For the Year Ended Dec Form

What is the For The Year Ended Dec

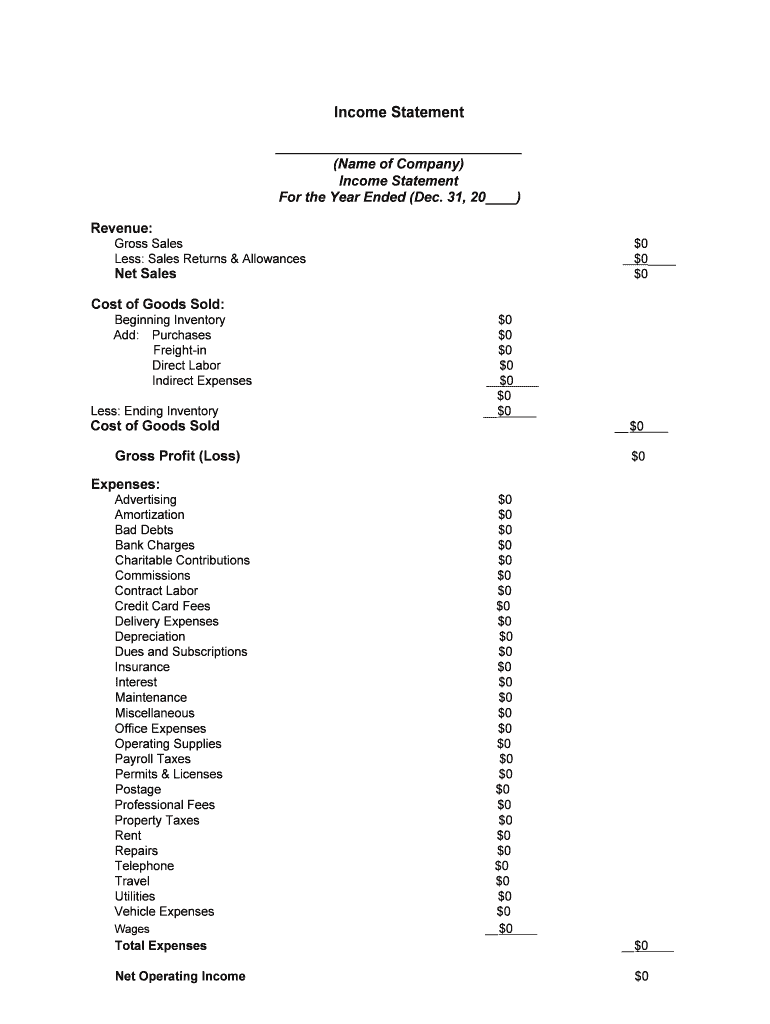

The "For The Year Ended Dec" form is primarily used for reporting financial information at the conclusion of a fiscal year that ends in December. This form is essential for businesses and individuals who need to summarize their financial activities, including income, expenses, and other pertinent data. It serves as a crucial document for tax reporting and compliance, ensuring that all financial transactions are accurately captured and reported to the Internal Revenue Service (IRS).

Steps to complete the For The Year Ended Dec

Completing the "For The Year Ended Dec" form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and receipts for expenses. Next, follow these steps:

- Fill out the identification section with your name, business name, and tax identification number.

- Report all sources of income, ensuring to include any additional income not previously documented.

- List all deductible expenses, categorizing them appropriately to ensure clarity.

- Calculate net income by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the For The Year Ended Dec

The "For The Year Ended Dec" form must be completed in accordance with IRS guidelines to maintain its legal validity. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). It is essential to ensure that all information is truthful and accurate, as any discrepancies can lead to penalties or legal issues.

Filing Deadlines / Important Dates

Timely filing of the "For The Year Ended Dec" form is crucial to avoid penalties. Generally, the deadline for submission is April fifteenth of the following year. However, if you require additional time, you may file for an extension, which typically grants an additional six months. It is important to mark these dates on your calendar to ensure compliance.

IRS Guidelines

The IRS provides specific guidelines for completing the "For The Year Ended Dec" form. These guidelines include instructions on what constitutes taxable income, allowable deductions, and the proper way to report various financial activities. Familiarizing yourself with these guidelines can help prevent errors and ensure that your form is completed correctly.

Examples of using the For The Year Ended Dec

There are various scenarios in which the "For The Year Ended Dec" form is utilized. For instance, a self-employed individual may use this form to report income earned from freelance work, while a business owner may use it to summarize the financial performance of their company over the year. Each example highlights the importance of accurately reporting financial information to meet tax obligations.

Quick guide on how to complete for the year ended dec

Complete For The Year Ended Dec effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle For The Year Ended Dec on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and electronically sign For The Year Ended Dec with ease

- Obtain For The Year Ended Dec and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of your documents or redact sensitive information with tools available through airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate printing out new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign For The Year Ended Dec and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing model for For The Year Ended Dec.?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. For The Year Ended Dec., you can choose from monthly or annual subscriptions that cater to your specific needs. Our pricing plans are designed to ensure you get the most value while seamlessly managing your document signing processes.

-

What features does airSlate SignNow provide for efficient document management?

For The Year Ended Dec., airSlate SignNow provides comprehensive features like eSigning, document templates, and workflow automation. These tools empower businesses to streamline their document management while enhancing collaboration and efficiency. Additionally, users can easily track document status and ensure compliance throughout the signing process.

-

How can airSlate SignNow benefit my business for For The Year Ended Dec.?

Using airSlate SignNow for For The Year Ended Dec. can signNowly reduce the time and resources spent on document processing. By automating eSigning and document workflows, businesses can improve turnaround times and enhance customer satisfaction. This efficiency ultimately aids in achieving better business outcomes and financial performance.

-

Are there integrations available with airSlate SignNow for various applications?

Yes, airSlate SignNow offers numerous integrations with popular applications like Salesforce, Google Workspace, and Microsoft Office. These integrations are crucial for businesses looking to enhance their processes for For The Year Ended Dec. By connecting your existing tools with airSlate SignNow, you can ensure seamless data flow and improved productivity.

-

Is airSlate SignNow secure for handling sensitive documents for For The Year Ended Dec.?

Absolutely! airSlate SignNow takes security seriously, which is why we utilize industry-standard encryption and comply with regulations such as GDPR and HIPAA. For The Year Ended Dec., you can trust that your sensitive documents are protected at every stage, ensuring peace of mind while handling important information.

-

Can I customize templates within airSlate SignNow for For The Year Ended Dec.?

Yes, airSlate SignNow allows users to create and customize document templates tailored to their specific needs. For The Year Ended Dec., this feature enables businesses to save time and maintain consistency by reusing documents with pre-defined fields. Customizable templates enhance efficiency and ensure that all necessary information is captured seamlessly.

-

What kind of customer support does airSlate SignNow provide?

airSlate SignNow offers robust customer support to assist users with any questions related to For The Year Ended Dec. Our support team is available via chat, email, and phone, ensuring that you receive timely assistance. Additionally, we provide extensive documentation and tutorials to help users maximize the value of our platform.

Get more for For The Year Ended Dec

- Rule 5140 form

- Gwinnett county public schools notarized residency mountainparkes form

- Vote form

- Girl scout bronze award log of hours girl scouts of maine form

- Free maryland vessel bill of sale form pdf form download

- Intent to enroll form cornville regional charter school cornvilleregionalcharterschool

- Maine general bill of sale form

- City of dearborn heights plumbing permit form

Find out other For The Year Ended Dec

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template