Tax Deeds on Form

What is the Tax Deeds On

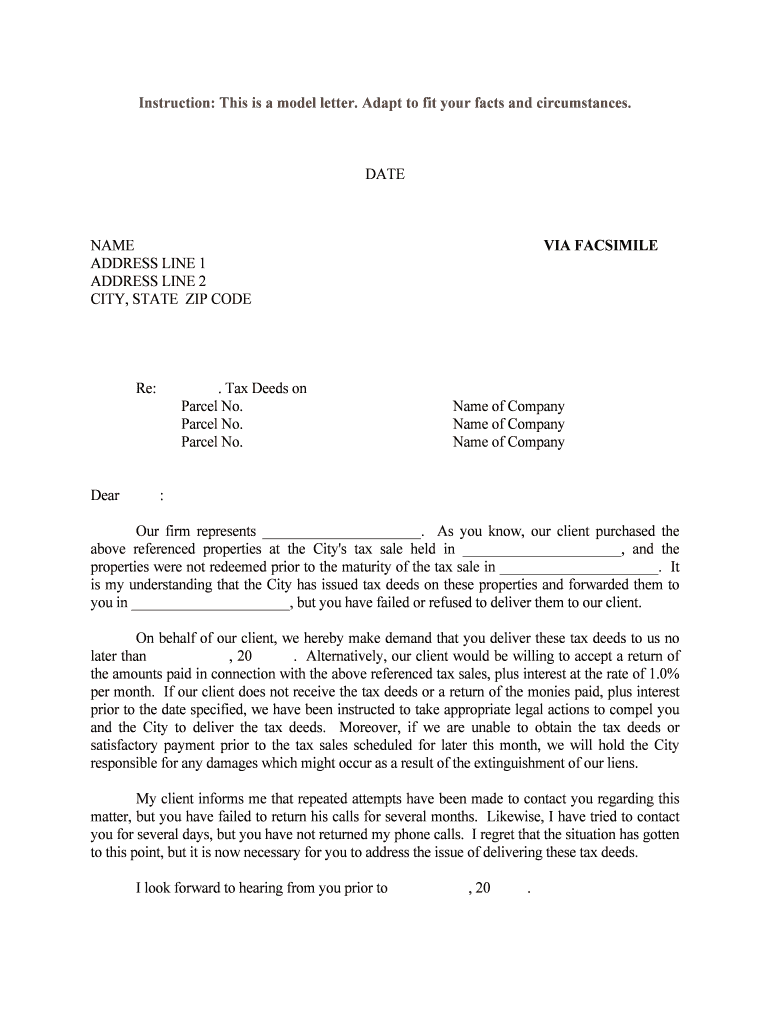

The Tax Deeds On form is a legal document used primarily in real estate transactions, particularly when properties are sold due to unpaid property taxes. This form serves as evidence of the transfer of ownership from the original owner to the purchaser, usually at a tax lien or tax deed sale. Understanding the implications of this form is crucial for both buyers and sellers, as it outlines the rights and responsibilities associated with the property being transferred.

How to use the Tax Deeds On

Using the Tax Deeds On form involves several steps that ensure compliance with local laws and regulations. First, it is essential to obtain the correct version of the form applicable in your state. Next, fill out the required information accurately, including the property details, buyer information, and any relevant tax information. After completing the form, it must be signed and dated by the appropriate parties. Finally, submit the form to the relevant local authority or agency for processing.

Steps to complete the Tax Deeds On

Completing the Tax Deeds On form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents related to the property and tax status.

- Obtain the Tax Deeds On form from your local tax authority or government website.

- Fill in the property description, including the parcel number and address.

- Provide the buyer's information, ensuring accuracy in names and contact details.

- Sign and date the form according to the requirements.

- Submit the completed form to the appropriate local office, either online, by mail, or in person.

Legal use of the Tax Deeds On

The legal use of the Tax Deeds On form is governed by state laws, which dictate how properties can be sold for unpaid taxes. This form is essential for establishing the legal transfer of ownership and ensuring that the new owner has clear title to the property. It is important to comply with all legal requirements to avoid disputes or challenges to the ownership in the future.

Key elements of the Tax Deeds On

Several key elements must be included in the Tax Deeds On form to ensure its validity:

- Property Description: Accurate details about the property, including address and parcel number.

- Buyer Information: Full name and contact details of the buyer.

- Tax Information: Details regarding the taxes owed and any relevant payment history.

- Signatures: Required signatures from the seller and buyer, along with dates.

- Notarization: Some states may require the document to be notarized for legal validity.

State-specific rules for the Tax Deeds On

Each state has its own regulations regarding the Tax Deeds On form, which can affect how the form is filled out and submitted. It is crucial to familiarize yourself with your state’s specific requirements, including any additional documentation needed, filing fees, and deadlines. Consulting with a local real estate attorney or tax professional can provide valuable guidance to ensure compliance with state laws.

Quick guide on how to complete tax deeds on

Facilitate Tax Deeds On effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It presents a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and eSign your documents swiftly without complications. Manage Tax Deeds On on any device using airSlate SignNow Android or iOS applications and simplify any document-oriented task today.

The easiest method to edit and eSign Tax Deeds On without any hassle

- Find Tax Deeds On and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Deeds On and ensure exceptional communication throughout any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Tax Deeds On and how do they work?

Tax Deeds On are legal documents that grant ownership of property due to unpaid taxes. When an owner fails to pay property taxes, the local government can auction the property, and the winning bidder receives a tax deed. This process is essential for investors seeking opportunities in real estate.

-

How can airSlate SignNow help with Tax Deeds On?

airSlate SignNow streamlines the documentation process for Tax Deeds On by providing a user-friendly platform for eSigning and sending necessary legal documents. With our solution, you can ensure that all paperwork is completed efficiently and securely, saving you time and reducing the chances of errors.

-

What are the pricing plans for airSlate SignNow regarding Tax Deeds On?

Our pricing plans are designed to be budget-friendly while catering to the specific needs of users dealing with Tax Deeds On. We offer various subscription options, allowing you to choose a plan that fits your business size and volume of transactions. Check our website for detailed pricing information and choose the right plan for you.

-

Can I integrate airSlate SignNow with other tools for managing Tax Deeds On?

Yes, airSlate SignNow seamlessly integrates with various third-party applications and platforms. This allows you to manage Tax Deeds On more efficiently by connecting with CRM systems, document management tools, and other business applications you might already be using.

-

What features does airSlate SignNow offer that are beneficial for handling Tax Deeds On?

airSlate SignNow provides a range of features specifically designed to assist with Tax Deeds On, including customizable templates, real-time tracking, and automated reminders for document signing. These features enhance the efficiency and accuracy of handling important tax-related documents.

-

Is airSlate SignNow compliant with legal standards for Tax Deeds On?

Absolutely, airSlate SignNow is compliant with all necessary legal standards for eSigning documents, including Tax Deeds On. Our platform ensures that all signatures are legally binding and secure, providing peace of mind to users handling sensitive transactions.

-

What support does airSlate SignNow provide for users managing Tax Deeds On?

We offer comprehensive support for users navigating through Tax Deeds On via multiple channels including email, chat, and a detailed knowledge base. Our team is dedicated to helping you resolve any issues swiftly, ensuring that your eSigning experience is smooth and efficient.

Get more for Tax Deeds On

- Time in time out sheet form

- Department of internal medicine division of rheumatology form

- Per the f 1 regulations employment may not start until the curricular practical training is authorized on the form

- Office of the registrar mc 018 form

- Home great hearts north phoenix prep serving grades 7 12 form

- University health service university of michigan authorization to release protected health information radiology

- Shift change form 19168594

- Portland oregon 97203 5798 form

Find out other Tax Deeds On

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online