Broker Compensation Disclosure 2007-2026

What is the Broker Compensation Disclosure

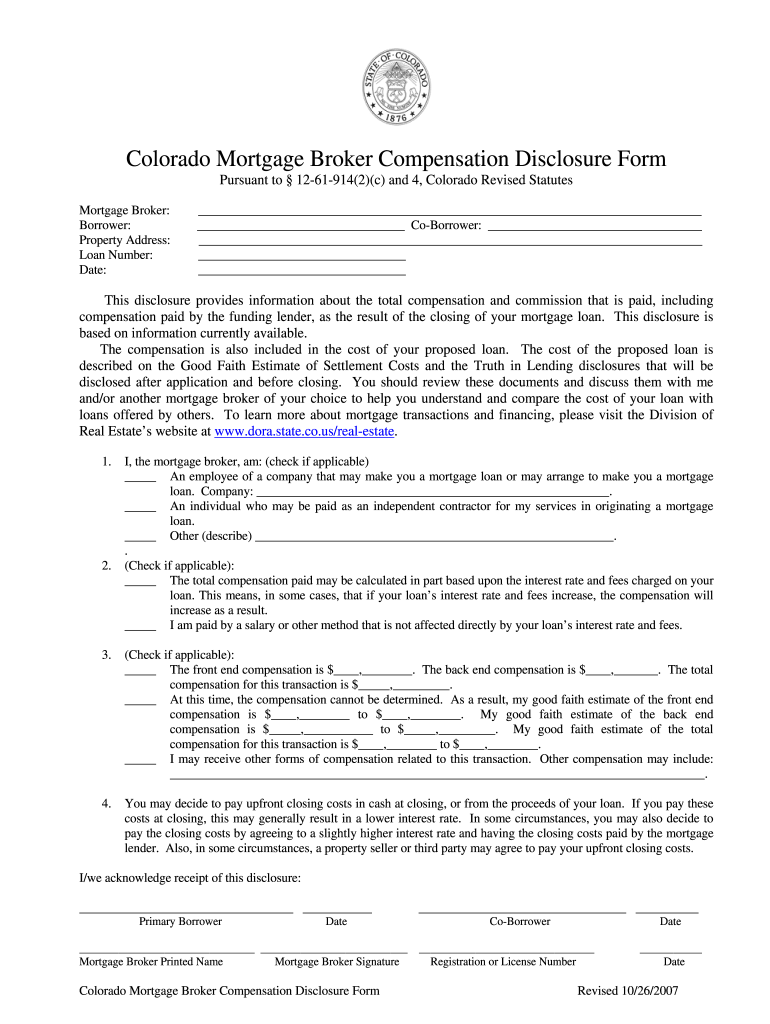

The Broker Compensation Disclosure is a critical document that outlines the compensation structure for mortgage brokers in Colorado. This form is designed to provide transparency regarding how brokers are paid for their services, ensuring that clients are fully aware of any fees or commissions that may be involved in their mortgage transactions. By detailing the compensation arrangements, the disclosure helps to foster trust between brokers and their clients, allowing for informed decision-making throughout the mortgage process.

Key Elements of the Broker Compensation Disclosure

Understanding the key elements of the Broker Compensation Disclosure is essential for both brokers and clients. The form typically includes:

- Broker's Name and Contact Information: Essential for identifying the broker responsible for the transaction.

- Compensation Structure: Detailed breakdown of how the broker will be compensated, including any fees, commissions, or bonuses.

- Disclosure of Conflicts of Interest: Information on any potential conflicts that may arise from the broker's compensation.

- Client Acknowledgment: A section for clients to sign, confirming their understanding of the compensation terms.

Steps to Complete the Broker Compensation Disclosure

Completing the Broker Compensation Disclosure involves several straightforward steps:

- Gather Necessary Information: Collect all relevant details, including the broker's compensation structure and client information.

- Fill Out the Form: Accurately complete all sections of the disclosure, ensuring clarity and completeness.

- Review for Accuracy: Double-check the information provided to avoid any errors or omissions.

- Obtain Signatures: Ensure that both the broker and client sign the form to acknowledge their agreement to the terms.

Legal Use of the Broker Compensation Disclosure

The legal use of the Broker Compensation Disclosure is governed by state regulations in Colorado. It is essential for brokers to comply with these regulations to avoid potential legal issues. The disclosure must be presented to clients prior to the execution of any mortgage agreement, ensuring that clients are informed about the broker's compensation. Failure to provide this disclosure may result in penalties or disciplinary actions against the broker.

How to Obtain the Broker Compensation Disclosure

Obtaining the Broker Compensation Disclosure is a straightforward process. Brokers can access the form through various resources, including:

- State Regulatory Agencies: Many state agencies provide official templates for the disclosure.

- Industry Associations: Organizations related to real estate and mortgage lending often offer resources and templates for brokers.

- Online Platforms: Various online tools and platforms provide customizable templates that meet legal requirements.

Examples of Using the Broker Compensation Disclosure

Real-world examples can illustrate how the Broker Compensation Disclosure is utilized in practice. For instance:

- A client seeking a mortgage meets with a broker who presents the disclosure, detailing the commission structure based on the loan amount.

- A broker uses the disclosure to clarify any potential conflicts of interest, such as receiving bonuses from lenders.

- During a loan transaction, the broker ensures that the client understands the fees involved, reinforcing transparency and trust.

Quick guide on how to complete colorado mortgage broker compensation disclosure form

Carefully review details and ensure accuracy in Broker Compensation Disclosure

Negotiating agreements, managing listings, scheduling appointments, and showings—real estate agents and professionals balance a multitude of responsibilities every day. Many of these responsibilities involve extensive paperwork, such as Broker Compensation Disclosure, that must be finalized promptly and with utmost precision.

airSlate SignNow is a comprehensive solution that aids professionals in real estate in alleviating the burden of paperwork, allowing them to focus more on their clients’ goals throughout the entire negotiation process and assist them in securing the most favorable terms.

Steps to complete Broker Compensation Disclosure with airSlate SignNow:

- Access the Broker Compensation Disclosure page or utilize our library’s search feature to locate the required form.

- Click on Get form—you will be promptly directed to the editor.

- Begin filling out the document by selecting fillable fields and entering your information.

- Add new text and modify its settings if necessary.

- Select the Sign option in the upper toolbar to create your signature.

- Explore other tools available to annotate and enhance your form, such as drawing, highlighting, adding shapes, and more.

- Select the notes section to include comments about your document.

- Conclude the process by downloading, sharing, or emailing your form to the relevant parties or companies.

Eliminate paper for good and streamline the homebuying process with our user-friendly and efficient platform. Experience enhanced convenience when completing Broker Compensation Disclosure and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How and what forms does a customs broker fill out for imported goods?

Omg I really don’t know :)I am a permanent client of brokers from https://clearit.ca/ , they usually solve all the details so that I don’t need to worry about any forms and other things.I will subscribe to this question, I am really interested now.

-

What are the types of forms investors typically have to fill out to invest with a broker?

You can easily find out this for youself by using google.If you can write on Quora it means that you have either a computer,a tablet or a smart phone .That means that you can get a comprehensive answer to your question yourself.You can also pick any brokerage and click into their investment requirements or request their investment brohure and,wallah! you have their requirements at your fingertips. You see they are not standard to the many online brokers. Some parts are but there are variation based on many factors. One example is whether you are an international investor or a domestic investor. happy research.

-

Why do you need to fill out a W-9 form to get back a broker fee from renting an apartment?

Is the person requesting that you fill out this form going to be cutting you a check for this fee? In other words, is this broker fee a payment to you for services you rendered? Money that you need to declare as income and thus pay income taxes to the IRS?If not, if this check is for some other reason, then I don’t believe that you should complete this form.I’m not a lawyer, so there could very well be something that I am unaware of, but it looks suspicious to me. I sure would like to know more about this issue.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the colorado mortgage broker compensation disclosure form

How to generate an eSignature for your Colorado Mortgage Broker Compensation Disclosure Form in the online mode

How to create an electronic signature for your Colorado Mortgage Broker Compensation Disclosure Form in Google Chrome

How to make an eSignature for signing the Colorado Mortgage Broker Compensation Disclosure Form in Gmail

How to make an electronic signature for the Colorado Mortgage Broker Compensation Disclosure Form from your smart phone

How to generate an eSignature for the Colorado Mortgage Broker Compensation Disclosure Form on iOS devices

How to create an eSignature for the Colorado Mortgage Broker Compensation Disclosure Form on Android

People also ask

-

What is the Broker Compensation Disclosure feature in airSlate SignNow?

The Broker Compensation Disclosure feature in airSlate SignNow allows businesses to transparently communicate commission structures and financial incentives to clients. This feature ensures compliance with regulations while enhancing client trust. By utilizing this tool, you can easily create and share disclosures that keep your clients informed.

-

How does airSlate SignNow handle Broker Compensation Disclosure documents?

airSlate SignNow streamlines the process of creating and managing Broker Compensation Disclosure documents. Users can easily generate custom templates, send them for eSignature, and securely store completed documents. Our platform simplifies compliance, making it easier for brokers to focus on their clients.

-

Is airSlate SignNow cost-effective for managing Broker Compensation Disclosures?

Yes, airSlate SignNow is a cost-effective solution for managing Broker Compensation Disclosures. Our pricing plans are designed to suit businesses of all sizes, providing essential features without breaking the bank. This affordability allows you to maintain compliance and enhance client communication efficiently.

-

What integrations does airSlate SignNow offer for Broker Compensation Disclosure management?

airSlate SignNow offers a variety of integrations that enhance your ability to manage Broker Compensation Disclosures. Whether you use CRM systems, document management platforms, or accounting software, our seamless integrations help keep your workflow efficient. This ensures that you can easily share and manage disclosures across different platforms.

-

How can airSlate SignNow improve my Broker Compensation Disclosure process?

By using airSlate SignNow, you can signNowly improve your Broker Compensation Disclosure process through automation and eSigning capabilities. Our platform reduces the time spent on paperwork, minimizes errors, and increases client satisfaction. This efficiency allows you to focus more on building relationships rather than administrative tasks.

-

Are there templates available for Broker Compensation Disclosures in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for Broker Compensation Disclosures. These templates are designed to meet industry standards and can be easily tailored to reflect your specific compensation structures. This feature saves you time and ensures you maintain compliance effortlessly.

-

What security measures does airSlate SignNow implement for Broker Compensation Disclosure documents?

airSlate SignNow prioritizes the security of your Broker Compensation Disclosure documents with advanced encryption and secure storage. Our platform complies with industry standards to protect sensitive information while ensuring easy access for authorized users. This commitment to security helps build trust with your clients.

Get more for Broker Compensation Disclosure

- Concealed carry court strikes down illinois ban chicago form

- Effective july 1 2018 illinois supreme court rule 16 is adopted form

- Domestic relations division american society of clinical form

- Whereas stable is the owner and operator of a certain commercial stable located in form

- Invoices are payable upon receipt form

- Should this account upon default be collected by or through an attorney at law the undersigned agrees to pay reasonable form

- Termination date form

- Attorneys fees in addition to the principal indebtedness and interest thereon form

Find out other Broker Compensation Disclosure

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast