7483 Form 001 Levy Instruction DOC

What is the 7483 Form 001 Levy Instruction doc

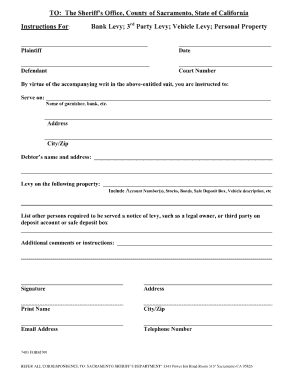

The 7483 Form 001 Levy Instruction doc is an official document used primarily for tax levy purposes in the United States. It provides instructions for the collection of taxes owed by individuals or businesses. This form is essential for the IRS and other governmental entities to enforce tax collection through levies, which may include garnishing wages or seizing assets. Understanding this form is crucial for anyone involved in tax compliance or facing tax-related issues.

How to use the 7483 Form 001 Levy Instruction doc

Using the 7483 Form 001 Levy Instruction doc involves carefully following the guidelines outlined within the document. Users must complete the form accurately, ensuring that all required information is provided. This includes details about the taxpayer, the amount owed, and any relevant supporting documentation. Once completed, the form should be submitted to the appropriate tax authority, which may include the IRS or state tax offices, depending on the nature of the levy.

Steps to complete the 7483 Form 001 Levy Instruction doc

Completing the 7483 Form 001 Levy Instruction doc requires several key steps:

- Gather necessary information, including taxpayer identification and details of the tax owed.

- Fill out the form accurately, ensuring all sections are completed as instructed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant tax authority, either online or by mail.

Legal use of the 7483 Form 001 Levy Instruction doc

The legal use of the 7483 Form 001 Levy Instruction doc is governed by federal and state tax laws. This form must be used in compliance with IRS regulations to ensure that the levy process is conducted lawfully. Failure to adhere to these guidelines can result in penalties or legal challenges. It is important for users to familiarize themselves with the legal implications of using this form to avoid any potential issues.

Key elements of the 7483 Form 001 Levy Instruction doc

Several key elements are essential for the 7483 Form 001 Levy Instruction doc to be valid:

- Taxpayer identification information, including Social Security numbers or Employer Identification Numbers.

- The amount of tax owed and any applicable interest or penalties.

- Details regarding the type of levy being requested, such as wage garnishment or asset seizure.

- Signatures from authorized representatives, if applicable.

Form Submission Methods

The 7483 Form 001 Levy Instruction doc can be submitted through various methods. Users may choose to file the form online via the IRS e-filing system, which offers a fast and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax authority or delivered in person at designated offices. Each submission method has its own processing times and requirements, so it is important to select the most suitable option based on individual circumstances.

Quick guide on how to complete 7483 form 001 levy instruction doc

Complete 7483 Form 001 Levy Instruction doc effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 7483 Form 001 Levy Instruction doc on any platform using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to edit and eSign 7483 Form 001 Levy Instruction doc with ease

- Locate 7483 Form 001 Levy Instruction doc and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or an invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 7483 Form 001 Levy Instruction doc and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 7483 form 001 levy instruction doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 7483 Form 001 Levy Instruction doc?

The 7483 Form 001 Levy Instruction doc is a legal document used in certain jurisdictions for levying assets. It provides specific instructions regarding the handling and disposition of assets under legal orders. Understanding this form is crucial for individuals and businesses involved in legal proceedings.

-

How can airSlate SignNow help with the 7483 Form 001 Levy Instruction doc?

AirSlate SignNow streamlines the process of sending and eSigning the 7483 Form 001 Levy Instruction doc. With our platform, you can quickly prepare, manage, and store your legal documents efficiently. The user-friendly interface ensures that you can navigate the signing process without any hassle.

-

Is there a cost associated with using airSlate SignNow for the 7483 Form 001 Levy Instruction doc?

Yes, there are various pricing plans available when using airSlate SignNow for the 7483 Form 001 Levy Instruction doc. Our plans are designed to be cost-effective, allowing businesses to choose an option that fits their budget. Additionally, each plan offers a range of features to enhance document management.

-

What features does airSlate SignNow offer for managing the 7483 Form 001 Levy Instruction doc?

AirSlate SignNow offers features such as document templates, automated workflows, and secure cloud storage specifically for the 7483 Form 001 Levy Instruction doc. You can customize your documents, track their status, and receive notifications upon completion. This enhances efficiency and ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for the 7483 Form 001 Levy Instruction doc?

Absolutely! AirSlate SignNow provides seamless integrations with a variety of applications, making it easy to utilize the 7483 Form 001 Levy Instruction doc within your existing workflows. Use it alongside CRMs, document management systems, and more for greater productivity and connectivity.

-

What benefits does airSlate SignNow offer when using the 7483 Form 001 Levy Instruction doc?

Using airSlate SignNow for the 7483 Form 001 Levy Instruction doc offers numerous benefits, including reduced turnaround time for document signing and enhanced security for sensitive information. Our platform ensures that you can complete necessary legal documentation quickly and efficiently, allowing you to focus on your core business operations.

-

Is it easy to access the 7483 Form 001 Levy Instruction doc on airSlate SignNow?

Yes, accessing the 7483 Form 001 Levy Instruction doc on airSlate SignNow is straightforward. Users can easily upload, manage, and send documents through our intuitive interface. Whether on a desktop or mobile device, you can work on your important legal papers anytime and anywhere.

Get more for 7483 Form 001 Levy Instruction doc

- Definitions and general instructions revenuekygov form

- Paceruscourtsgovfile casecourt cmecf lookupcalifornia central district courtpacer federal court records form

- Mortgage assistance application form 710 fannie mae

- Aama recertification policiescma aama certificationrecertification and exam guidecma aama certificationrecertification and exam form

- Referencevoya financial plan invest protect voyacomvoya financial plan invest protect voyacomreference form

- Jurisdiction of the juvenile court departmentjurisdiction of the juvenile court departmentminnesota judicial branch juvenile form

- Mc 100 petition for order authorizing hospitalization for evaluation form

- Nycourtsgov forms rjiforms ny state courts judiciary of new york

Find out other 7483 Form 001 Levy Instruction doc

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter