features, our support team is available to help you navigate through any challenges.

Get more for Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu

- Highland community college transcript request form

- Csun client data form

- Reason for request please place an x where applicable pp franklin academy form

- Jefferson tuition reimbursement form

- Ucsc scientific diving methods and certification ucscedu form

- Proctor form

- Office of financial aid medgar evers college mec cuny form

- Prerequisite list form

Find out other Notice Of Denial Of Credit For Personal, Family, Or Household PurposesBased On Information Received From Person Other Than Consu

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast