CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

What is the CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

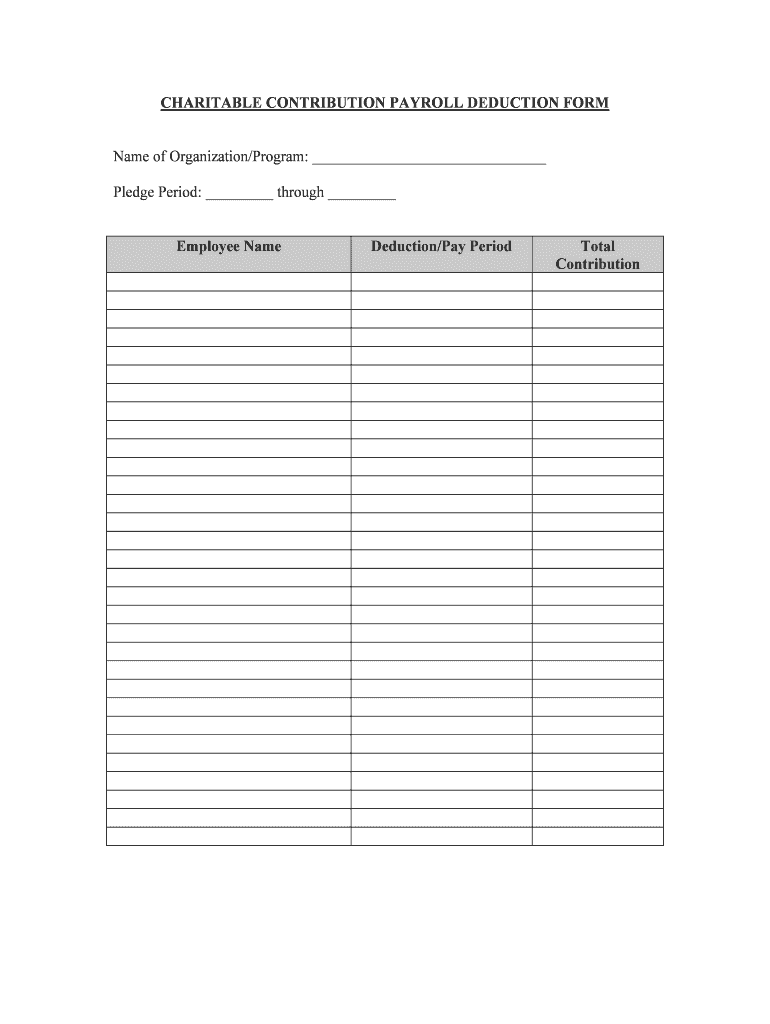

The charitable contribution payroll deduction form is a document that allows employees to authorize their employers to deduct a specified amount from their paycheck to be donated to a charitable organization. This form facilitates a streamlined process for both employees and employers, ensuring that contributions are made consistently and efficiently. By using this form, employees can easily support causes they care about while benefiting from potential tax deductions associated with charitable giving.

How to use the CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

To use the charitable contribution payroll deduction form, employees need to fill out the document with their personal information, including name, employee ID, and the amount they wish to contribute. It is important to specify the charitable organization that will receive the funds. Once completed, the form should be submitted to the payroll or human resources department for processing. Employers then ensure that the specified amount is deducted from the employee's paycheck and forwarded to the designated charity.

Steps to complete the CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

Completing the charitable contribution payroll deduction form involves several straightforward steps:

- Obtain the form from your employer or download it from a trusted source.

- Fill in your personal details, including your full name and employee identification number.

- Indicate the amount you wish to contribute from each paycheck.

- Specify the charitable organization you wish to support.

- Review the form for accuracy and completeness.

- Submit the form to your payroll or HR department for processing.

Key elements of the CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

The charitable contribution payroll deduction form contains several key elements that ensure clarity and compliance:

- Employee Information: This section typically requires the employee's name, ID number, and contact information.

- Contribution Amount: Employees must specify the exact amount to be deducted from their paychecks.

- Charitable Organization Details: The form should include the name and possibly the tax identification number of the charity.

- Signature: A signature or electronic signature is usually required to validate the authorization.

- Date: The date of submission is essential for record-keeping and compliance purposes.

Legal use of the CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

The charitable contribution payroll deduction form is legally binding when properly filled out and signed. It must comply with federal and state regulations regarding payroll deductions and charitable contributions. Employers are responsible for ensuring that the deductions are made in accordance with the employee's authorization and that the contributions are forwarded to the designated charity. Adhering to these legal requirements helps protect both employees and employers from potential disputes.

Form Submission Methods (Online / Mail / In-Person)

Submitting the charitable contribution payroll deduction form can typically be done through various methods, depending on the employer's policies:

- Online Submission: Many organizations allow employees to submit forms electronically through a secure portal.

- Mail: Employees may also choose to print the form and send it via postal mail to the payroll or HR department.

- In-Person: Submitting the form in person is often an option, allowing for immediate confirmation of receipt.

Quick guide on how to complete charitable contribution payroll deduction form

Complete CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM with ease

- Obtain CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM?

A CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM is a document that allows employees to authorize deductions from their paychecks for donations to charitable organizations. This form simplifies the process of making regular contributions while providing tax benefits to the donors.

-

How can airSlate SignNow help with CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs?

airSlate SignNow offers a secure and user-friendly platform to create, send, and eSign your CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs. This streamlined process not only saves time but also ensures that all data is managed efficiently and securely, meeting compliance requirements.

-

Is there a cost associated with using airSlate SignNow for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs?

Yes, while airSlate SignNow offers competitive pricing, the cost may vary based on the plan you select. Regardless, our solutions for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs are designed to be cost-effective, providing excellent value for enhanced productivity and compliance.

-

What features does airSlate SignNow provide for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs?

airSlate SignNow includes features such as customizable templates, electronic signatures, real-time tracking, and secure storage for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs. These functionalities facilitate a streamlined workflow, enhancing efficiency and reducing paperwork.

-

Can I integrate airSlate SignNow with other software for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, allowing you to manage your CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs alongside your existing software. This capability simplifies data management and ensures that all your forms are easily accessible within your preferred systems.

-

What are the benefits of using airSlate SignNow for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs?

Using airSlate SignNow for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMs offers numerous benefits including enhanced security, reduced processing time, and improved organizational compliance. With our eSigning solution, you can ensure that all donations are processed accurately and efficiently.

-

Is it easy to create a CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM using airSlate SignNow?

Yes, creating a CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM with airSlate SignNow is quick and intuitive. Our platform provides customizable templates that simplify the form creation process, allowing you to tailor them to meet your organization's specific needs.

Get more for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

Find out other CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template