Accounts Receivables on the Balance Sheet Form

What is the Accounts Receivables On The Balance Sheet

The accounts receivables on the balance sheet represent the amounts owed to a business by its customers for goods or services delivered but not yet paid for. This asset is crucial for understanding a company's liquidity and financial health. It reflects the credit extended to customers and indicates potential future cash inflows. Proper management of accounts receivables is essential for maintaining cash flow and ensuring that a business can meet its obligations.

Key elements of the Accounts Receivables On The Balance Sheet

Several key elements define accounts receivables on the balance sheet:

- Customer Invoices: These documents detail the amount owed by customers and the terms of payment.

- Payment Terms: This includes the duration customers have to settle their invoices, which can affect cash flow.

- Allowance for Doubtful Accounts: A provision made for potential uncollectible accounts, reflecting a realistic view of expected cash inflows.

- Age of Receivables: This metric helps assess how long invoices have been outstanding, providing insight into collection efficiency.

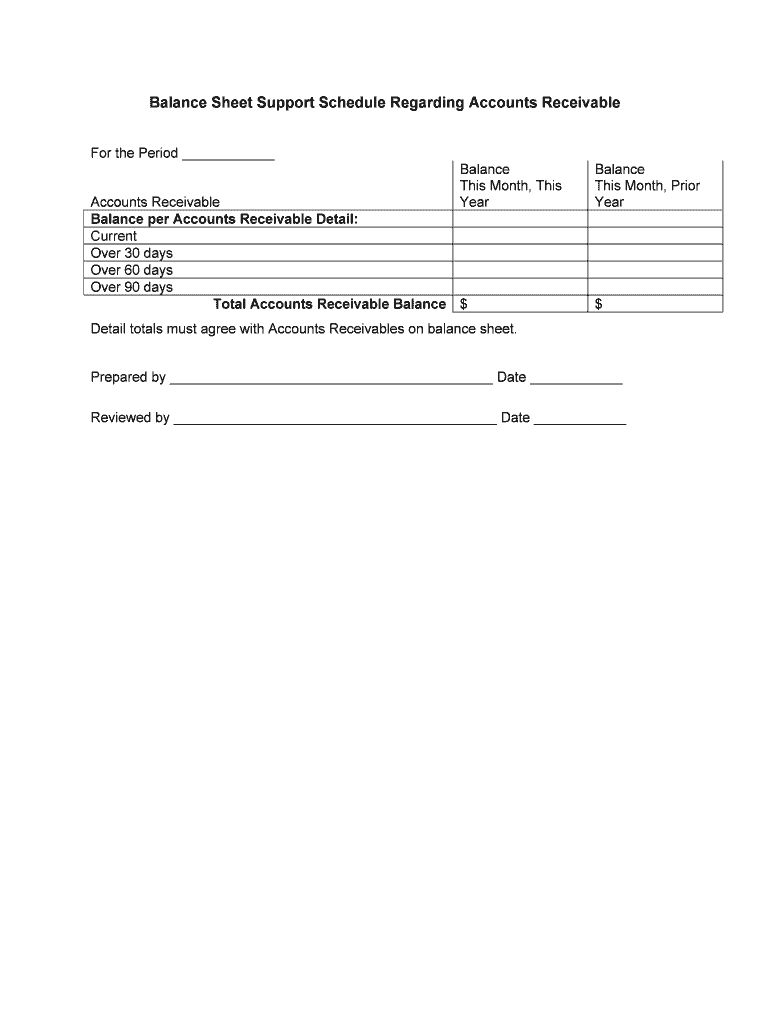

Steps to complete the Accounts Receivables On The Balance Sheet

Completing the accounts receivables on the balance sheet involves several steps:

- Gather Customer Invoices: Collect all outstanding invoices issued to customers.

- Assess Payment Terms: Review the terms associated with each invoice to determine expected payment dates.

- Calculate Total Receivables: Sum all outstanding amounts to arrive at the total accounts receivables figure.

- Account for Doubtful Accounts: Estimate and deduct the allowance for doubtful accounts to reflect realistic receivables.

- Document Findings: Ensure all calculations and assumptions are well-documented for future reference.

Legal use of the Accounts Receivables On The Balance Sheet

The accounts receivables on the balance sheet must adhere to specific legal standards to ensure compliance and validity. This includes maintaining accurate records of all transactions and ensuring that invoices comply with applicable laws. Additionally, businesses must follow the guidelines set forth by the Financial Accounting Standards Board (FASB) and the Generally Accepted Accounting Principles (GAAP) to accurately report receivables. Failure to comply with these standards can result in legal repercussions and financial penalties.

Examples of using the Accounts Receivables On The Balance Sheet

Understanding how accounts receivables appear on the balance sheet can be enhanced through examples:

- A company sells $10,000 worth of products on credit. This amount will be recorded as accounts receivable until payment is received.

- If a customer pays $2,000 of their outstanding invoice, the accounts receivable will be adjusted to reflect the new balance of $8,000.

- In cases where a customer is unlikely to pay, a business may write off $1,000 as an uncollectible account, reducing the total accounts receivable accordingly.

How to use the Accounts Receivables On The Balance Sheet

Using accounts receivables on the balance sheet effectively involves monitoring and managing outstanding invoices. Businesses should regularly review their accounts receivables to ensure timely collection and maintain healthy cash flow. This includes implementing strategies for follow-up communications with customers, assessing the age of receivables, and analyzing trends in payment behaviors. By actively managing accounts receivables, businesses can enhance their financial stability and operational efficiency.

Quick guide on how to complete accounts receivables on the balance sheet

Effortlessly Prepare Accounts Receivables On The Balance Sheet on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and store it securely online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents swiftly without any delays. Manage Accounts Receivables On The Balance Sheet on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Accounts Receivables On The Balance Sheet with Ease

- Find Accounts Receivables On The Balance Sheet and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools developed by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and hit the Done button to finalize your changes.

- Select your preferred method for sending your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks, from any device of your choosing. Alter and eSign Accounts Receivables On The Balance Sheet to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Accounts Receivables On The Balance Sheet?

Accounts Receivables On The Balance Sheet represent the money owed to a business by its customers for goods or services delivered but not yet paid for. This financial metric is crucial as it reflects the company’s liquidity and operational efficiency. Keeping track of accounts receivables effectively is essential for maintaining a healthy cash flow.

-

How does airSlate SignNow help manage Accounts Receivables On The Balance Sheet?

airSlate SignNow aids in managing Accounts Receivables On The Balance Sheet by providing a seamless platform for invoicing and eSigning documents. This reduces delays in payment processing and increases efficiency. By streamlining your accounts receivable process, you can improve cash flow and ensure timely payments from clients.

-

What features does airSlate SignNow offer for tracking accounts receivables?

With airSlate SignNow, you can track Accounts Receivables On The Balance Sheet by using automated invoicing and reminders. The platform allows for easy document management and eSignature capabilities, ensuring quicker turnaround times. These features lead to enhanced tracking and collection of outstanding payments, improving overall financial management.

-

Is airSlate SignNow suitable for small businesses looking to manage Accounts Receivables On The Balance Sheet?

Yes, airSlate SignNow is an ideal solution for small businesses managing Accounts Receivables On The Balance Sheet. Its user-friendly interface and cost-effective pricing make it accessible for businesses of all sizes. Small businesses can utilize the platform to streamline their invoicing processes, enhancing their financial visibility.

-

What are the pricing options for airSlate SignNow while managing Accounts Receivables On The Balance Sheet?

airSlate SignNow offers flexible pricing options tailored to meet various business needs, including managing Accounts Receivables On The Balance Sheet. You can choose from different plans that cater to individual requirements, ensuring cost-effectiveness without compromising on essential features. This allows businesses to invest efficiently in their financial processes.

-

Can airSlate SignNow integrate with existing accounting systems for Accounts Receivables On The Balance Sheet?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting softwares, allowing for a cohesive approach to managing Accounts Receivables On The Balance Sheet. This integration helps ensure that your invoicing and payment processes are synchronized with your accounting records. As a result, it enhances accuracy and reduces administrative workload.

-

What benefits can be expected from using airSlate SignNow for Accounts Receivables On The Balance Sheet?

Using airSlate SignNow for Accounts Receivables On The Balance Sheet can lead to numerous benefits, including faster payment cycles and improved cash flow. The easy-to-use platform allows for quick document handling and tracking, enhancing operational efficiency. Additionally, a streamlined invoicing process can signNowly reduce errors and improve customer satisfaction.

Get more for Accounts Receivables On The Balance Sheet

Find out other Accounts Receivables On The Balance Sheet

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online