Incorporators of Non Profit Church Corporation Form

What is the Incorporators Of Non Profit Church Corporation

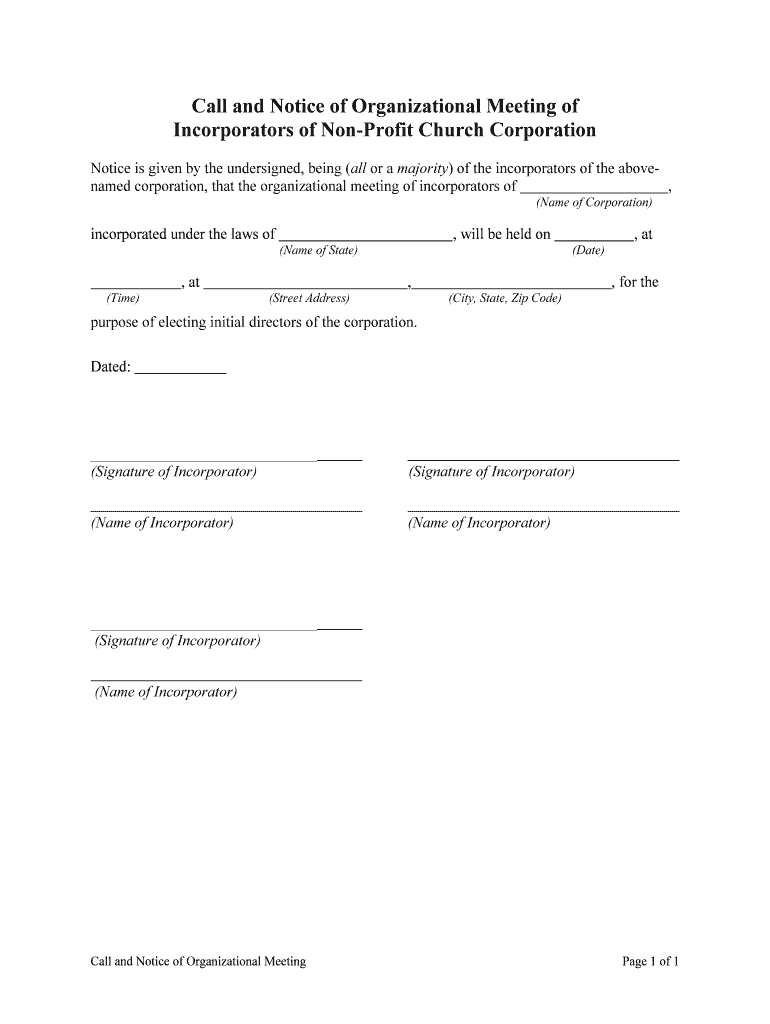

The Incorporators Of Non Profit Church Corporation form is a legal document used to establish a non-profit church organization. This form outlines the foundational structure of the church, including its purpose, governance, and operational framework. It is essential for ensuring that the church operates within the legal parameters set by state and federal laws. By filing this form, the church can gain recognition as a non-profit entity, which is crucial for tax-exempt status and eligibility for various grants and donations.

Steps to complete the Incorporators Of Non Profit Church Corporation

Completing the Incorporators Of Non Profit Church Corporation form involves several key steps:

- Gather necessary information about the church, including its name, purpose, and the names of the incorporators.

- Ensure compliance with state-specific regulations regarding non-profit organizations.

- Fill out the form accurately, providing all required details and signatures from the incorporators.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the appropriate state agency, either online or by mail, depending on local requirements.

Legal use of the Incorporators Of Non Profit Church Corporation

The legal use of the Incorporators Of Non Profit Church Corporation form is vital for establishing a recognized non-profit entity. This form must be completed in accordance with state laws to ensure its validity. Once filed, it provides legal protection to the church and its members, allowing them to operate without personal liability for the church's debts and obligations. Furthermore, it enables the church to apply for tax-exempt status, which is crucial for receiving donations and grants.

Key elements of the Incorporators Of Non Profit Church Corporation

Several key elements must be included in the Incorporators Of Non Profit Church Corporation form:

- Name of the church: Must be unique and not conflict with existing entities.

- Purpose statement: A clear description of the church's mission and activities.

- Incorporators' details: Names and addresses of individuals responsible for filing the form.

- Registered agent information: Designation of a person or entity to receive legal documents on behalf of the church.

- Bylaws or governing structure: Outline of how the church will be governed, including membership and decision-making processes.

How to obtain the Incorporators Of Non Profit Church Corporation

The Incorporators Of Non Profit Church Corporation form can typically be obtained from the website of the state agency responsible for business registrations. This may include the Secretary of State or a similar office. Many states provide downloadable forms in PDF format, which can be filled out electronically or printed for manual completion. It is important to ensure that you are using the most current version of the form to comply with any recent legal changes.

State-specific rules for the Incorporators Of Non Profit Church Corporation

Each state has its own specific rules and regulations regarding the Incorporators Of Non Profit Church Corporation form. These may include variations in filing fees, required documentation, and processing times. It is essential to consult the state’s guidelines to ensure compliance. Additionally, some states may require additional forms or disclosures, such as a statement of purpose or a list of board members, to accompany the main form.

Quick guide on how to complete incorporators of non profit church corporation

Prepare Incorporators Of Non Profit Church Corporation effortlessly on any device

Web-based document handling has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents efficiently without delays. Manage Incorporators Of Non Profit Church Corporation on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Incorporators Of Non Profit Church Corporation with ease

- Obtain Incorporators Of Non Profit Church Corporation and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that need new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Incorporators Of Non Profit Church Corporation and guarantee exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow for Incorporators Of Non Profit Church Corporation?

airSlate SignNow provides a range of benefits for Incorporators Of Non Profit Church Corporation, including fast and secure document signing, seamless collaboration, and comprehensive tracking features. With our user-friendly platform, you can streamline the incorporation process and ensure that all necessary documents are handled efficiently. This not only saves time but also enhances accuracy in the documentation process.

-

How does airSlate SignNow help with the document management for Incorporators Of Non Profit Church Corporation?

airSlate SignNow simplifies document management for Incorporators Of Non Profit Church Corporation by allowing users to upload, store, and organize all relevant documents in one secure location. Our platform enables easy access to documents when needed, ensuring that you maintain compliance and stay organized throughout the incorporation process. This also facilitates better collaboration among stakeholders involved in the incorporation.

-

What is the pricing structure for airSlate SignNow when used by Incorporators Of Non Profit Church Corporation?

airSlate SignNow offers competitive pricing plans tailored for Incorporators Of Non Profit Church Corporation. Our flexible subscription options include monthly and annual billing, making it affordable for organizations of all sizes. You can choose a plan that fits your budget while gaining access to extensive features that enhance your incorporation process.

-

Can Incorporators Of Non Profit Church Corporation integrate airSlate SignNow with other tools?

Yes, airSlate SignNow offers seamless integrations with a variety of tools that Incorporators Of Non Profit Church Corporation may already be using. This compatibility allows you to connect with popular productivity apps like Google Drive, Slack, and CRM systems, streamlining your document workflow. Integrating these tools enhances collaboration and improves efficiency during the incorporation process.

-

How secure is airSlate SignNow for Incorporators Of Non Profit Church Corporation documents?

airSlate SignNow employs industry-leading security measures to ensure that documents for Incorporators Of Non Profit Church Corporation remain protected. Our platform uses robust encryption protocols and compliance with data protection regulations, safeguarding sensitive information. Additionally, features like two-factor authentication help ensure that only authorized users have access to your documents.

-

What features does airSlate SignNow offer for Incorporators Of Non Profit Church Corporation?

airSlate SignNow includes essential features for Incorporators Of Non Profit Church Corporation such as customizable document templates, electronic signatures, automated workflows, and progress tracking. These features allow you to tailor the incorporation process to meet your specific needs, ensuring all necessary steps are completed efficiently and accurately. The intuitive interface makes it easy for any team member to navigate the platform.

-

Is there customer support available for Incorporators Of Non Profit Church Corporation using airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support for Incorporators Of Non Profit Church Corporation to assist with any inquiries or challenges. Our knowledgeable support team is available via chat, email, or phone, ensuring you receive prompt assistance when needed. We are committed to helping you maximize the benefits of our platform for your incorporation needs.

Get more for Incorporators Of Non Profit Church Corporation

Find out other Incorporators Of Non Profit Church Corporation

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe