General Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping Form

What is the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

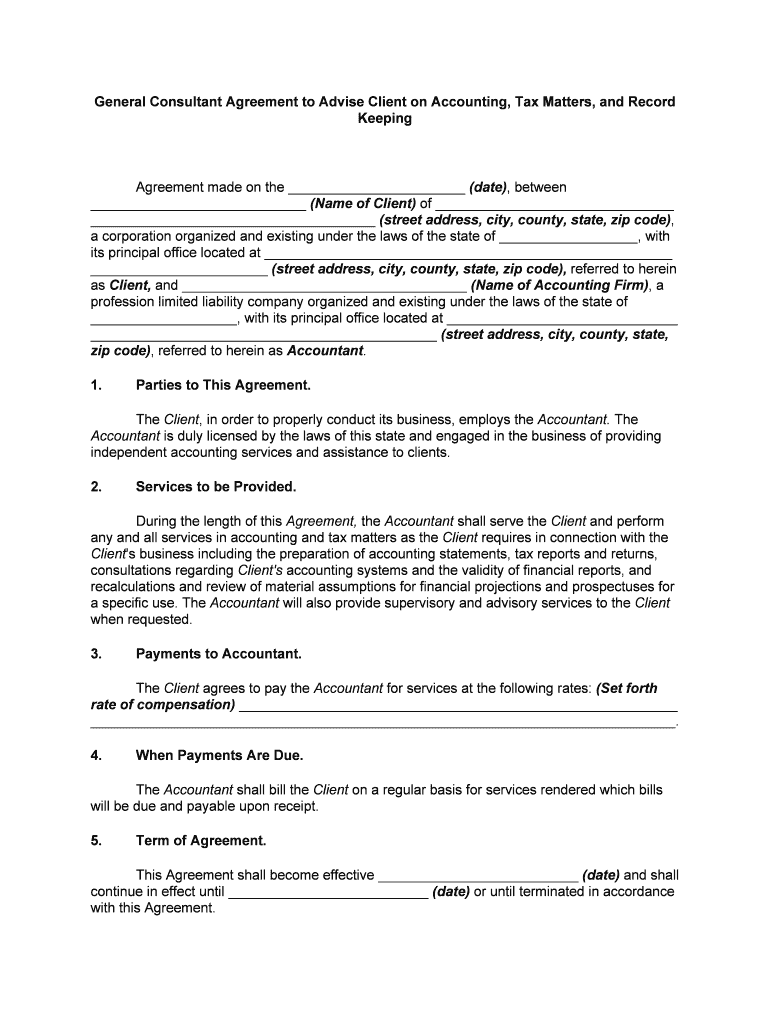

The General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping is a formal document that outlines the responsibilities and expectations between a client and an accounting professional. This agreement typically covers various aspects of financial management, including tax preparation, compliance, and record-keeping practices. By establishing clear terms, both parties can ensure a mutual understanding of the services provided, the scope of work, and the associated fees. This agreement serves as a foundational tool for effective communication and accountability in the client-accountant relationship.

How to Use the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

Using the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping involves several key steps. First, both the client and the accountant should review the document to ensure that all necessary information is included. This includes the scope of services, fees, and any specific terms related to confidentiality and data protection. Once both parties agree on the terms, the document should be signed electronically or in print, depending on preference. It is essential to keep a copy of the signed agreement for future reference, as it serves as a legal record of the understanding between the two parties.

Steps to Complete the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

Completing the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping involves a systematic approach:

- Gather necessary information, including client details and service specifications.

- Clearly outline the scope of work and any limitations.

- Specify fees and payment terms to avoid misunderstandings.

- Include clauses regarding confidentiality and data protection.

- Review the agreement with the client to ensure clarity and mutual understanding.

- Obtain signatures from both parties, ensuring compliance with eSignature laws if signed electronically.

Key Elements of the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

Several key elements must be included in the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping to ensure its effectiveness:

- Scope of Services: A detailed description of the services to be provided, including specific tasks and responsibilities.

- Fees and Payment Terms: Clear information on pricing, payment schedules, and any additional costs that may arise.

- Confidentiality Clause: Provisions to protect sensitive client information and ensure compliance with privacy regulations.

- Termination Conditions: Guidelines on how either party can terminate the agreement, including notice periods.

- Dispute Resolution: Procedures for resolving disagreements that may arise during the engagement.

Legal Use of the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

The legal use of the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping is crucial for ensuring that both parties adhere to the terms outlined in the document. For the agreement to be legally binding, it must meet specific requirements, such as mutual consent and the inclusion of essential elements like signatures. Compliance with relevant laws, such as the ESIGN Act and UETA, is also necessary when using electronic signatures. This ensures that the agreement holds up in a court of law and protects the rights of both the client and the accountant.

Examples of Using the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

Examples of using the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping can vary based on the client's needs. For instance, a small business owner may use this agreement to outline the terms of tax preparation services, including bookkeeping and financial reporting. An individual seeking personal tax assistance may utilize the agreement to define the scope of services for tax filing and advice. Each scenario highlights the flexibility of the agreement in catering to different client needs while ensuring clarity and accountability in the professional relationship.

Quick guide on how to complete general agreement to advise client on accounting tax matters and record keeping

Prepare General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping effortlessly on any device

Online document management has become increasingly popular with companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping with ease

- Obtain General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your preference. Edit and eSign General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

The General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping is a formal document that outlines the services an advisor will provide regarding accounting and tax guidance. This agreement ensures clarity between the client and the advisor, helping to avoid misunderstandings and set clear expectations for deliverables and responsibilities.

-

What are the key features of the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

The key features of the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping include detailed descriptions of services, timelines for deliverables, and fees associated with the advisory role. Additionally, it may cover confidentiality clauses and any legal obligations of both parties, ensuring a comprehensive understanding of the engagement.

-

How can the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping benefit my business?

This agreement can signNowly benefit your business by providing clear guidelines for accounting and tax advisory services, which can lead to improved compliance and reduced financial risk. By having a structured agreement in place, you can also foster a stronger working relationship with your advisor, ensuring more effective collaboration.

-

Is there a cost associated with the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

Yes, there are typically costs associated with the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping, as it often outlines fees for services rendered. These fees can vary based on the complexity of the services provided and the advisor's experience. It's recommended to discuss and agree upon these costs upfront when signing the agreement.

-

Can I customize the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

Absolutely! The General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping can be customized to suit the specific needs of your business and the advisory services required. Customization might include adding specific services, adjusting timelines, and integrating unique terms that reflect your business arrangements.

-

What integrations are available with the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

The General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping can be integrated with various accounting and document management software to streamline processes. This integration helps enhance efficiency by allowing for real-time data sharing and ensuring that all parties have access to the necessary documents and information.

-

How does airSlate SignNow facilitate the signing of the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

AirSlate SignNow provides a user-friendly platform that allows businesses to easily eSign the General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping. With its straightforward interface, users can complete the signing process quickly and securely, ensuring that all necessary parties can finalize the agreement without unnecessary delays.

Get more for General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

- Class 3 evs form

- Interdisciplinary pain medicine ismed meduni wien form

- Fillable online law school certification form new mexico

- Straumann guarantee form

- 2015 crisc form

- Cna worksheets form

- Use of platelet transfusions prior to lumbar punctures or form

- Adm animal nutrition is proud to support youth form

Find out other General Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now