AGREEMENT for DIRECT PAYMENT of TAXES, ASSESSMENTS, Form

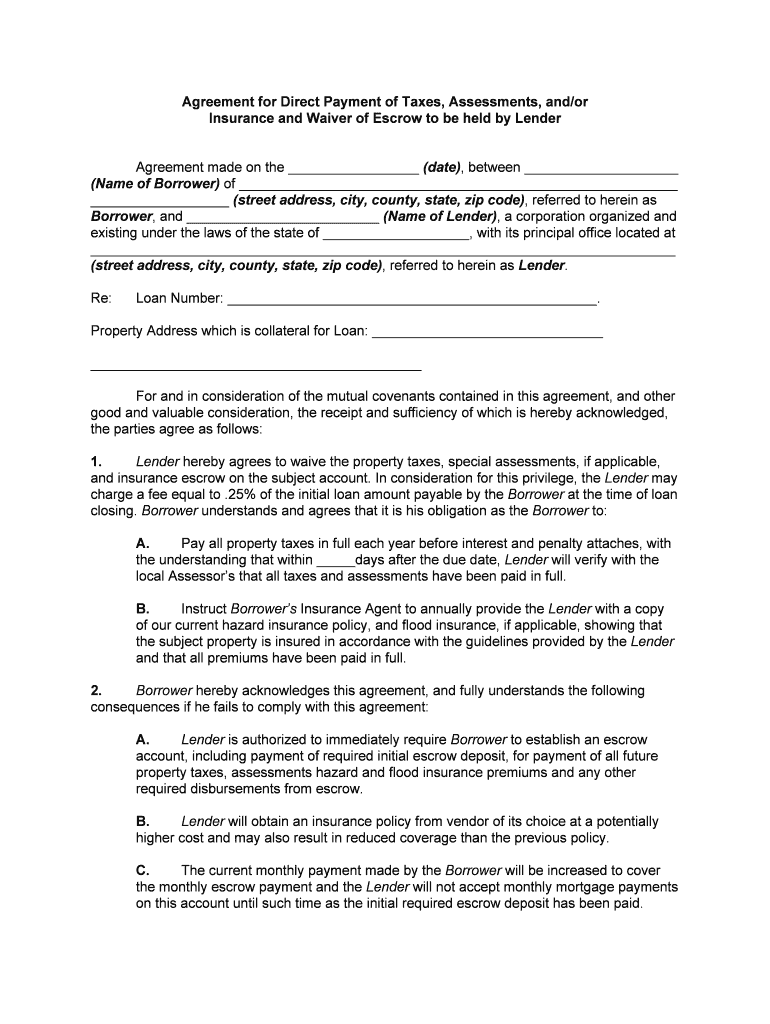

What is the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS

The Agreement for Direct Payment of Taxes, Assessments is a formal document that allows taxpayers to authorize the direct payment of taxes and assessments from their bank accounts. This agreement streamlines the payment process, ensuring timely payments and reducing the risk of late fees or penalties. It is particularly useful for individuals and businesses who prefer automated payments, providing convenience and peace of mind.

Steps to complete the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS

Completing the Agreement for Direct Payment of Taxes, Assessments involves several key steps:

- Gather necessary information, including your tax identification number, bank account details, and payment amounts.

- Obtain the correct form from your local tax authority or online resources.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form according to your local tax authority's guidelines, either online or by mail.

Legal use of the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS

The Agreement for Direct Payment of Taxes, Assessments is legally binding once signed by the taxpayer and accepted by the tax authority. To ensure its validity, the agreement must comply with relevant laws governing electronic signatures and payment authorizations. This includes adherence to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which establish the legal standing of electronic documents.

Key elements of the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS

Several key elements must be included in the Agreement for Direct Payment of Taxes, Assessments to ensure its effectiveness:

- Taxpayer Information: Full name, address, and tax identification number.

- Bank Account Details: Account number and routing number for direct payments.

- Payment Schedule: Frequency of payments, such as monthly or quarterly.

- Authorization Signature: Signature of the taxpayer authorizing the direct payment.

- Terms and Conditions: Any specific terms related to the payment agreement.

How to use the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS

Using the Agreement for Direct Payment of Taxes, Assessments is straightforward. Once completed, the taxpayer submits the form to their local tax authority. After acceptance, payments will be automatically deducted from the designated bank account according to the agreed schedule. It is important to monitor bank statements to ensure payments are processed correctly and to maintain sufficient funds to avoid overdraft fees.

Examples of using the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS

This agreement is commonly utilized by various taxpayers, including:

- Homeowners who wish to automate their property tax payments.

- Businesses managing sales tax obligations through direct payments.

- Individuals who prefer to set up automatic income tax payments to avoid penalties.

These examples highlight the versatility of the agreement in catering to different taxpayer needs, ensuring compliance and convenience.

Quick guide on how to complete agreement for direct payment of taxes assessments

Effortlessly Prepare AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly option compared to traditional printed and signed papers, as you can easily access the required forms and securely save them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, effortlessly

- Locate AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure confidential information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs within a few clicks from any device you choose. Edit and electronically sign AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, and how does it work?

The AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, is a legal document that allows taxpayers to authorize direct payments to tax authorities. By using airSlate SignNow, businesses can easily create and eSign this agreement, streamlining the payment process and ensuring compliance with tax regulations.

-

What are the benefits of using airSlate SignNow for my AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS?

Using airSlate SignNow for your AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, offers several benefits, including reduced paperwork, faster processing times, and enhanced security for sensitive information. Additionally, it allows for easy tracking of agreements and payments, ensuring that you stay in compliance with your tax obligations.

-

Is there a free trial available for airSlate SignNow when creating an AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS?

Yes, airSlate SignNow offers a free trial that allows users to explore the platform's features, including the creation of an AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS. This trial period enables prospective customers to evaluate the effectiveness and ease of use before committing to a subscription.

-

How can I ensure my AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, is legally binding?

To ensure your AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, is legally binding, use airSlate SignNow’s secure electronic signature feature, which complies with relevant eSignature laws. Additionally, make sure that all parties involved are properly identified and consent to the terms outlined in the agreement.

-

What integrations does airSlate SignNow offer for managing my AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS?

airSlate SignNow seamlessly integrates with various platforms such as Google Drive, Dropbox, and CRM systems, making it easier to manage your AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS. These integrations help centralize your document management and streamline workflows, enhancing overall efficiency.

-

How secure is my data when using airSlate SignNow for tax documents like the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS?

airSlate SignNow prioritizes the security of your data. All documents, including the AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, are encrypted during transmission and storage, ensuring that your sensitive information is protected from unauthorized access or bsignNowes.

-

Can I customize my AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS, templates. This flexibility means you can tailor the agreement to meet specific requirements and preferences, ensuring that all necessary details are accurately captured.

Get more for AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS,

Find out other AGREEMENT FOR DIRECT PAYMENT OF TAXES, ASSESSMENTS,

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement