8821a Form

What is the 8821a

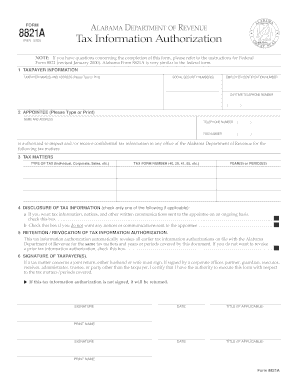

The 8821a form is a tax document used by taxpayers in the United States to authorize the Internal Revenue Service (IRS) to disclose their tax information to a designated third party. This form is particularly important for individuals who wish to allow their tax preparers, accountants, or other representatives to access sensitive tax information on their behalf. By completing the 8821a, taxpayers ensure that their chosen representatives can obtain necessary information to assist with tax-related matters.

How to use the 8821a

Using the 8821a form involves a few straightforward steps. First, the taxpayer must fill out the form with their personal information, including name, address, and Social Security number. Next, the taxpayer designates the third party by providing their name and contact details. It is essential to specify the type of tax information being authorized for disclosure, such as income tax, employment tax, or other relevant categories. Finally, the taxpayer must sign and date the form to validate the authorization.

Steps to complete the 8821a

Completing the 8821a form requires careful attention to detail. Follow these steps:

- Provide your full name, address, and Social Security number in the appropriate sections.

- Enter the name and contact information of the person or organization you are authorizing.

- Select the specific tax information you wish to disclose, ensuring clarity in your choices.

- Sign and date the form to confirm your authorization.

- Keep a copy of the completed form for your records.

Legal use of the 8821a

The 8821a form is legally binding once properly completed and signed by the taxpayer. It complies with IRS regulations, allowing authorized individuals to access tax information while maintaining the taxpayer's privacy. The form must be submitted to the IRS for processing, which will then grant the designated party access to the specified tax information. It is important to ensure that the form is filled out accurately to avoid any legal complications.

Filing Deadlines / Important Dates

While the 8821a form does not have a specific filing deadline, it is crucial to submit it in a timely manner when tax-related assistance is needed. Taxpayers should consider the timing of their tax filings and any deadlines associated with their tax returns. Submitting the form early can help ensure that the designated third party has access to necessary information when preparing tax documents or addressing IRS inquiries.

Required Documents

When completing the 8821a form, taxpayers should have the following documents ready:

- Personal identification, such as a driver’s license or Social Security card.

- Tax returns from previous years, if applicable.

- Any correspondence from the IRS that may be relevant.

Having these documents on hand can facilitate accurate and efficient completion of the form.

Form Submission Methods (Online / Mail / In-Person)

The 8821a form can be submitted to the IRS through various methods. Taxpayers may choose to file the form online using authorized e-filing services, which can expedite processing times. Alternatively, the form can be mailed to the appropriate IRS address, ensuring it is sent via a method that provides tracking for confirmation. In some cases, taxpayers may also deliver the form in person to their local IRS office, though this option may vary by location.

Quick guide on how to complete 8821a

Complete 8821a seamlessly on any device

The management of documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 8821a on any platform with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to modify and eSign 8821a effortlessly

- Obtain 8821a and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 8821a and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8821a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8821a form and how does airSlate SignNow help with it?

The 8821a form is used for authorizing a third party to receive information from the IRS on your behalf. airSlate SignNow simplifies this process by allowing you to eSign the 8821a form conveniently, streamlining your communication with the IRS.

-

What features of airSlate SignNow can I use for the 8821a form?

airSlate SignNow offers various features that are perfect for handling your 8821a form, such as cloud storage, customizable templates, and secure eSigning. These features ensure that you can manage your forms efficiently while maintaining compliance with IRS regulations.

-

Is there a free trial available for airSlate SignNow to help with the 8821a form?

Yes, airSlate SignNow provides a free trial that allows you to experience all its features, including those for handling the 8821a form. This trial is ideal for prospective customers wanting to see how our platform can benefit them without any financial commitment.

-

How does pricing work for airSlate SignNow when using it for the 8821a form?

airSlate SignNow offers flexible pricing plans that can accommodate your needs for processing the 8821a form. The cost-effective plans ensure that you can receive quality service while effectively managing your signings without overspending.

-

Can I integrate airSlate SignNow with other tools to enhance my 8821a form processes?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive and Dropbox, making it easier to manage your 8821a form alongside your existing workflows. These integrations enhance efficiency and reduce the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for the 8821a form compared to traditional methods?

Using airSlate SignNow for your 8821a form provides numerous benefits over traditional methods, including faster processing times and reduced paperwork. Additionally, eSigning is secure and convenient, allowing you to complete your forms from anywhere at any time.

-

Is airSlate SignNow a secure platform for signing the 8821a form?

Yes, security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and complies with legal regulations, ensuring that your 8821a form is protected throughout the signing process.

Get more for 8821a

Find out other 8821a

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself