26 U S Code7206 Fraud and False StatementsU S Form

What is the 26 U S Code7206 Fraud And False StatementsU S

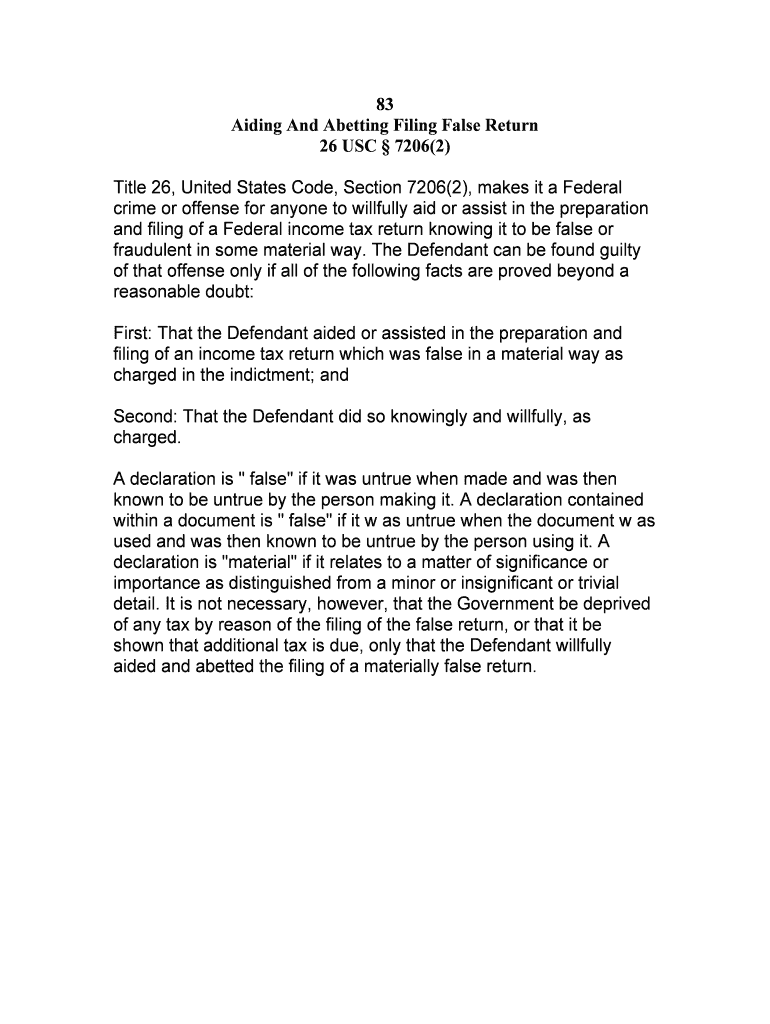

The 26 U S Code7206 addresses fraud and false statements in relation to federal tax matters. This section of the U.S. Code outlines the legal implications of knowingly providing false information on tax returns or related documents. Violations can lead to severe penalties, including fines and imprisonment. Understanding this law is crucial for individuals and businesses to ensure compliance and avoid legal repercussions.

How to use the 26 U S Code7206 Fraud And False StatementsU S

Using the 26 U S Code7206 effectively requires a clear understanding of its provisions. Taxpayers must ensure that all information submitted on tax returns and related documents is accurate and truthful. This includes income reporting, deductions, and credits. Utilizing reliable digital platforms for eSigning and submitting documents can enhance compliance and reduce the risk of errors.

Steps to complete the 26 U S Code7206 Fraud And False StatementsU S

Completing the requirements outlined in the 26 U S Code7206 involves several steps:

- Gather all necessary financial documents, including income statements and receipts.

- Accurately report all income and deductions on your tax return.

- Review your return for any discrepancies or errors before submission.

- Utilize a trusted eSignature solution to sign and submit your documents securely.

Legal use of the 26 U S Code7206 Fraud And False StatementsU S

The legal use of the 26 U S Code7206 emphasizes the importance of honesty in tax reporting. Taxpayers must be aware that any intentional misrepresentation can lead to charges of fraud. Legal counsel may be beneficial for individuals or businesses uncertain about their compliance with this code, especially when facing complex tax situations.

Penalties for Non-Compliance

Non-compliance with the provisions of the 26 U S Code7206 can result in severe penalties. These may include:

- Fines up to $250,000 for individuals and $500,000 for corporations.

- Imprisonment for up to three years.

- Additional civil penalties for underpayment of taxes due to fraud.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the application of the 26 U S Code7206. These guidelines include clarifications on what constitutes fraud and the necessary documentation to support claims. Taxpayers are encouraged to consult IRS resources or seek professional advice to ensure adherence to these guidelines.

Quick guide on how to complete 26 us code7206 fraud and false statementsus

Effortlessly Prepare 26 U S Code7206 Fraud And False StatementsU S on Any Device

Web-based document management has gained traction among organizations and users alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and safely retain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage 26 U S Code7206 Fraud And False StatementsU S on any device using airSlate SignNow's Android or iOS apps and streamline any paperwork-related process today.

Steps to Modify and eSign 26 U S Code7206 Fraud And False StatementsU S with Ease

- Obtain 26 U S Code7206 Fraud And False StatementsU S and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring you to print new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device of your preference. Edit and eSign 26 U S Code7206 Fraud And False StatementsU S and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of 26 U S Code 7206 Fraud And False Statements U S in relation to electronic signatures?

The 26 U S Code 7206 Fraud And False Statements U S outlines serious implications for fraudulent activities, including those involving electronic signatures. Understanding this code is crucial for businesses using eSigning tools like airSlate SignNow to ensure compliance and avoid legal issues related to fraud.

-

How can airSlate SignNow help me comply with 26 U S Code 7206 Fraud And False Statements U S?

airSlate SignNow provides a secure platform for eSigning documents, ensuring that all signatures comply with legal standards. By incorporating features that validate user identities and track document history, we help you adhere to requirements found in 26 U S Code 7206 Fraud And False Statements U S.

-

What are the pricing options for airSlate SignNow and how do they relate to compliance with 26 U S Code 7206 Fraud And False Statements U S?

airSlate SignNow offers flexible pricing plans tailored to various business needs while ensuring compliance with relevant laws, including 26 U S Code 7206 Fraud And False Statements U S. Our competitive pricing allows businesses to implement essential eSigning features without compromising on legal adherence.

-

What features does airSlate SignNow offer that relate to preventing issues under 26 U S Code 7206 Fraud And False Statements U S?

Key features of airSlate SignNow include secure document storage, audit trails, and identity verification processes. These features collectively help minimize the risk of fraud and reinforce compliance with statutes like 26 U S Code 7206 Fraud And False Statements U S, providing peace of mind for your business.

-

How can I integrate airSlate SignNow with my existing tools while remaining compliant with 26 U S Code 7206 Fraud And False Statements U S?

airSlate SignNow easily integrates with various business applications, ensuring seamless workflows. By maintaining robust security measures during these integrations, we help you stay compliant with 26 U S Code 7206 Fraud And False Statements U S while improving operational efficiency.

-

What benefits does airSlate SignNow offer that align with the principles of 26 U S Code 7206 Fraud And False Statements U S?

Using airSlate SignNow, businesses benefit from enhanced security, streamlined processes, and improved customer trust. These advantages align with the principles outlined in 26 U S Code 7206 Fraud And False Statements U S, emphasizing the importance of integrity in transactional communications.

-

Is there a trial period for airSlate SignNow that allows me to assess compliance with 26 U S Code 7206 Fraud And False Statements U S?

Yes, airSlate SignNow provides a trial period that allows businesses to evaluate our features. During this time, users can explore how our platform supports compliance with critical regulations, including 26 U S Code 7206 Fraud And False Statements U S, ensuring it meets their needs.

Get more for 26 U S Code7206 Fraud And False StatementsU S

Find out other 26 U S Code7206 Fraud And False StatementsU S

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF