Missouri Form 149 2019

What is the Missouri Form 149

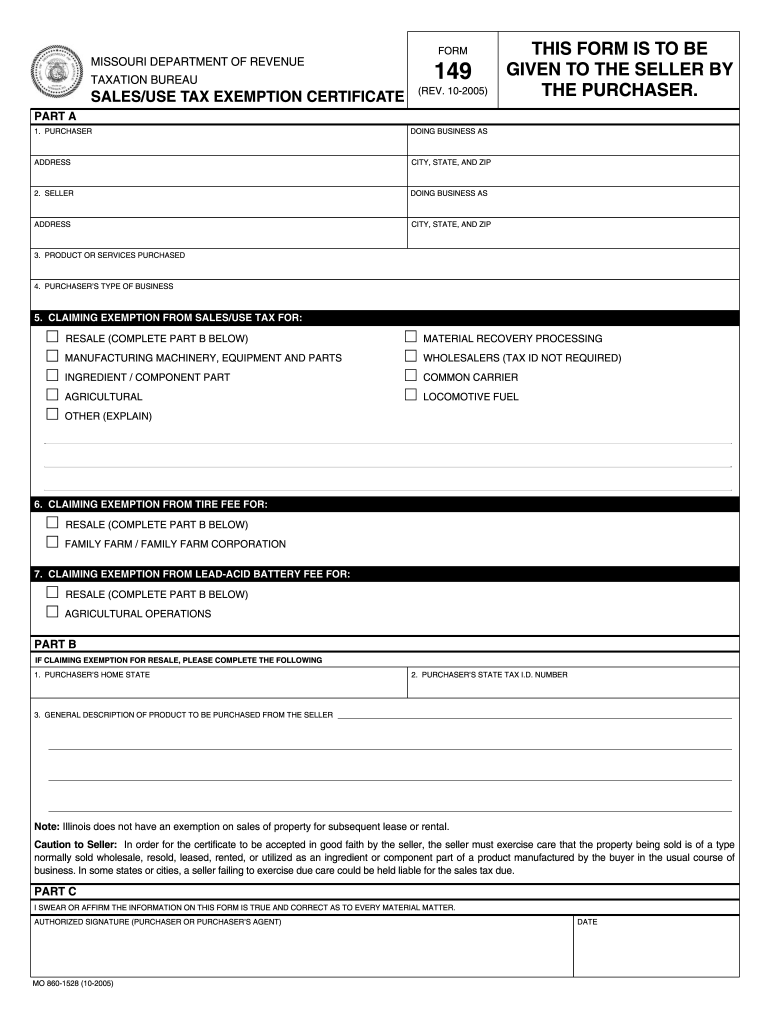

The Missouri Form 149 is a tax form used by individuals and businesses to report specific types of income and claim various tax credits. This form plays a crucial role in ensuring compliance with state tax regulations. Typically, it is utilized for reporting income from sources such as wages, self-employment, and other taxable activities. Understanding the purpose of this form is essential for accurate tax reporting and avoiding potential penalties.

How to use the Missouri Form 149

Using the Missouri Form 149 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions or credits. Next, fill out the form by entering your personal information, income details, and any applicable credits. It is important to double-check all entries for accuracy before submitting the form to avoid delays or issues with your tax return.

Steps to complete the Missouri Form 149

Completing the Missouri Form 149 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and deduction records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any eligible deductions and credits by following the instructions provided on the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submitting it.

Legal use of the Missouri Form 149

The Missouri Form 149 must be filled out and submitted in compliance with state tax laws. To ensure its legal use, it is important to follow all instructions carefully and provide accurate information. Electronic signatures are acceptable, provided that the eSignature complies with relevant legal standards. Utilizing a reliable eSigning platform can enhance the security and validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form 149 are critical to avoid penalties. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Form 149 can be submitted through various methods, including online filing, mailing, or in-person submission. Online filing is often the most efficient and allows for quicker processing. If you choose to mail the form, ensure it is sent to the correct address as specified by the Missouri Department of Revenue. In-person submissions can be made at designated tax offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete missouri form 149 2005

Finish Missouri Form 149 seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow offers you all the tools required to create, modify, and eSign your documents promptly without interruptions. Manage Missouri Form 149 on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to alter and eSign Missouri Form 149 effortlessly

- Find Missouri Form 149 and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from a device of your choice. Modify and eSign Missouri Form 149 and guarantee outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form 149 2005

Create this form in 5 minutes!

How to create an eSignature for the missouri form 149 2005

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is Missouri Form 149?

Missouri Form 149 is a document used for specific tax reporting in the state of Missouri. This form is essential for businesses to correctly report their taxes and avoid penalties. Understanding its requirements can streamline your tax processes and ensure compliance.

-

How can airSlate SignNow help with Missouri Form 149?

airSlate SignNow enables businesses to easily prepare, send, and eSign Missouri Form 149. Our platform simplifies document management and ensures that your forms are securely signed and tracked. This can signNowly reduce the time spent on administrative tasks related to tax documentation.

-

Is there a cost associated with using airSlate SignNow for Missouri Form 149?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. Each plan provides features to efficiently manage documents like Missouri Form 149, ensuring that you only pay for what you need. You can also take advantage of a free trial to explore our tools before committing.

-

Can I integrate airSlate SignNow with other software for managing Missouri Form 149?

Absolutely! airSlate SignNow supports integrations with various software tools that can help with managing Missouri Form 149 and other documents. This allows you to streamline your workflows, reduce errors, and enhance overall productivity.

-

What are the benefits of using airSlate SignNow for eSigning Missouri Form 149?

Using airSlate SignNow for eSigning Missouri Form 149 offers numerous benefits, including improved efficiency and reduced turnaround time. Our electronic signature solution is legally binding and compliant, ensuring your documents are valid. Additionally, it enhances the security of your sensitive information through encryption.

-

How secure is airSlate SignNow for handling Missouri Form 149?

airSlate SignNow prioritizes security by incorporating advanced encryption and compliance measures for all documents, including Missouri Form 149. We adhere to industry-standard security practices, ensuring that your information remains confidential and protected from unauthorized access.

-

Can airSlate SignNow help with multiple signers for Missouri Form 149?

Yes, airSlate SignNow is designed to facilitate documents requiring multiple signers, including Missouri Form 149. You can easily send the form to multiple recipients, track their signing status, and manage the workflow seamlessly within our platform. This feature simplifies collaboration and expedites the document signing process.

Get more for Missouri Form 149

Find out other Missouri Form 149

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate