Testamentary Provisions for Charitable Form

What is the Testamentary Provisions For Charitable

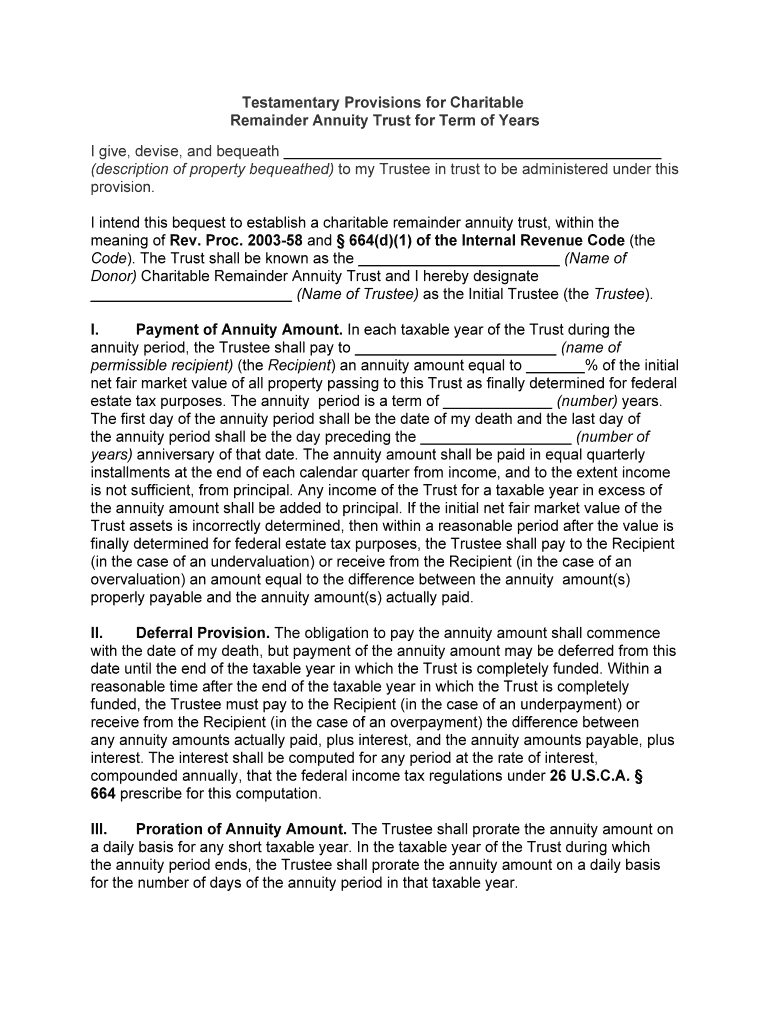

The Testamentary Provisions For Charitable refers to specific clauses within a will that designate assets or funds to charitable organizations upon the testator's death. These provisions allow individuals to support causes they care about, ensuring their legacy contributes to the greater good. By including such provisions, a testator can specify the amount or percentage of their estate to be donated, as well as any particular charities or types of charities they wish to benefit. This can include nonprofit organizations, educational institutions, or religious entities.

How to use the Testamentary Provisions For Charitable

Utilizing the Testamentary Provisions For Charitable involves careful planning and clear communication of your wishes. Begin by identifying the charitable organizations you want to support. It is important to research these organizations to ensure they align with your values. Next, consult with an estate planning attorney to draft or amend your will, incorporating the specific provisions for your chosen charities. Be explicit about the distribution of assets, including any conditions or restrictions on the gifts. Once the will is finalized, ensure that it is signed and witnessed according to state laws to make it legally binding.

Steps to complete the Testamentary Provisions For Charitable

Completing the Testamentary Provisions For Charitable involves several key steps:

- Identify your charitable interests and the organizations you wish to support.

- Consult with an estate planning attorney to understand the legal implications.

- Draft the will, including specific clauses that outline your charitable intentions.

- Specify the amount or percentage of your estate to be allocated to each charity.

- Ensure the will is signed and witnessed according to your state’s requirements.

- Store the will in a safe place and inform your executor of its location.

Legal use of the Testamentary Provisions For Charitable

The legal use of the Testamentary Provisions For Charitable is governed by state laws regarding wills and estates. To be legally enforceable, these provisions must be clearly articulated in a properly executed will. It is essential to comply with state-specific requirements for will execution, including the number of witnesses and notarization, if necessary. Additionally, the chosen charities must be recognized as tax-exempt organizations under IRS regulations to ensure that the gifts are valid and fulfill the testator's intentions.

Key elements of the Testamentary Provisions For Charitable

Key elements of the Testamentary Provisions For Charitable include:

- Identification of Charities: Clearly naming the organizations to receive the bequest.

- Specificity of Gifts: Stating the exact amount or percentage of the estate designated for charitable purposes.

- Conditions: Outlining any conditions or restrictions on the gifts, if applicable.

- Executor Instructions: Providing guidance to the executor on how to fulfill these provisions.

IRS Guidelines

The IRS provides guidelines regarding charitable contributions made through testamentary provisions. These contributions can qualify for estate tax deductions, reducing the taxable estate value. To qualify, the charity must be a recognized 501(c)(3) organization. It is advisable to consult with a tax professional or estate planner to ensure compliance with IRS regulations and to maximize the tax benefits associated with charitable giving in your estate plan.

Quick guide on how to complete testamentary provisions for charitable

Effortlessly Prepare Testamentary Provisions For Charitable on Any Device

Digital document management has grown increasingly favored by organizations and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the needed form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, adjust, and electronically sign your documents swiftly without complications. Manage Testamentary Provisions For Charitable on any device using airSlate SignNow's Android or iOS applications, and streamline any document-based task today.

How to Modify and Electronically Sign Testamentary Provisions For Charitable with Ease

- Locate Testamentary Provisions For Charitable and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and electronically sign Testamentary Provisions For Charitable and guarantee clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Testamentary Provisions For Charitable donations?

Testamentary Provisions For Charitable donations refer to the specific instructions within a will that designate funds or assets to be given to charitable organizations after one's passing. This allows individuals to support causes they care about and leave a lasting impact. By including these provisions, you can ensure your wishes are legally binding.

-

How can airSlate SignNow assist with Testamentary Provisions For Charitable?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents, including wills and testamentary provisions. Our user-friendly interface allows you to incorporate your charitable provisions directly into your documents with ease. This ensures your charitable intentions are documented accurately and securely.

-

Are there any costs associated with using airSlate SignNow for Testamentary Provisions For Charitable?

airSlate SignNow offers various pricing plans that cater to different needs, including individuals and businesses looking to incorporate Testamentary Provisions For Charitable. Our plans are designed to be cost-effective, and you can select the one that best fits your requirements. Sign up today to see how affordable managing your documents can be.

-

What features does airSlate SignNow offer for managing testamentary documents?

With airSlate SignNow, you can create customizable templates for Testamentary Provisions For Charitable, automate workflows, and ensure compliance with legal standards. Our advanced features include secure storage, collaboration tools, and real-time updates, making the management of your testamentary documents effortless. You can focus on your charitable intentions while we handle the paperwork.

-

How does airSlate SignNow ensure the security of Testamentary Provisions For Charitable?

Security is a top priority at airSlate SignNow. We utilize encryption protocols and secure cloud storage to protect all documents, including your Testamentary Provisions For Charitable. Our compliance with industry standards ensures that your sensitive information is kept safe throughout the entire signing process.

-

Can I integrate airSlate SignNow with other platforms for my testamentary documents?

Yes, airSlate SignNow offers integration capabilities with various platforms, allowing you to seamlessly connect with other tools you may already be using for managing Testamentary Provisions For Charitable. This integration enhances workflow efficiency and helps streamline your document management processes.

-

What are the benefits of including Testamentary Provisions For Charitable in my will?

Incorporating Testamentary Provisions For Charitable in your will provides numerous benefits, such as ensuring your estate is allocated according to your wishes and supporting causes you believe in. This can also provide potential tax benefits for your heirs, making it a strategic financial decision. Airlines SignNow helps you articulate these provisions clearly and legally.

Get more for Testamentary Provisions For Charitable

Find out other Testamentary Provisions For Charitable

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy