Employment Agreement with Staff Accountant Form

What is the Employment Agreement With Staff Accountant

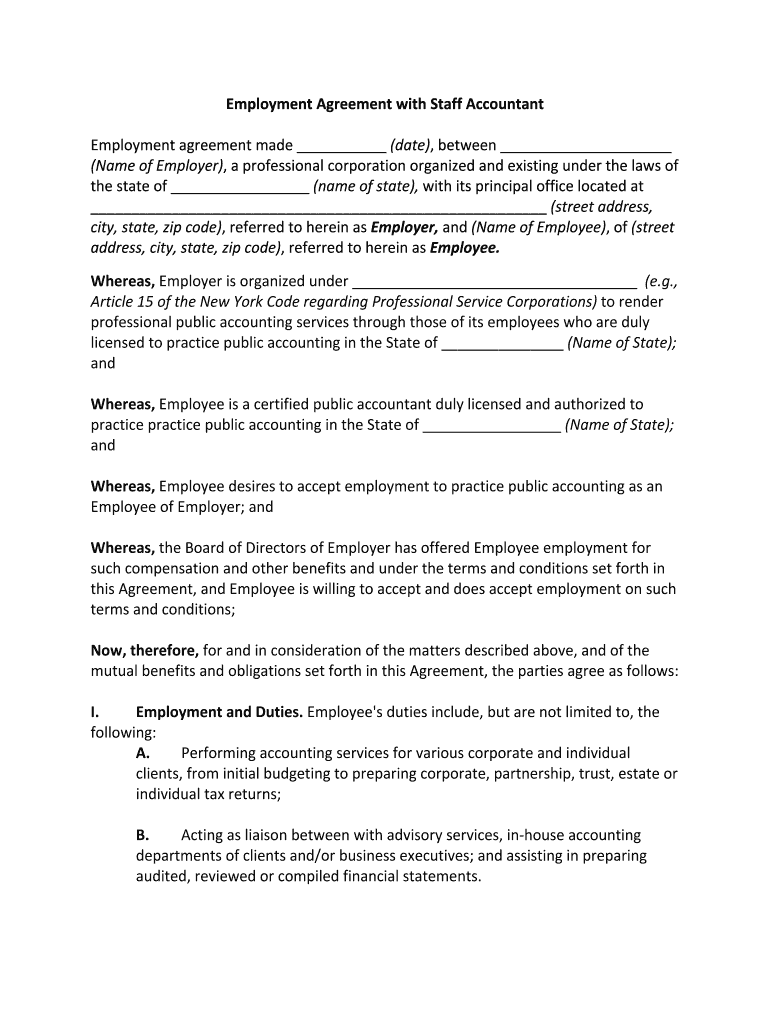

The Employment Agreement With Staff Accountant is a formal document that outlines the terms and conditions of employment between an organization and a staff accountant. This agreement typically includes details such as job responsibilities, compensation, benefits, work hours, and termination conditions. It serves as a legal contract that protects both the employer and the employee by clearly defining expectations and obligations.

Key Elements of the Employment Agreement With Staff Accountant

Several essential components should be included in the Employment Agreement With Staff Accountant to ensure clarity and legal compliance. These elements typically encompass:

- Job Title and Description: A clear outline of the staff accountant's role and responsibilities.

- Compensation: Details regarding salary, payment frequency, and any bonuses or commissions.

- Benefits: Information about health insurance, retirement plans, and other perks.

- Work Schedule: Expectations regarding working hours and any overtime policies.

- Termination Clause: Conditions under which either party may terminate the agreement.

- Confidentiality Agreement: Provisions to protect sensitive company information.

Steps to Complete the Employment Agreement With Staff Accountant

Completing the Employment Agreement With Staff Accountant involves several straightforward steps to ensure accuracy and compliance. These steps include:

- Gather Information: Collect all necessary details about the employee and the position.

- Draft the Agreement: Use a template or create a customized document that includes all key elements.

- Review the Document: Ensure that all terms are clear and comply with relevant laws.

- Obtain Signatures: Both parties should sign the document to make it legally binding.

- Store the Agreement: Keep a copy for both the employer and the employee for future reference.

Legal Use of the Employment Agreement With Staff Accountant

For the Employment Agreement With Staff Accountant to be legally binding, it must adhere to specific legal standards. This includes compliance with federal and state employment laws, such as wage and hour laws, anti-discrimination regulations, and any applicable tax laws. Ensuring that the agreement is clear, fair, and mutually agreed upon is vital to uphold its legal standing.

How to Use the Employment Agreement With Staff Accountant

The Employment Agreement With Staff Accountant can be utilized in various ways to streamline the hiring process and establish clear expectations. It serves as a reference point for both parties throughout the employment relationship. Employers can use it to outline performance expectations and review processes, while employees can refer to it for clarity on their rights and responsibilities.

State-Specific Rules for the Employment Agreement With Staff Accountant

Each state in the U.S. may have unique regulations that affect the Employment Agreement With Staff Accountant. Employers should be aware of state-specific laws regarding employment contracts, including minimum wage requirements, termination rights, and non-compete clauses. Consulting with a legal professional is advisable to ensure compliance with local laws and regulations.

Quick guide on how to complete employment agreement with staff accountant

Complete Employment Agreement With Staff Accountant effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Employment Agreement With Staff Accountant on any platform using airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to edit and eSign Employment Agreement With Staff Accountant without hassle

- Locate Employment Agreement With Staff Accountant and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Employment Agreement With Staff Accountant and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Employment Agreement With Staff Accountant?

An Employment Agreement With Staff Accountant is a formal contract that outlines the terms of employment between a business and its staff accountant. This agreement typically includes details such as job responsibilities, salary, benefits, and termination conditions. Having a well-crafted employment agreement helps ensure clarity and compliance for both parties.

-

How does airSlate SignNow facilitate creating an Employment Agreement With Staff Accountant?

airSlate SignNow provides an intuitive platform that allows businesses to easily create and customize an Employment Agreement With Staff Accountant. Users can choose from templates, add specific terms, and manage the entire signing process digitally, making it efficient and straightforward. The platform's user-friendly interface ensures that agreements are ready for eSigning in no time.

-

What features does airSlate SignNow offer for Employment Agreements?

With airSlate SignNow, features for managing an Employment Agreement With Staff Accountant include customizable templates, secure eSignature capabilities, and document tracking. You can also set reminders for signers and ensure compliance with legal standards. These features help streamline the hiring process while maintaining professionalism.

-

Is it cost-effective to use airSlate SignNow for Employment Agreements?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Employment Agreements With Staff Accountant efficiently. The platform offers flexible pricing plans, allowing businesses to choose a package that suits their needs and budgets. By simplifying the signing process, companies can save time and reduce administrative costs.

-

What are the benefits of using airSlate SignNow for Employment Agreements?

Using airSlate SignNow to create an Employment Agreement With Staff Accountant provides numerous benefits, including faster turnaround times and improved accuracy. Businesses can easily track document status and ensure that all necessary signatures are collected. This results in a more streamlined hiring process and enhances the overall employee onboarding experience.

-

Can airSlate SignNow integrate with other HR tools for Employment Agreements?

Absolutely! airSlate SignNow offers integration with various HR tools and platforms, which is beneficial for managing your Employment Agreement With Staff Accountant. Integrating these systems helps ensure all employee data is consistent and accessible from a single platform, simplifying workflows and improving productivity.

-

How does airSlate SignNow ensure the security of Employment Agreements?

airSlate SignNow prioritizes the security of your Employment Agreement With Staff Accountant by utilizing industry-standard encryption and secure cloud storage. This protects sensitive information during the signing process and ensures that only authorized individuals can access and sign the documents. Being compliant with data protection regulations further enhances trust and security.

Get more for Employment Agreement With Staff Accountant

Find out other Employment Agreement With Staff Accountant

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document