Agreement between Mortgage Brokers to Find Acceptable Lender Form

What is the Agreement Between Mortgage Brokers To Find Acceptable Lender

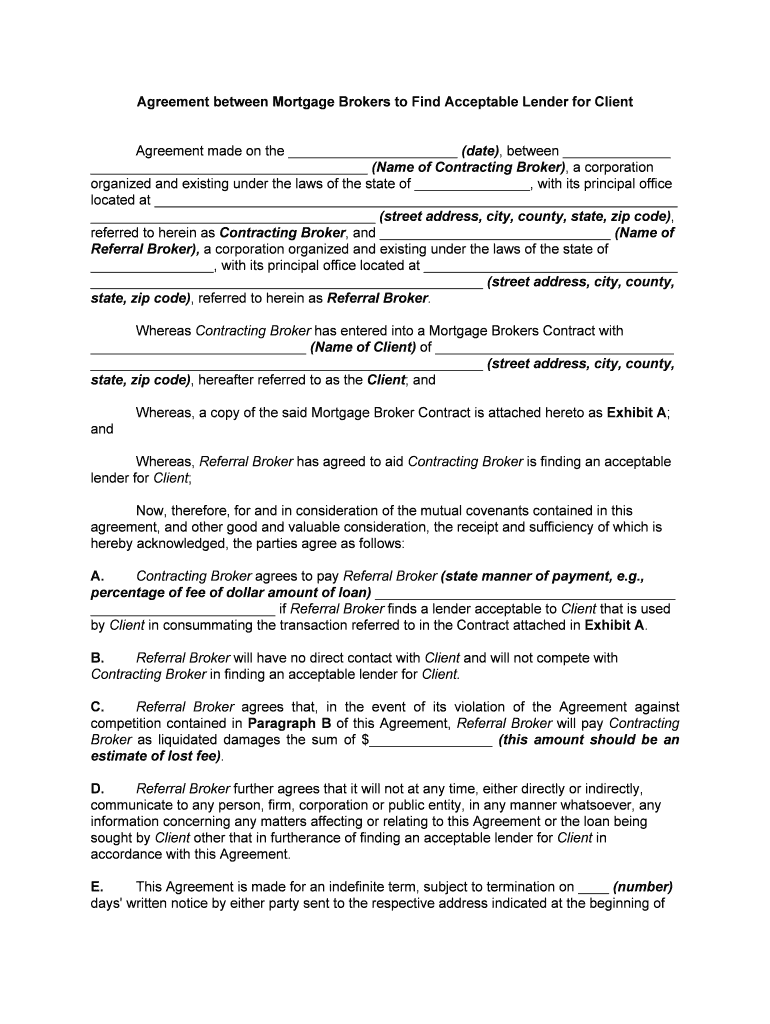

The Agreement Between Mortgage Brokers To Find Acceptable Lender is a legal document that outlines the terms and conditions under which mortgage brokers collaborate to identify suitable lending options for their clients. This agreement serves to clarify the roles and responsibilities of each broker involved in the process, ensuring that all parties are aligned in their efforts to secure financing that meets the needs of borrowers. By formalizing this collaboration, brokers can enhance their efficiency and effectiveness in navigating the lending landscape.

Key Elements of the Agreement Between Mortgage Brokers To Find Acceptable Lender

Understanding the key elements of this agreement is essential for mortgage brokers. The document typically includes:

- Identification of Parties: Names and contact information of all brokers involved.

- Scope of Work: Detailed description of the services each broker will provide.

- Compensation Structure: Terms regarding how brokers will be compensated for their services.

- Confidentiality Clause: Provisions to protect sensitive information shared between brokers.

- Dispute Resolution: Procedures for resolving any disagreements that may arise during the collaboration.

Steps to Complete the Agreement Between Mortgage Brokers To Find Acceptable Lender

Completing the Agreement Between Mortgage Brokers To Find Acceptable Lender involves several important steps:

- Gather Required Information: Collect the necessary details about all parties involved, including names, addresses, and contact information.

- Draft the Agreement: Use a template or create a document that includes all key elements, ensuring clarity and completeness.

- Review and Edit: Each broker should review the agreement to ensure accuracy and that all terms are acceptable.

- Obtain Signatures: All parties must sign the agreement to make it legally binding.

- Distribute Copies: Provide each broker with a signed copy of the agreement for their records.

Legal Use of the Agreement Between Mortgage Brokers To Find Acceptable Lender

The legal use of this agreement is crucial for ensuring compliance with state and federal regulations governing mortgage transactions. It must adhere to relevant laws, including those related to real estate practices and consumer protection. By following the legal guidelines, brokers can protect themselves and their clients from potential disputes or liabilities that may arise during the lending process.

How to Obtain the Agreement Between Mortgage Brokers To Find Acceptable Lender

Obtaining the Agreement Between Mortgage Brokers To Find Acceptable Lender can be done through various means. Brokers may access templates online, consult with legal professionals to draft a custom agreement, or utilize resources from professional organizations within the mortgage industry. It is important to ensure that any template used is compliant with current regulations and tailored to the specific needs of the brokers involved.

State-Specific Rules for the Agreement Between Mortgage Brokers To Find Acceptable Lender

Each state may have its own regulations and requirements regarding the Agreement Between Mortgage Brokers To Find Acceptable Lender. Brokers should familiarize themselves with these state-specific rules to ensure compliance. This may include licensing requirements, disclosure obligations, and specific language that must be included in the agreement. Consulting with a legal expert familiar with local laws can help brokers navigate these complexities effectively.

Quick guide on how to complete agreement between mortgage brokers to find acceptable lender

Complete Agreement Between Mortgage Brokers To Find Acceptable Lender effortlessly on any device

Digital document management has gained widespread acceptance among organizations and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Agreement Between Mortgage Brokers To Find Acceptable Lender on any device with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and eSign Agreement Between Mortgage Brokers To Find Acceptable Lender with ease

- Acquire Agreement Between Mortgage Brokers To Find Acceptable Lender and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Form your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet-ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form hunts, or mistakes that require printing new copies. airSlate SignNow meets all your requirements for document management in just a few clicks from any device of your choice. Edit and eSign Agreement Between Mortgage Brokers To Find Acceptable Lender and maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Agreement Between Mortgage Brokers To Find Acceptable Lender?

The Agreement Between Mortgage Brokers To Find Acceptable Lender is a formal document that outlines the partnership between mortgage brokers aimed at identifying and securing suitable lenders for clients. This agreement is crucial in ensuring that both parties benefit from shared resources, improving the chances of successful loans.

-

How can airSlate SignNow facilitate the Agreement Between Mortgage Brokers To Find Acceptable Lender?

airSlate SignNow streamlines the process of creating and eSigning the Agreement Between Mortgage Brokers To Find Acceptable Lender. With its intuitive interface, brokers can easily draft, send, and manage agreements, ensuring quick turnaround times and reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow in relation to agreements?

airSlate SignNow offers flexible pricing plans to suit various needs, including options tailored for teams working on Agreements Between Mortgage Brokers To Find Acceptable Lender. Each plan provides a cost-effective solution that scales with your business, allowing for budget-friendly document management.

-

What features does airSlate SignNow provide for managing mortgage agreements?

With airSlate SignNow, users benefit from features such as customizable templates, automated workflows, and real-time tracking for the Agreement Between Mortgage Brokers To Find Acceptable Lender. These tools ensure greater efficiency and transparency throughout the entire agreement process.

-

How does airSlate SignNow ensure the security of agreements?

airSlate SignNow takes the security of your documents seriously, utilizing encryption and secure storage to protect the Agreement Between Mortgage Brokers To Find Acceptable Lender. This commitment to security allows users to focus on their business without worrying about data bsignNowes or unauthorized access.

-

Can airSlate SignNow integrate with other tools used in mortgage brokering?

Yes, airSlate SignNow can integrate seamlessly with a variety of business tools and CRM systems commonly used in the mortgage industry. This compatibility enhances the management of the Agreement Between Mortgage Brokers To Find Acceptable Lender, streamlining your overall operations for better workflow efficiency.

-

What are the benefits of using airSlate SignNow for mortgage brokers?

Using airSlate SignNow allows mortgage brokers to simplify their document management practices, particularly for the Agreement Between Mortgage Brokers To Find Acceptable Lender. Key benefits include reduced paperwork, faster processing times, and improved client communication, all contributing to a more productive work environment.

Get more for Agreement Between Mortgage Brokers To Find Acceptable Lender

- Form 656 b 2011

- 2011 form withholding

- Form 8822 2011

- Schedule r form 940 rev december 2017 allocation schedule for aggregate form 940 filers irs

- 944 2011 form

- Form 944 x rev february 2011 adjusted employers annual federal tax return or claim for refund

- Gen instr for certain info returns 2011 form

- Can i file 943 online 2011 form

Find out other Agreement Between Mortgage Brokers To Find Acceptable Lender

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now