PROJECTED RETIREMENT CASH FLOW STATEMENT Form

What is the projected retirement cash flow statement

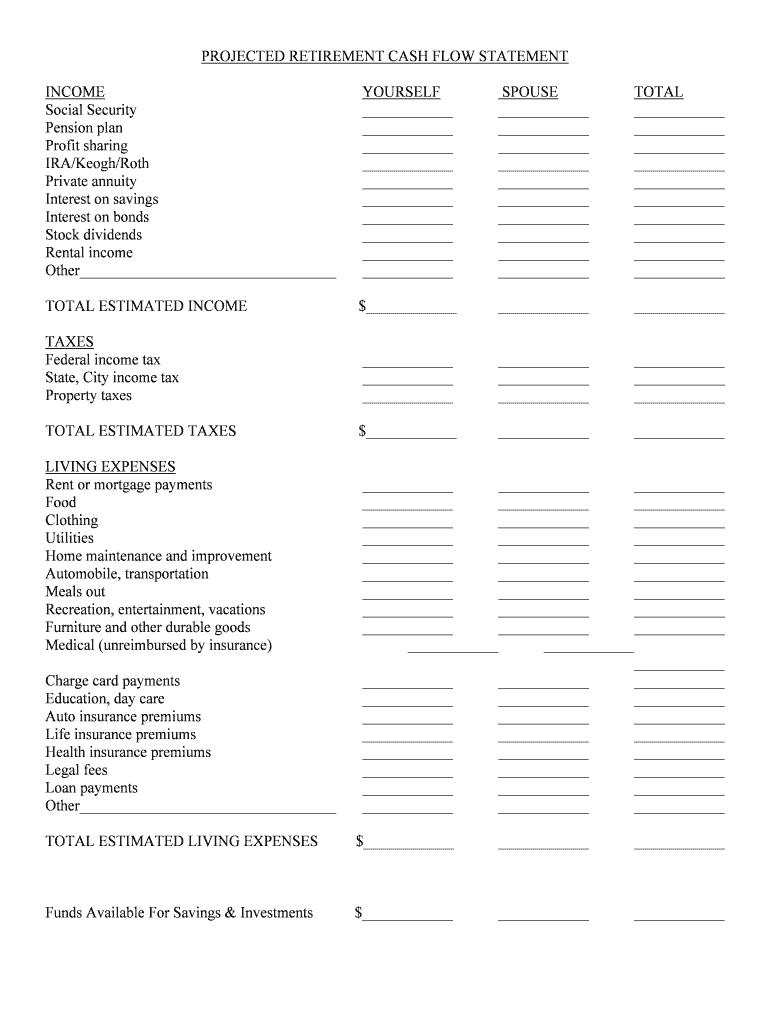

The projected retirement cash flow statement is a financial document that outlines expected income and expenses during retirement. This statement helps individuals plan for their financial future by estimating how much money they will need to maintain their desired lifestyle. It typically includes sources of income such as Social Security, pensions, and investments, as well as anticipated expenses like housing, healthcare, and leisure activities. By analyzing this information, individuals can make informed decisions about saving and investing for retirement.

How to use the projected retirement cash flow statement

Using the projected retirement cash flow statement involves several steps. First, gather all relevant financial information, including current income, savings, and expected retirement benefits. Next, estimate your future income sources and expenses during retirement. This may involve projecting the growth of investments and considering inflation rates. Once you have this data, you can create a detailed cash flow statement that outlines your projected income and expenses over the years. This statement can serve as a guide for making adjustments to your savings and investment strategies as needed.

Steps to complete the projected retirement cash flow statement

Completing the projected retirement cash flow statement requires a systematic approach. Start by listing all potential income sources, such as Social Security, pensions, and investment returns. Then, estimate your monthly and annual expenses, including fixed costs like housing and variable costs like travel. After compiling this information, create a timeline that projects these figures over your expected retirement years. Ensure to regularly update your statement to reflect changes in your financial situation or lifestyle preferences.

Key elements of the projected retirement cash flow statement

Several key elements make up the projected retirement cash flow statement. These include:

- Income sources: This includes Social Security benefits, pensions, annuities, and investment income.

- Expenses: Categorize expenses into fixed and variable costs, such as housing, healthcare, and discretionary spending.

- Inflation rate: Consider the impact of inflation on both income and expenses over time.

- Investment growth: Project the growth of your investments based on historical performance and market trends.

Legal use of the projected retirement cash flow statement

The projected retirement cash flow statement is a legal document that can be used for various financial planning purposes. It may be required by financial institutions when applying for loans or mortgages, as it demonstrates your financial stability and planning. Additionally, it can be useful in estate planning and discussions with financial advisors. To ensure its legal validity, it is important to keep the statement accurate and up-to-date, reflecting your current financial situation and future projections.

Examples of using the projected retirement cash flow statement

There are several practical applications for the projected retirement cash flow statement. For instance, individuals can use it to determine if they are on track to meet their retirement goals. It can also help in deciding when to retire by comparing projected income against expected expenses. Additionally, this statement can be beneficial for couples planning their retirement together, allowing them to align their financial goals and expectations. By reviewing various scenarios, such as different retirement ages or spending habits, individuals can make more informed decisions about their future.

Quick guide on how to complete projected retirement cash flow statement

Prepare PROJECTED RETIREMENT CASH FLOW STATEMENT effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as a perfect eco-conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage PROJECTED RETIREMENT CASH FLOW STATEMENT on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign PROJECTED RETIREMENT CASH FLOW STATEMENT seamlessly

- Locate PROJECTED RETIREMENT CASH FLOW STATEMENT and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign PROJECTED RETIREMENT CASH FLOW STATEMENT to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Projected Retirement Cash Flow Statement?

A Projected Retirement Cash Flow Statement is a financial document that estimates future cash flow during retirement, helping individuals plan for their financial needs. It outlines expected income sources, expenses, and potential shortfalls over time. Utilizing this statement ensures better financial security and informed decision-making for a comfortable retirement.

-

How can airSlate SignNow help in preparing a Projected Retirement Cash Flow Statement?

airSlate SignNow offers an easy-to-use platform that allows users to upload financial documents and collaborate with advisors to create a Projected Retirement Cash Flow Statement. The software simplifies the eSigning process, ensuring that all stakeholders can review and authorize the document quickly. Utilizing these features makes retirement planning more efficient and accessible.

-

Is there a cost associated with generating a Projected Retirement Cash Flow Statement using airSlate SignNow?

Yes, there is a cost associated, but airSlate SignNow provides cost-effective solutions tailored to your business needs. Pricing varies based on features and the number of users, allowing you to find a plan that fits your budget. Investing in a reliable eSignature service ensures you have the tools necessary to create a thorough Projected Retirement Cash Flow Statement without breaking the bank.

-

What features does airSlate SignNow offer for Projected Retirement Cash Flow Statement management?

airSlate SignNow includes features like document sharing, collaboration tools, and secure eSigning options that streamline the management of your Projected Retirement Cash Flow Statement. Additionally, the platform supports real-time updates and integrations with popular financial applications. These features ensure that your retirement planning process is organized and efficient.

-

Can I integrate airSlate SignNow with other financial tools to enhance my Projected Retirement Cash Flow Statement?

Absolutely! airSlate SignNow offers integrations with various financial software, enabling users to combine their data and automate the creation of a Projected Retirement Cash Flow Statement. This allows for seamless data transfer and collaboration across platforms. Integrating these tools can signNowly enhance your retirement planning efforts.

-

How does a Projected Retirement Cash Flow Statement benefit retirees?

A Projected Retirement Cash Flow Statement helps retirees visualize their financial future by anticipating income and expenses during retirement years. By understanding potential cash flow, retirees can make informed choices about spending, investing, and lifestyle adjustments. This proactive approach ensures financial stability and peace of mind.

-

What types of documents can I sign and store related to my Projected Retirement Cash Flow Statement?

With airSlate SignNow, you can sign and store various documents related to your Projected Retirement Cash Flow Statement, such as investment agreements, financial plans, and tax documents. This centralizes all pertinent materials in one location for easy access. Ensuring these documents are eSigned and securely stored streamlines your retirement planning process.

Get more for PROJECTED RETIREMENT CASH FLOW STATEMENT

Find out other PROJECTED RETIREMENT CASH FLOW STATEMENT

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter