Fl Tax Bond 2017-2026

What is the Fl Tax Bond

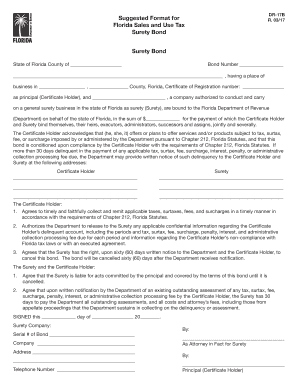

The Florida tax bond, often referred to as the fl tax bond, is a type of surety bond required by the Florida Department of Revenue. This bond ensures that businesses comply with state tax laws and regulations. It serves as a financial guarantee that the bonded entity will pay any taxes owed to the state, including sales and use taxes. If the business fails to meet its tax obligations, the bond can be claimed against to cover the owed amounts. This bond is essential for various business types, including retailers and service providers, to operate legally in Florida.

How to Obtain the Fl Tax Bond

Acquiring a Florida tax bond involves a straightforward process. First, businesses need to identify a licensed surety bond provider. This provider will assess the applicant's creditworthiness and financial stability, as these factors influence the bond premium. Once approved, the business will need to complete the necessary paperwork and pay the required premium to secure the bond. It is crucial to ensure that the bond amount meets the requirements set by the Florida Department of Revenue, which can vary based on the type of business and the expected tax liability.

Steps to Complete the Fl Tax Bond

Completing the fl tax bond requires careful attention to detail. The following steps outline the process:

- Gather necessary information, including business details and tax identification numbers.

- Choose a reliable surety bond provider and submit an application.

- Provide financial documentation as requested by the surety.

- Review the bond agreement carefully before signing.

- Pay the premium to activate the bond.

- Submit the bond to the Florida Department of Revenue as required.

Legal Use of the Fl Tax Bond

The legal framework surrounding the Florida tax bond is designed to protect both the state and the taxpayer. The bond must be executed in accordance with Florida law, ensuring that it is legally binding. It is essential for businesses to maintain compliance with all tax regulations to avoid penalties. The bond serves as a safeguard for the state, allowing it to recover unpaid taxes through claims against the bond if necessary. Understanding the legal implications of the bond is vital for any business operating in Florida.

Key Elements of the Fl Tax Bond

Several key elements define the fl tax bond, making it a crucial component for compliance:

- Bond Amount: The total amount of the bond, which varies based on the business type and expected tax liabilities.

- Obligee: The Florida Department of Revenue, which requires the bond to ensure compliance.

- Principal: The business or individual obtaining the bond.

- Surety: The bonding company that guarantees the bond's obligations.

- Duration: The bond typically remains in effect until the business no longer requires it or until it is canceled.

Filing Deadlines / Important Dates

Timely filing is crucial for maintaining compliance with the Florida Department of Revenue. Businesses should be aware of the following important dates:

- Initial bond submission deadlines, which vary based on the type of tax.

- Renewal dates for the bond, typically aligned with the business's tax reporting schedule.

- Deadlines for submitting tax returns to ensure the bond remains valid.

Quick guide on how to complete fl tax bond

Effortlessly Prepare Fl Tax Bond on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to find the correct form and store it securely online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any delays. Manage Fl Tax Bond on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

A Simple Way to Modify and eSign Fl Tax Bond

- Obtain Fl Tax Bond and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Fl Tax Bond to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fl tax bond

Create this form in 5 minutes!

How to create an eSignature for the fl tax bond

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the significance of 'Florida revenue suggested' for businesses?

Understanding the 'Florida revenue suggested' statistics allows businesses to benchmark their performance against industry standards. This data can reveal opportunities for growth and efficiency, helping businesses make informed financial decisions.

-

How does airSlate SignNow support the management of 'Florida revenue suggested' documents?

airSlate SignNow offers a seamless platform to sign and manage documents related to 'Florida revenue suggested' reports. The user-friendly interface ensures that businesses can efficiently handle essential paperwork while staying compliant with local laws.

-

What pricing options does airSlate SignNow offer for managing 'Florida revenue suggested' needs?

airSlate SignNow provides flexible pricing plans tailored to accommodate various business needs. By choosing a plan that fits your budget, you can effortlessly manage your 'Florida revenue suggested' documentation processes without overspending.

-

What features does airSlate SignNow provide that are beneficial for 'Florida revenue suggested' documentation?

Key features include eSignature capabilities, document templates, and secure cloud storage, all designed to streamline your 'Florida revenue suggested' documentation process. These features ensure quick turnaround times and enhanced operational efficiency.

-

Can airSlate SignNow help in automating workflows related to 'Florida revenue suggested' documents?

Absolutely! airSlate SignNow allows you to automate workflows, which can signNowly reduce the time spent on handling 'Florida revenue suggested' documents. This automation improves accuracy and frees up resources for other critical tasks.

-

What integrations does airSlate SignNow offer for managing 'Florida revenue suggested' tasks?

airSlate SignNow seamlessly integrates with various tools and platforms, such as CRM systems and accounting software, to help manage 'Florida revenue suggested' tasks effectively. This integration enables a holistic approach to revenue management in Florida.

-

How can businesses benefit from using airSlate SignNow for 'Florida revenue suggested' compliance?

Using airSlate SignNow helps businesses maintain compliance with regulations regarding 'Florida revenue suggested' documentation. This compliance minimizes the risk of legal issues and promotes professional credibility and reliability.

Get more for Fl Tax Bond

Find out other Fl Tax Bond

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form