GENERAL DISCLOSURES REQUIRED by the FEDERAL TRUTH in LENDING ACT Form

Understanding the General Disclosures Required by the Federal Truth in Lending Act

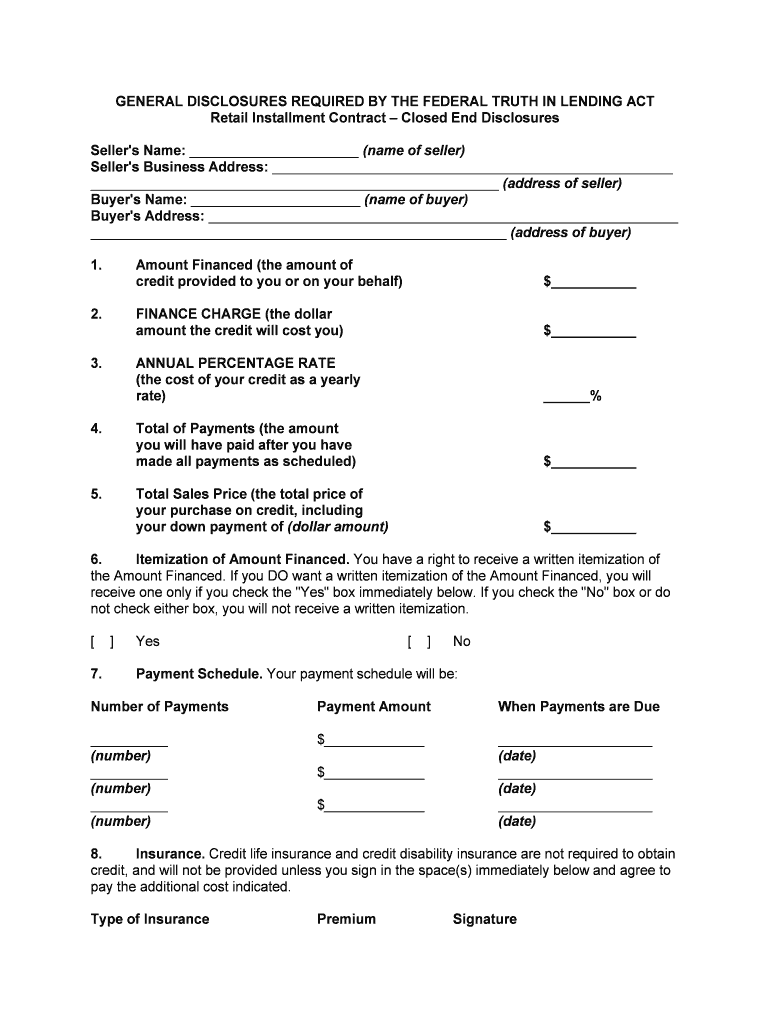

The General Disclosures Required by the Federal Truth in Lending Act (TILA) are essential for ensuring transparency in lending practices. These disclosures provide borrowers with clear information about the terms and costs associated with a loan. Key aspects include the annual percentage rate (APR), finance charges, total payments, and the payment schedule. By law, lenders must present this information in a standardized format, allowing consumers to compare different loan offers effectively. This transparency helps borrowers make informed decisions regarding their financial commitments.

Steps to Complete the General Disclosures Required by the Federal Truth in Lending Act

Completing the General Disclosures under TILA involves several important steps. First, gather all relevant information about the loan, including the principal amount, interest rate, and any associated fees. Next, ensure that the lender provides the necessary disclosures in writing. Review the disclosures carefully to confirm that all required elements are included, such as the APR and total cost of the loan. If filling out the form electronically, use a reliable eSigning solution to ensure that the document is legally binding and secure. Finally, retain a copy of the completed disclosures for your records.

Key Elements of the General Disclosures Required by the Federal Truth in Lending Act

Several key elements must be included in the General Disclosures under TILA. These include:

- Annual Percentage Rate (APR): This reflects the true cost of borrowing, including interest and fees.

- Finance Charges: The total cost of credit expressed as a dollar amount.

- Total Payments: The total amount the borrower will pay over the life of the loan.

- Payment Schedule: Details on the number of payments, payment amounts, and due dates.

- Late Fees: Information on any penalties for late payments.

These elements are crucial for borrowers to understand their financial obligations fully.

Legal Use of the General Disclosures Required by the Federal Truth in Lending Act

The legal use of the General Disclosures required by TILA ensures that lenders comply with federal regulations. These disclosures must be provided to borrowers before they finalize a loan agreement. Failure to provide accurate disclosures can result in penalties for lenders, including fines and potential legal action. Additionally, borrowers have the right to rescind certain types of loans if they do not receive the required disclosures in a timely manner. This legal framework protects consumers and promotes fair lending practices.

How to Use the General Disclosures Required by the Federal Truth in Lending Act

Using the General Disclosures effectively involves understanding the information presented. Borrowers should compare the disclosures from different lenders to evaluate loan offers. Pay attention to the APR and total payments, as these figures directly impact the cost of borrowing. It is also important to consider any fees associated with the loan, as these can significantly affect the overall financial commitment. By utilizing these disclosures, borrowers can make informed choices that align with their financial goals.

Examples of Using the General Disclosures Required by the Federal Truth in Lending Act

Examples of how to use the General Disclosures include comparing mortgage offers from multiple lenders. For instance, if one lender offers a lower APR but higher fees, while another has a slightly higher APR with lower fees, the total cost should be calculated to determine which option is more favorable. Additionally, when applying for a personal loan, reviewing the disclosures can help identify any hidden costs or unfavorable terms. These practical applications illustrate how the disclosures serve as a valuable tool for consumers in making sound financial decisions.

Quick guide on how to complete general disclosures required by the federal truth in lending act

Complete GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT effortlessly on any device

Online document management has gained traction with organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without holdups. Manage GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT without any hassle

- Find GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT and then click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize essential sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to preserve your changes.

- Select how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Adjust and eSign GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the general disclosures required by the Federal Truth in Lending Act?

The general disclosures required by the Federal Truth in Lending Act include essential information about loan terms, such as the annual percentage rate (APR), finance charges, and total payments. These disclosures aim to provide borrowers with clear insights into the costs associated with their loans, fostering transparency and informed decision-making.

-

How does airSlate SignNow help with compliance regarding general disclosures required by the Federal Truth in Lending Act?

airSlate SignNow streamlines the eSigning process, allowing businesses to easily integrate the general disclosures required by the Federal Truth in Lending Act into their documents. By automating document workflows, companies can ensure that clients receive timely and accurate disclosures, helping maintain compliance and avoid potential penalties.

-

What features does airSlate SignNow offer for businesses managing general disclosures required by the Federal Truth in Lending Act?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure document storage. These functionalities enable businesses to effectively manage the general disclosures required by the Federal Truth in Lending Act and provide clients with a seamless experience during the eSigning process.

-

Is airSlate SignNow affordable for small businesses needing to comply with the Federal Truth in Lending Act?

Yes, airSlate SignNow is a cost-effective solution tailored for businesses of all sizes, including small businesses. Our pricing plans are designed to provide access to essential features to help comply with the general disclosures required by the Federal Truth in Lending Act without straining budgets.

-

Can airSlate SignNow integrate with other software to manage disclosures related to the Federal Truth in Lending Act?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and financial software, allowing businesses to efficiently manage their workflows and ensure that all general disclosures required by the Federal Truth in Lending Act are communicated effectively. This interoperability enhances overall operational efficiency.

-

How does airSlate SignNow safeguard documents containing general disclosures required by the Federal Truth in Lending Act?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols and secure access controls to protect documents that include general disclosures required by the Federal Truth in Lending Act, ensuring both compliance and confidentiality for our users.

-

What benefits can businesses expect by using airSlate SignNow for disclosures under the Federal Truth in Lending Act?

By using airSlate SignNow, businesses can enjoy benefits such as increased efficiency, reduced administrative costs, and improved customer satisfaction. Streamlining the process for general disclosures required by the Federal Truth in Lending Act can also lead to quicker transaction times and enhanced client trust.

Get more for GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT

Find out other GENERAL DISCLOSURES REQUIRED BY THE FEDERAL TRUTH IN LENDING ACT

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF