Philanthropy Tax InstituteTaxwise Giving Form

What is the Philanthropy Tax Institute Taxwise Giving

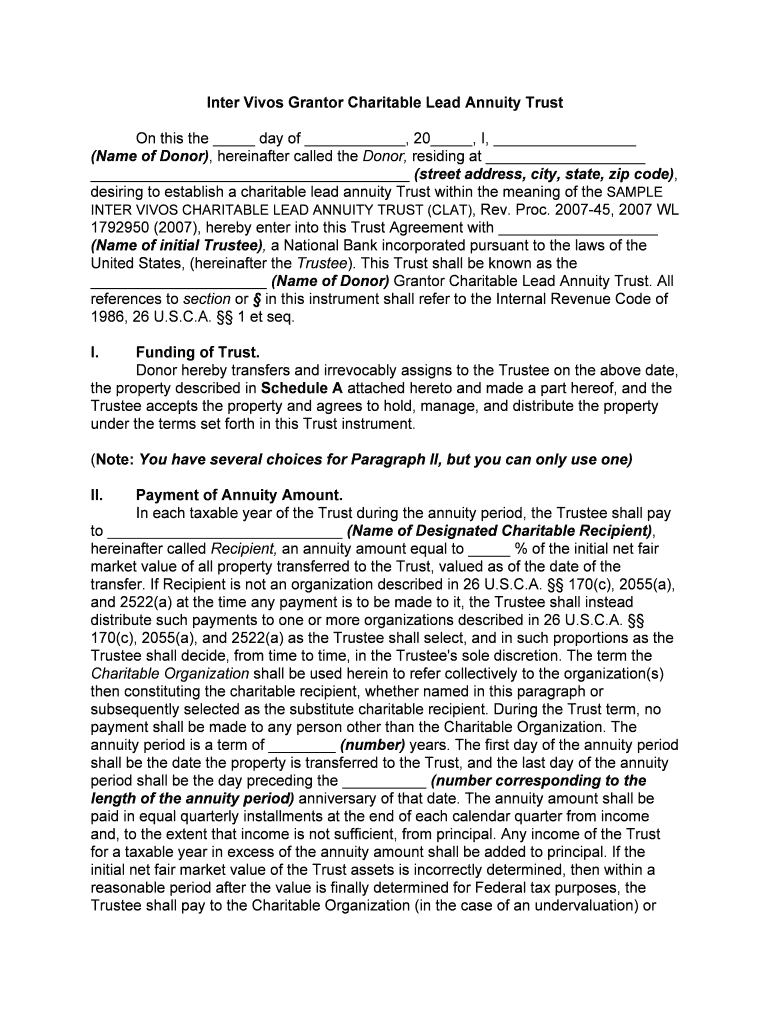

The Philanthropy Tax Institute Taxwise Giving form is designed to facilitate charitable contributions while ensuring compliance with tax regulations. This form serves as a guide for individuals and organizations looking to make tax-deductible donations. It outlines the necessary information required for proper documentation and helps donors maximize their tax benefits while supporting their chosen causes. Understanding this form is crucial for anyone engaged in philanthropy, as it provides clarity on the tax implications of charitable giving.

How to use the Philanthropy Tax Institute Taxwise Giving

Using the Philanthropy Tax Institute Taxwise Giving form involves several straightforward steps. First, gather all relevant information about the donation, including the recipient organization’s details and the amount being donated. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Once the form is completed, it can be submitted electronically or printed for mailing. Utilizing digital tools can streamline this process, allowing for easier tracking and management of your charitable contributions.

Steps to complete the Philanthropy Tax Institute Taxwise Giving

Completing the Philanthropy Tax Institute Taxwise Giving form requires careful attention to detail. Follow these steps:

- Collect necessary documentation, including receipts and organization information.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically via a secure platform or print it for mailing.

- Keep a copy of the completed form for your records.

Legal use of the Philanthropy Tax Institute Taxwise Giving

The legal use of the Philanthropy Tax Institute Taxwise Giving form is essential for ensuring that donations are recognized as tax-deductible. Compliance with IRS regulations is critical, as improper use can lead to penalties or disqualification of the tax benefits. The form must be filled out accurately and submitted in accordance with the guidelines set forth by the IRS. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of using this form.

Key elements of the Philanthropy Tax Institute Taxwise Giving

Several key elements make up the Philanthropy Tax Institute Taxwise Giving form. These include:

- Donor Information: Details about the individual or organization making the donation.

- Recipient Information: Name and address of the charitable organization receiving the donation.

- Donation Amount: The total value of the contribution being made.

- Type of Donation: Specification of whether the donation is cash, property, or other assets.

- Date of Donation: When the contribution was made.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for the Philanthropy Tax Institute Taxwise Giving form. Generally, donations must be reported in the tax year they are made, and specific deadlines may vary based on the type of donation and the recipient organization. It is essential to check the IRS guidelines for the most up-to-date information on deadlines, as failure to meet these dates can result in missed tax benefits. Keeping a calendar of important dates related to charitable giving can aid in compliance and planning.

Quick guide on how to complete philanthropy tax institutetaxwise giving

Accomplish Philanthropy Tax InstituteTaxwise Giving seamlessly on any device

Managing documents online has become increasingly prevalent among companies and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents rapidly without delays. Manage Philanthropy Tax InstituteTaxwise Giving on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Philanthropy Tax InstituteTaxwise Giving effortlessly

- Obtain Philanthropy Tax InstituteTaxwise Giving and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Philanthropy Tax InstituteTaxwise Giving and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Philanthropy Tax InstituteTaxwise Giving program?

The Philanthropy Tax InstituteTaxwise Giving program is designed to help individuals and organizations maximize their charitable contributions. By using tax-efficient strategies, this program allows donors to optimize their tax benefits while supporting their favorite causes. With tailored guidance, participants can navigate the complexities of philanthropy effectively.

-

How does Philanthropy Tax InstituteTaxwise Giving benefit donors?

The Philanthropy Tax InstituteTaxwise Giving program provides signNow benefits for donors, including the ability to reduce their taxable income through strategic giving. This optimizes not only the financial impact of their donations but also fosters a deeper connection to the community. Donors can make informed decisions while enjoying the tax advantages associated with their generosity.

-

What features does the Philanthropy Tax InstituteTaxwise Giving offer?

The Philanthropy Tax InstituteTaxwise Giving offers various features such as personalized tax strategies, comprehensive giving plans, and ongoing support for donors. These features ensure that participants can effectively manage their philanthropic efforts while maximizing their tax savings. Additionally, the program provides educational resources to enhance understanding of charitable giving.

-

Is there a cost associated with the Philanthropy Tax InstituteTaxwise Giving?

Yes, there may be associated costs with the Philanthropy Tax InstituteTaxwise Giving program, depending on the services required. Typically, fees are structured to ensure access to tailored resources that provide maximum benefit to the donor. It's advisable for prospective participants to consult with program advisors to understand the pricing structure.

-

Can I integrate Philanthropy Tax InstituteTaxwise Giving with my current financial software?

The Philanthropy Tax InstituteTaxwise Giving program is designed to seamlessly integrate with various financial software, allowing donors to manage their contributions effortlessly. This integration facilitates streamlined tracking of donations and associated tax benefits in one place. Compatibility with popular software ensures ease of use for all participants.

-

Who can benefit from the Philanthropy Tax InstituteTaxwise Giving?

Individuals, businesses, and nonprofit organizations can all benefit from the Philanthropy Tax InstituteTaxwise Giving. Those looking to maximize their charitable donations while minimizing tax liabilities will find this program particularly advantageous. Additionally, planning professionals can also leverage its features to better serve their clients.

-

How can I get started with the Philanthropy Tax InstituteTaxwise Giving?

Getting started with the Philanthropy Tax InstituteTaxwise Giving is straightforward. Prospective donors can visit the program's website to access resources and schedule a consultation. A dedicated support team is available to guide individuals through the enrollment process and address any initial questions.

Get more for Philanthropy Tax InstituteTaxwise Giving

Find out other Philanthropy Tax InstituteTaxwise Giving

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT