Instructions for Form 5227 IRS

What is the Instructions For Form 5227 IRS

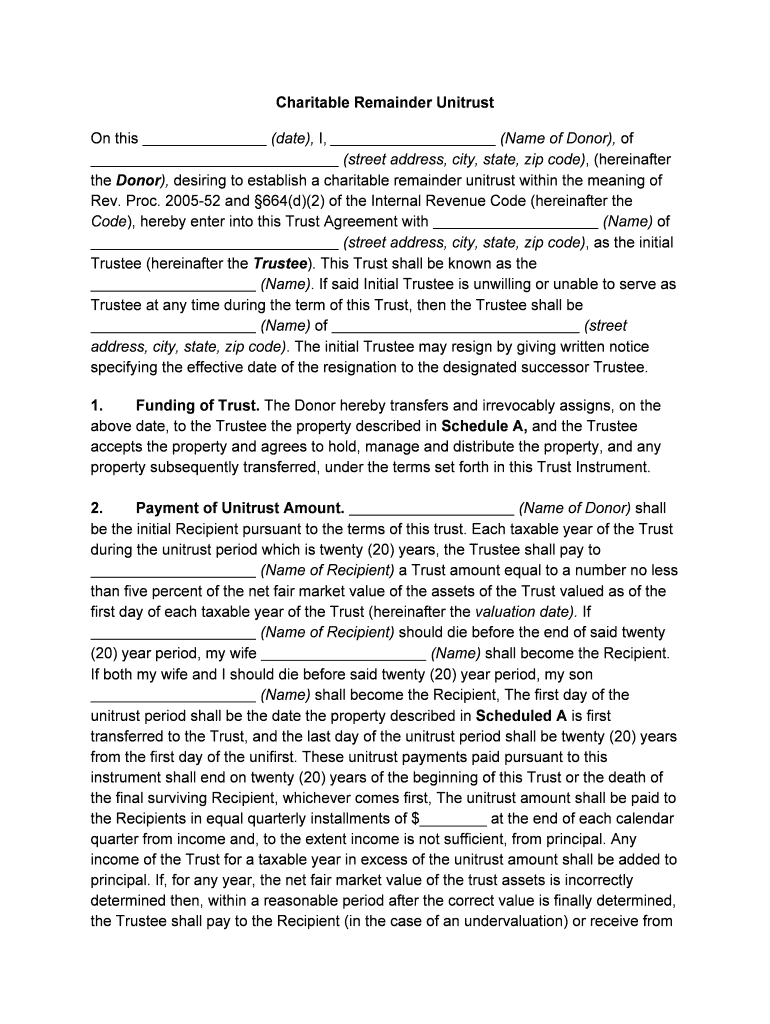

The Instructions for Form 5227, officially known as the "Split-Interest Trust Information Return," provide detailed guidance on how to report information related to split-interest trusts. This form is essential for trustees of such trusts to disclose financial details to the IRS. It outlines the necessary information required, including the trust's income, deductions, and distributions. Understanding these instructions is crucial for compliance with federal tax regulations and for ensuring that all relevant information is accurately reported.

How to use the Instructions For Form 5227 IRS

Using the Instructions for Form 5227 involves a careful review of the guidelines to ensure accurate completion. Trustees should begin by gathering all relevant financial information regarding the trust. This includes income earned, expenses incurred, and distributions made to beneficiaries. Following the instructions step-by-step will help in filling out the form correctly. It is advisable to refer back to the instructions frequently while completing the form to avoid errors that could lead to compliance issues.

Steps to complete the Instructions For Form 5227 IRS

Completing the Instructions for Form 5227 involves several key steps:

- Gather all necessary financial documents related to the trust.

- Review the instructions thoroughly to understand each section of the form.

- Fill out the form, ensuring all required information is included.

- Double-check the entries for accuracy, particularly in financial reporting.

- Submit the completed form electronically or via mail, depending on your preference.

Legal use of the Instructions For Form 5227 IRS

The legal use of the Instructions for Form 5227 is vital for compliance with IRS regulations. These instructions provide the framework for trustees to report their trust's financial activities accurately. Failure to adhere to these guidelines can result in penalties, including fines or legal repercussions. Understanding the legal implications of the information reported on this form ensures that trustees fulfill their fiduciary duties while remaining compliant with tax laws.

Form Submission Methods (Online / Mail / In-Person)

Form 5227 can be submitted using various methods, providing flexibility for trustees. The form can be filed electronically through the IRS e-file system, which is often the preferred method due to its efficiency and speed. Alternatively, trustees may choose to mail the completed form to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic and mail submissions the primary options for compliance.

IRS Guidelines

The IRS guidelines for Form 5227 are comprehensive and cover various aspects of trust reporting. These guidelines include detailed instructions on what constitutes reportable income, allowable deductions, and the specific information required for beneficiaries. Adhering to these guidelines is essential for ensuring that the trust complies with federal tax obligations and avoids potential audits or penalties.

Quick guide on how to complete instructions for form 5227 irs

Finish Instructions For Form 5227 IRS effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents rapidly without delays. Manage Instructions For Form 5227 IRS on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Instructions For Form 5227 IRS with ease

- Obtain Instructions For Form 5227 IRS and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form 5227 IRS and guarantee outstanding communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the 5227 instructions for using airSlate SignNow?

The 5227 instructions for airSlate SignNow provide a comprehensive guide on how to effectively send and eSign documents. By following these instructions, users can seamlessly navigate the platform, ensuring documents are signed efficiently and securely.

-

How much does the airSlate SignNow service cost according to the 5227 instructions?

According to the 5227 instructions, airSlate SignNow offers various pricing plans to accommodate different business needs. Pricing is designed to be cost-effective, ensuring businesses can choose a plan that fits their budget while still benefiting from all features.

-

What features are highlighted in the 5227 instructions for airSlate SignNow?

The 5227 instructions outline several key features of airSlate SignNow, including document templates, real-time tracking, and advanced security options. These features are designed to enhance document management and streamline the eSigning process.

-

What are the benefits of using airSlate SignNow as mentioned in the 5227 instructions?

The benefits highlighted in the 5227 instructions emphasize improved efficiency and time savings with airSlate SignNow. Users can quickly send, track, and receive eSigned documents, reducing delays in business processes and enhancing overall productivity.

-

How do the 5227 instructions describe the integration capabilities of airSlate SignNow?

The 5227 instructions indicate that airSlate SignNow integrates seamlessly with various applications, enhancing its functionality. Whether it's CRM systems or cloud storage services, these integrations allow businesses to incorporate eSigning into their existing workflows effortlessly.

-

Are there any specific security measures outlined in the 5227 instructions for airSlate SignNow?

Yes, the 5227 instructions detail the robust security measures implemented by airSlate SignNow. Features such as encryption, audit trails, and multi-factor authentication help ensure that all signed documents are secure and compliant with regulations.

-

Can I customize my documents as per the 5227 instructions in airSlate SignNow?

Absolutely! The 5227 instructions explain how you can customize documents using airSlate SignNow's user-friendly tools. Users can add fields, set signing orders, and personalize templates to meet their specific business requirements.

Get more for Instructions For Form 5227 IRS

- Instructions for form 6385 tax attributes carryovers alaska

- 26 cfr 601602 tax forms and instructions also part i 1 23

- Tax alaska 6967160 form

- Tax alaska 6967210 form

- Tax alaska 6967203 form

- Motor vehicle alabama department of revenue alabamagov form

- Ar1000dc form

- Arkansas schedule k 1 2014 dfa arkansas form

Find out other Instructions For Form 5227 IRS

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast