FG1313a California Fish and Game Commission State of California Fgc Ca 2010-2026

What is the FG-1313a California Fish and Game Commission State of California FGC CA?

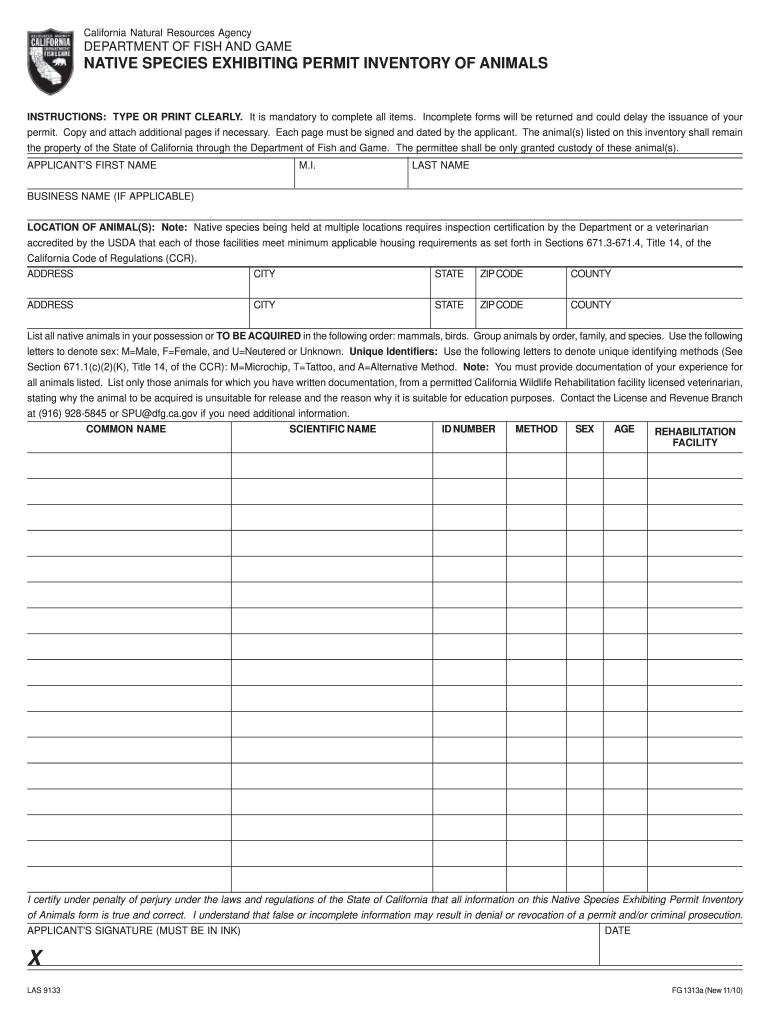

The FG-1313a is a specific form issued by the California Fish and Game Commission. This state form is essential for individuals or entities engaged in activities regulated by California's wildlife laws. It serves various purposes, including applications for permits, licenses, or reporting requirements related to wildlife management. Understanding the FG-1313a is crucial for compliance with state regulations and ensuring that all necessary permissions are obtained for lawful activities involving wildlife.

Steps to Complete the FG-1313a California Fish and Game Commission State of California FGC CA

Completing the FG-1313a requires careful attention to detail to ensure compliance with state regulations. Here are the steps to follow:

- Gather all necessary information, including personal details and specifics related to the wildlife activity.

- Access the FG-1313a form through the official California Fish and Game Commission website or other authorized sources.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form as instructed, either online or via mail, depending on the guidelines provided.

Legal Use of the FG-1313a California Fish and Game Commission State of California FGC CA

The FG-1313a form is legally binding when completed and submitted according to the guidelines set forth by the California Fish and Game Commission. It is crucial to adhere to the legal requirements associated with the form, including providing accurate information and obtaining necessary signatures. Non-compliance with these regulations can result in penalties or denial of permits. Utilizing a reliable digital tool for eSigning can enhance the legitimacy of the submission, ensuring compliance with eSignature laws.

How to Obtain the FG-1313a California Fish and Game Commission State of California FGC CA

The FG-1313a form can be obtained through several channels. The most straightforward method is to visit the California Fish and Game Commission's official website, where the form is typically available for download. Alternatively, individuals can request a physical copy by contacting the commission directly. It is advisable to ensure that you are using the most current version of the form to avoid any complications during the submission process.

Key Elements of the FG-1313a California Fish and Game Commission State of California FGC CA

Understanding the key elements of the FG-1313a is essential for effective completion. Important components include:

- Applicant Information: Personal details of the individual or entity submitting the form.

- Activity Description: Clear explanation of the wildlife-related activity for which the form is being submitted.

- Signature Section: Area designated for the applicant’s signature, which may require additional verification.

- Submission Guidelines: Instructions on how and where to submit the completed form.

State-Specific Rules for the FG-1313a California Fish and Game Commission State of California FGC CA

California has specific regulations governing the use of the FG-1313a form. These rules may include deadlines for submission, specific documentation required, and particular conditions under which the form must be completed. It is essential to familiarize yourself with these state-specific rules to ensure compliance and avoid potential legal issues. Staying updated with any changes in regulations is also advisable, as wildlife laws can evolve over time.

Quick guide on how to complete fg1313a california fish and game commission state of california fgc ca

Prepare FG1313a California Fish And Game Commission State Of California Fgc Ca easily on any gadget

Digital document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents quickly and without delays. Handle FG1313a California Fish And Game Commission State Of California Fgc Ca on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task now.

How to modify and eSign FG1313a California Fish And Game Commission State Of California Fgc Ca with ease

- Find FG1313a California Fish And Game Commission State Of California Fgc Ca and tap on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign FG1313a California Fish And Game Commission State Of California Fgc Ca and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I am a resident of California. I interned in New Jersey last year. From what I read, all I need is two state tax forms and one non-resident form for federal taxes. Do I also need to take into account that I live in California, but I interned out-of-state? Will this alter my process to file the taxes?

Let’s see if I understand this. You live in California. You interned in New Jersey. Why are you a non-resident for the Fed? You lived in the US, you are a resident. I’m guessing you lived in New Jersey while you were an intern, so you would file a part year resident for New Jersey. If you moved from Jersey to Ca mid year then you would file as a part year resident for California also.Get someone to do this for you as you don’t seem to understandGetATMEtaxprep.com

-

How can I become a resident of California and Arizona at the same time? My game plan is to qualify for state-residency and reduced school tuition rates?

Requirements for Resident StatusArizona Resident Classification for Tuition PurposesII. Requirements for Resident Status:The general rule is that in order to obtain resident status for tuition purposes, a student must establish his or her domicile in Arizona at least one year immediately prior to the last day of regular registration for the semester in which the student proposes to attend the university. Arizona domicile occurs when a financially independent person is physically present in Arizona with the intention of making Arizona his or her permanent home.Objective evidence of financial independence. Indicators of financial independence include: 1) Place of employment and proof of earnings 2) Other sources of support 3) Proof of filing an Arizona state income tax return 4) Residence claimed on federal income tax return 5) Veteran status 6) Whether claimed as a dependent for income tax purposes by a parent or any other individual for two years immediately preceding the request for residency classification. A student will generally be considered financially independent if he or she:Is a veteran of the U.S. Armed forces, orWas not claimed as an income tax deduction by his or her parents or any other individual for the two years immediately preceding the request for residency classification, and has demonstrated objective evidence of self-support for the two tax years immediately preceding the request for residency classification.An adult student (age 18 or older) or legally emancipated minor must couple his or her physical presence within Arizona for one year with evidence of financial independence and objective evidence that such presence is consistent with his or her intent in making Arizona his or her permanent home. If these steps are delayed, the duration period will be extended until all requirements have been demonstrated for one full year, with financial independence.The domicile of an unemancipated minor is that of his or her mother, father or legal guardian provided there is no evidence indicating that the guardianship was created primarily for the purpose of conferring the classification of resident on the individual. In addition, an unemancipated person who is enrolled at the University and who remains in Arizona after his or her parents establish a domicile elsewhere does not lose resident status while in continuous attendance toward the degree for which currently enrolled.There are certain exceptions to the general rule. A student may also be eligible for resident status if he or she can establish that, on or before the last day of regular registration, he or she meets one of the following criteria:Dependent : The student is domiciled in Arizona and has not met the one-year durational requirement, but one or both of the student’s parents are domiciled in Arizona and one or both of the student’s parents are entitled to claim him or her as a dependent child for federal and state tax purposes (whether or not the parent actually claims the student as a dependent child).Spouse of an AZ Resident: The individual is domiciled in Arizona and has not met the one year durational requirement, but the student’s spouse has established domicile in Arizona for at least one year and has demonstrated financial independence, and the student’s spouse is entitled to claim the person as an exemption for federal and state tax purposes. If the person is a non-US citizen, the person must be in an eligible visa status pursuant to federal law to classify as an in-state student for tuition purposes. Contact the Residency Classification Officer for further assistance.Transferred Employee: The student is domiciled in Arizona but has not met the one-year durational requirement, and is an employee or spouse of an employee transferred to Arizona by his or her employer for employment purposes, is NOT self-employed or employed in a family owned business not previously operating in Arizona, AND can provide proof of payment or reimbursement of moving expenses by his or her employer.Teachers on Contract: The person is an employee of a school district in this state and is under contract to teach on a full-time basis, or is employed as a full-time non-certified classroom aide, at a school with that school district. The person is eligible for classification as an in-state student only for courses necessary to complete the requirements for certification by the State Board of Education to teach in a school district in this state. This does not include other members of the family.Military Stationed in AZ: The individual is a member of the U. S. Armed Forces, including Reserve and National Guards, stationed in Arizona pursuant to military orders or is a member’s spouse or dependent child at the time of admission. A student does not lose resident status while in continuous attendance toward the degree for which currently enrolled if military service is discontinued. In addition, a person domiciled in Arizona immediately prior to becoming a member of the U. S. Armed Forces will not lose resident status because of his/her absence from Arizona while a member of the U.S. Armed Forces, provided that he or she has demonstrated continued intent to maintain Arizona domicile. Military Outside AZ: The individual is a member of the Armed Forces of the United States stationed outside of Arizona pursuant to military order or is the spouse or dependent child, and the person claimed Arizona as the person’s legal residence for at least twelve consecutive months prior to the last date of registration. The person claiming in-state status under this section shall be required to provide a copy of the Military Form DD-2058 which verifies their state of legal residence, and provide evidence of having filed an Arizona Resident Income Tax Return with the Arizona Department of Revenue for the prior tax year on all income from all sources.Military Honorably Discharged: The individual is an honorably discharged member of the Armed Forces of the United States. Must provide a copy of DD-214 Member 4 or Service 2 showing Honorable Discharge, evidence of AZ Voter Registration and a copy of a document that illustrates your intent to be a resident of Arizona. (i.e.. Lease, AZ driver’s license, AZ vehicle registration, AZ employment, change of permanent address on all pertinent records, etc.) Native American: The individual is an enrolled member in a federally recognized Arizona tribe; verified by a Certificate of Indian Blood or Tribal Identification Card. 75 Mile: The person is domiciled within 75 miles of the Arizona border in San Bernardino, Imperial or Riverside Counties in California, enrolling for no more than six (6) credit hours offered by Arizona State University, Northern Arizona University of University of Arizona in Mohave, La Paz or Yuma Counties, Arizona.Doctoral Graduate Student: The person is a doctoral graduate student who is a candidate for degree, having completed all requirements for the degree except dissertation and who qualified as a resident student immediately prior to being eligible to begin dissertation.Alien: An alien may qualify as a resident (a) by meeting the general one year durational requirement, (b) by meeting one of the exceptions to the general rules, or (c) by having been granted refugee status and meeting all other requirements for domicile in this state; provided that in establishing domicile, the alien must nothold a visa that prohibits establishing domicile in this state. In accordance with federal law, no undocumented alien may receive in-state residency status for tuition purposes notwithstanding any language suggesting the contrary in either State Statute or Regental Policy.Student ContentFaculty ContentStaff ContentOther Content© 2017 Arizona Board of Regents. The University of Arizona, Tucson, Arizona

-

Once a restraining order has been served to recipient and he lives with you, how long do they have to move out in the state of California?

First, IANAL - not a lawyer, just someone who’s pretty familiar with the law.My understanding is, unless specified otherwise, a restraining order is immediately effective. The restrained party can’t even visit the residence in question and they don’t have a right to make you leave so they can go there.There’s no “right to move out” but their stuff’s still theirs however, so you either need to get it all out of the place for them, or let them get it all out via some sort of supervised visit.Destroying their property’s not OK in this case, nor is disposing of it. Usually the police will agree to help keep the peace as you transfer personal property items to the restrained individual.

-

Can I pay an out of state real estate agent for a referral in California? If so, how much and does their broker have to be notified?

Referrals, like all payments are broker to broker, not agent to agent. This may sound like a technicality but it is the way it is.It really doesn’t matter if you are licensed in California and the referring broker is in California or in another state, the way it works is the same. The referring agent completes the referral agreement and gets it signed by his broker. He then sends it over to you. You will need to have your broker sign it before you can receive any payment.

-

Some in California want to secede from the state and form the new state of California. According to Article 4 Section 3 of the US Constitution, permission to secede must be sought from the state legislature. How did W Virginia secede from Virginia?

West Virginia became a separate state the same way California would have to split into separate states. The people of West Virginia wanted to separate from Virginia, and Congress wanted them to. In the case of West Virginia it didn’t hurt that the State of Virginia was in rebellion and as far as Congress was concerned didn’t have a legitimate legislature to block separation.Splitting a state into smaller states or joining small states into one larger state are possible as long as Congress and the state legislatures involved agree. Don’t hold your breath.

-

My son wants to go to California to college. If he starts college as an out of state resident and I move to CA at the same time, could he get in state tuition his second year?

You’d better read the residency requirements very carefully to make sure you get the correct information instead of relying on a third party here. Because a mistake can be very costly. CA is very restrictive as to instate tuition, because so many students from OOS would like to attend here. Here’s the entire policy to review for your particular situation (for UC only, CSU and CCC have different policies):https://www.ucop.edu/general-cou...You will have to submit a petition to change residency and you’ll likely have no way to know if it will be accepted.If you’d be moving here, it makes a lot more sense for him to take a gap year, you both establish residency, then he applies.How to establish residencyFrequently asked questionsIf I enter UC as a nonresident, can I become a resident for my sophomore/junior/senior year?If you're an undergraduate under the age of 24 and your parent(s) are not California residents, it is very unlikely that you will be able to qualify as a California resident for purposes of UC tuition because of the university’s two-year financial independence requirement.Also, you do not become a resident for purposes of tuition and fees simply by living in California for a year or more. If you’ve moved to California primarily to attend the University of California, you are here for educational purposes and may not be eligible for a resident classification for purposes of tuition and fees.If I'm initially classified as a nonresident student, am I locked into nonresident status for the rest of my time at UC?No: if you enter UC as a financially independent undergraduate (or graduate student), you aren't necessarily locked into nonresident status for the duration of your attendance. Once you've satisfied all applicable requirements to establish residency, you can submit a Petition for Resident Classification.

-

I am currently an independent contractor, based out in california and shelling out more than 50% of my income as federal, state taxes and other statuatory deductions. What are best ways to save tax and how can I do it?

A2A - Well CA has a 13.3% tax for those with income over a Million. The Federal rate is 39.6%. for 52.9% so I guess I need to congratulate you on your success.Seriously, since your a sole proprietor I doubt very seriously that you are in a 50%+ tax bracket. How are you arriving at those percentages.As to deduction you need to keep track of everything that is business related.However, the starting point is how are you arriving at that percentage because I feel strongly that you are doing something wrong in you perception of this tax rate.

-

I’m scared to tell my mother I want to move with my fiancee to another state. How do I move out of my parents’ home and into my fiancé’s home where he lives in California?

It depends. How old are you? How old is your Fiancee? Why not just marry him rather than move in? If you are SURE about the relationship, marry him. If not…don’t move in and play marriage.How far away is California from where you live? If it is only a couple of hours mom might not be so stressed…but from the question you sound young. I would recommend that you discuss it with your fiancee and have the both of you go to her and ask for her blessing…and then go on down to City Hall. A WEDDING is not the same as a MARRIAGE.

Create this form in 5 minutes!

How to create an eSignature for the fg1313a california fish and game commission state of california fgc ca

How to make an electronic signature for the Fg1313a California Fish And Game Commission State Of California Fgc Ca online

How to create an eSignature for your Fg1313a California Fish And Game Commission State Of California Fgc Ca in Google Chrome

How to make an electronic signature for putting it on the Fg1313a California Fish And Game Commission State Of California Fgc Ca in Gmail

How to generate an eSignature for the Fg1313a California Fish And Game Commission State Of California Fgc Ca from your mobile device

How to generate an electronic signature for the Fg1313a California Fish And Game Commission State Of California Fgc Ca on iOS devices

How to generate an eSignature for the Fg1313a California Fish And Game Commission State Of California Fgc Ca on Android devices

People also ask

-

What is the FG1313a California Fish And Game Commission State Of California Fgc Ca form?

The FG1313a California Fish And Game Commission State Of California Fgc Ca form is a required document for applicants seeking specific permits or licenses related to wildlife management in California. This form ensures that all necessary information is collected, streamlining the approval process for permits.

-

How can airSlate SignNow help with the FG1313a California Fish And Game Commission State Of California Fgc Ca process?

airSlate SignNow simplifies the process of filling out and submitting the FG1313a California Fish And Game Commission State Of California Fgc Ca form. With its user-friendly interface, you can easily eSign and send the document, reducing turnaround time and enhancing efficiency.

-

What are the pricing options for using airSlate SignNow for FG1313a California Fish And Game Commission State Of California Fgc Ca?

airSlate SignNow offers a range of pricing plans that cater to different needs, whether you are an individual or a business. You can choose a plan that best fits your requirements for managing and signing the FG1313a California Fish And Game Commission State Of California Fgc Ca documentation.

-

Are there any features in airSlate SignNow specifically beneficial for the FG1313a California Fish And Game Commission State Of California Fgc Ca?

Yes, airSlate SignNow includes features like templates, automated workflows, and real-time tracking, which are particularly useful for managing the FG1313a California Fish And Game Commission State Of California Fgc Ca documentation. These features help ensure that all necessary steps are followed and deadlines are met.

-

Can airSlate SignNow integrate with other tools for managing FG1313a California Fish And Game Commission State Of California Fgc Ca forms?

Absolutely! airSlate SignNow seamlessly integrates with various platforms like Google Drive, Dropbox, and CRM systems, making it easy to manage your FG1313a California Fish And Game Commission State Of California Fgc Ca forms alongside other important documents and workflows.

-

What are the benefits of using airSlate SignNow for the FG1313a California Fish And Game Commission State Of California Fgc Ca?

Using airSlate SignNow for the FG1313a California Fish And Game Commission State Of California Fgc Ca provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Its electronic signature capabilities also ensure that your documents are legally binding and compliant.

-

Is it easy to eSign the FG1313a California Fish And Game Commission State Of California Fgc Ca with airSlate SignNow?

Yes, eSigning the FG1313a California Fish And Game Commission State Of California Fgc Ca with airSlate SignNow is incredibly easy. The intuitive platform guides you through the signing process, allowing you to complete your documents quickly and securely.

Get more for FG1313a California Fish And Game Commission State Of California Fgc Ca

- Prepared by recording form

- The grantor a corporation organized under the form

- Requested by and return to form

- Whereas the undersigned has been employed by to furnish form

- The grantor a corporation organized under the laws of the form

- Final waiver of lien contractors affidavit title services inc form

- 00 and form

- 00 cash in hand paid form

Find out other FG1313a California Fish And Game Commission State Of California Fgc Ca

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later