Cp 575 Form

What is the Cp 575 Form

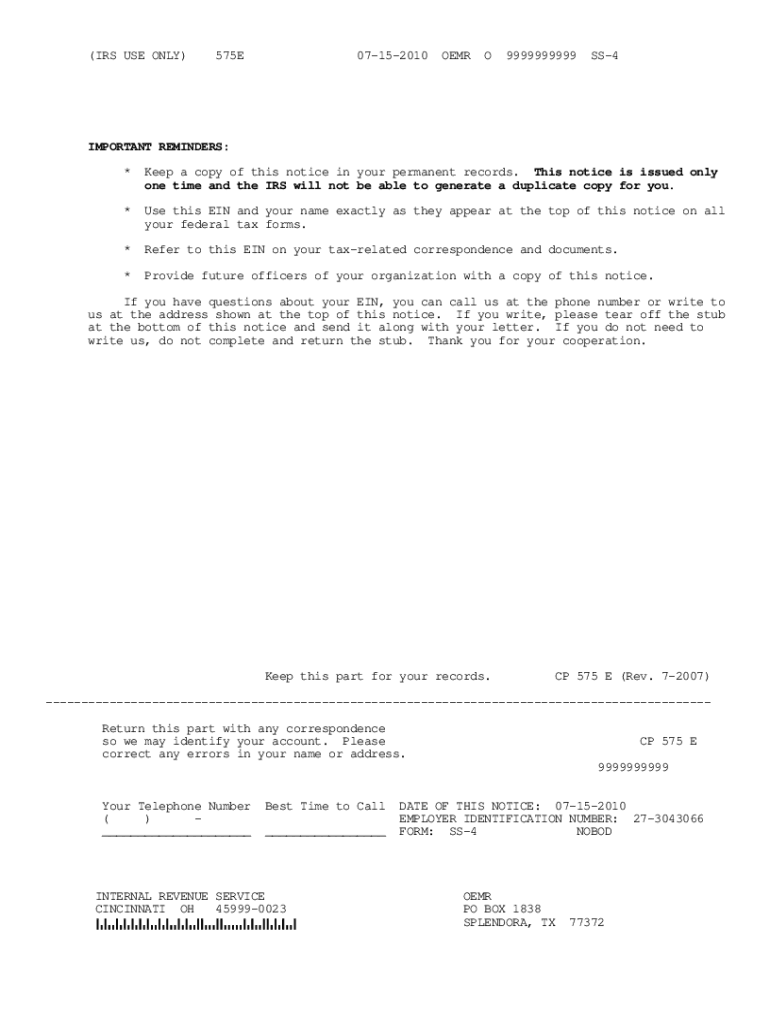

The Cp 575 form, also known as the IRS Form CP 575, is a notification issued by the Internal Revenue Service (IRS) to inform taxpayers of their Employer Identification Number (EIN). This form is crucial for businesses and entities that require an EIN for tax reporting purposes. The CP 575 serves as an official confirmation of the EIN assignment, which is essential for various tax-related activities, including filing tax returns, opening business bank accounts, and applying for business licenses.

How to obtain the Cp 575 Form

To obtain the Cp 575 form, you typically do not need to request it separately, as it is automatically sent by the IRS after you successfully apply for an Employer Identification Number. If you have not received your CP 575 form, you can contact the IRS directly to inquire about your EIN status. Additionally, you can access the form online through the IRS website or by visiting a local IRS office for assistance.

Steps to complete the Cp 575 Form

Completing the Cp 575 form involves several key steps. First, ensure that you have all necessary information at hand, including your business name, address, and the type of entity you are registering. Next, accurately fill out the form by providing the required details in each section. It's important to double-check your entries for accuracy to avoid delays. Once completed, submit the form according to the IRS guidelines, either online or via mail, depending on your preference and the specific instructions provided by the IRS.

Legal use of the Cp 575 Form

The Cp 575 form is legally binding as it serves as official documentation of your Employer Identification Number. This form must be used in compliance with IRS regulations. Businesses must ensure that they use the current version of the form and provide accurate information to avoid any legal issues or penalties. Proper use of the CP 575 is essential for maintaining compliance with federal tax laws and regulations.

Key elements of the Cp 575 Form

Key elements of the Cp 575 form include the business name, the assigned Employer Identification Number, the type of entity (such as sole proprietorship, partnership, or corporation), and the date of issuance. These elements are critical for identifying your business for tax purposes. Additionally, the form may contain instructions for future use of the EIN, including filing requirements and responsibilities associated with the assigned number.

Form Submission Methods (Online / Mail / In-Person)

The Cp 575 form can be submitted through various methods, depending on your preference and the specific instructions from the IRS. Typically, businesses can apply for an EIN online through the IRS website, which is the fastest method. Alternatively, you may choose to submit the form by mail or in person at a local IRS office. Each submission method has its own processing time, so it is advisable to select the one that best fits your timeline and needs.

Filing Deadlines / Important Dates

While the Cp 575 form itself does not have a specific filing deadline, it is essential to apply for an Employer Identification Number as soon as your business is established. Timely application ensures that you can meet other tax-related deadlines, such as filing your business tax returns. Keep in mind that certain business activities may have specific deadlines, so staying informed about these dates is crucial for compliance.

Quick guide on how to complete irs form cp 575 pdf

Discover the most efficient method to complete and endorse your Cp 575 Form

Are you still spending time creating your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to fill out and endorse your Cp 575 Form and related forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle paperwork swiftly and in compliance with official standards - robust PDF editing, management, security, signing, and sharing features, all accessible within an easy-to-use interface.

Only a few steps are required to fill out and endorse your Cp 575 Form:

- Upload the editable template to the editor using the Get Form button.

- Review the information needed in your Cp 575 Form.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Conceal areas that are no longer relevant.

- Hit Sign to create a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Cp 575 Form in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our solution also facilitates flexible form sharing. There’s no need to print your forms when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the irs form cp 575 pdf

How to make an eSignature for your Irs Form Cp 575 Pdf online

How to create an electronic signature for the Irs Form Cp 575 Pdf in Chrome

How to generate an eSignature for putting it on the Irs Form Cp 575 Pdf in Gmail

How to make an eSignature for the Irs Form Cp 575 Pdf straight from your mobile device

How to create an eSignature for the Irs Form Cp 575 Pdf on iOS

How to generate an electronic signature for the Irs Form Cp 575 Pdf on Android OS

People also ask

-

What is the cp575 internal revenue form?

The cp575 internal revenue form is an important document issued by the IRS to businesses that have applied for an Employer Identification Number (EIN). It serves as a confirmation of your EIN and is necessary for tax purposes and business registration.

-

How can airSlate SignNow help with the cp575 internal revenue form?

With airSlate SignNow, you can easily upload, send, and eSign your cp575 internal revenue form securely. Our platform simplifies the process of managing official documents, ensuring that your interactions with the IRS are streamlined and efficient.

-

Is airSlate SignNow a cost-effective solution for managing the cp575 internal revenue form?

Yes, airSlate SignNow offers a cost-effective solution for managing your cp575 internal revenue form. We provide various pricing plans tailored to meet the needs of businesses of all sizes, allowing you to choose an option that fits your budget while ensuring compliance and security.

-

What features does airSlate SignNow offer for eSigning the cp575 internal revenue form?

AirSlate SignNow provides comprehensive features for eSigning your cp575 internal revenue form, including customizable workflows, in-app notifications, and secure storage. Our user-friendly interface makes it easy for you to send documents for signatures without hassle.

-

Can I integrate airSlate SignNow with other tools when handling the cp575 internal revenue form?

Absolutely! AirSlate SignNow offers seamless integrations with various tools and applications, allowing you to easily manage your cp575 internal revenue form along with other business processes. This ensures that your workflow remains efficient and organized.

-

What are the benefits of using airSlate SignNow for the cp575 internal revenue form?

Using airSlate SignNow for your cp575 internal revenue form offers numerous benefits, including time savings, enhanced security, and easier document management. Our platform helps you track the status of your forms and provides a reliable way to ensure compliance.

-

How secure is airSlate SignNow when handling sensitive documents like the cp575 internal revenue form?

AirSlate SignNow takes security seriously and employs industry-standard encryption to protect sensitive documents, including the cp575 internal revenue form. We are committed to safeguarding your data and ensuring a secure eSigning experience.

Get more for Cp 575 Form

Find out other Cp 575 Form

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement