RESOLUTION to MAKE SPECIFIC LOAN Form

What is the resolution to make specific loan?

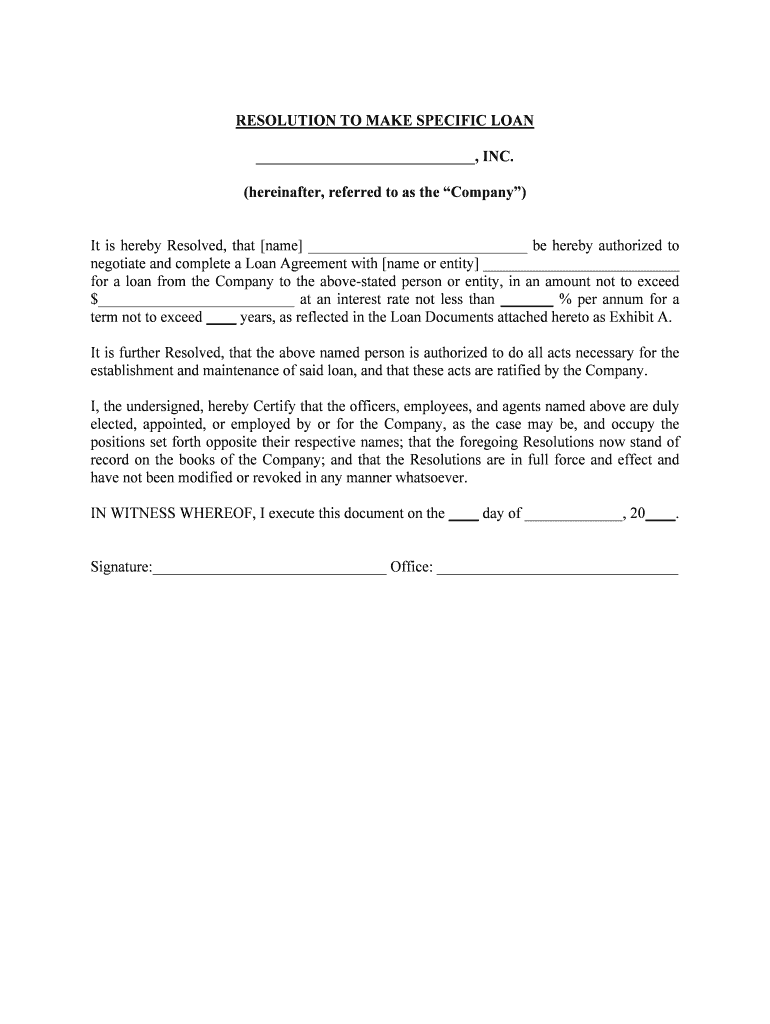

The resolution to make specific loan is a formal document used by organizations to authorize a particular loan transaction. This document outlines the terms and conditions of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a record of the decision made by the organization's governing body, such as the board of directors or members, to proceed with the loan. This resolution ensures that all parties involved are aware of the obligations and responsibilities associated with the loan agreement.

Steps to complete the resolution to make specific loan

Completing the resolution to make specific loan involves several key steps to ensure its validity and compliance with legal standards. First, gather all necessary information regarding the loan, including the lender's details, loan amount, and terms. Next, draft the resolution, clearly stating the purpose of the loan and the authority under which it is being executed. It's essential to include the date of the resolution and the signatures of the authorized individuals. After drafting, review the document for accuracy and completeness. Finally, distribute copies to all relevant parties and retain a signed copy for your records.

Legal use of the resolution to make specific loan

The legal use of the resolution to make specific loan is crucial for ensuring that the document is recognized as binding. To be legally valid, the resolution must comply with applicable state laws and regulations governing loan agreements. This includes obtaining the necessary approvals from the organization's governing body and ensuring that all signatories have the authority to execute the document. Additionally, the resolution should be executed in accordance with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows for electronic signatures to be legally binding in the United States.

Key elements of the resolution to make specific loan

Key elements of the resolution to make specific loan include the following:

- Loan amount: Specify the total amount being borrowed.

- Purpose of the loan: Clearly state the reason for obtaining the loan.

- Terms and conditions: Outline the interest rate, repayment schedule, and any collateral.

- Authorization: Include the names and titles of individuals authorized to sign the resolution.

- Date: Indicate the date of the resolution's approval.

How to obtain the resolution to make specific loan

To obtain the resolution to make specific loan, organizations typically need to draft the document internally or consult with legal counsel to ensure compliance with applicable laws. Templates for such resolutions may be available through legal resources or business associations. It is important to customize the template to reflect the specific details of the loan and the organization's requirements. Once drafted, the resolution should be presented to the governing body for approval before being signed and executed.

Examples of using the resolution to make specific loan

Examples of using the resolution to make specific loan can vary depending on the organization's needs. For instance, a nonprofit organization may use this resolution to secure funding for a community project, while a corporation might utilize it to finance equipment purchases. In each case, the resolution serves as a formal record of the decision-making process and the terms agreed upon, ensuring transparency and accountability in financial dealings.

Quick guide on how to complete resolution to make specific loan

Complete RESOLUTION TO MAKE SPECIFIC LOAN effortlessly on any device

Online document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle RESOLUTION TO MAKE SPECIFIC LOAN on any device using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to alter and eSign RESOLUTION TO MAKE SPECIFIC LOAN with ease

- Locate RESOLUTION TO MAKE SPECIFIC LOAN and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign RESOLUTION TO MAKE SPECIFIC LOAN and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a resolution to make specific loan?

A resolution to make a specific loan is a formal document that outlines the terms and conditions under which a loan will be executed. This resolution acts as an agreement between the borrower and lender and is essential for ensuring clarity in the transaction process. airSlate SignNow simplifies the process of creating, signing, and managing these documents effectively.

-

How can airSlate SignNow help with my resolution to make specific loan?

airSlate SignNow provides businesses with tools to create, customize, and eSign resolutions to make specific loans quickly and securely. Our platform ensures that all necessary fields are completed accurately and allows for easy tracking of document status. This streamlines the process, reducing the time spent on paperwork and enhancing productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, starting from a free trial to advanced paid subscriptions. Each plan includes essential features for creating and managing resolutions to make specific loans. You can choose the plan that best fits your budget and required functionality.

-

Are there any key features that support the resolution to make specific loan?

Yes, airSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning, all of which are vital for managing a resolution to make specific loans effectively. These features minimize errors, ensure compliance, and enhance collaboration among involved parties throughout the loan process.

-

Can airSlate SignNow integrate with other tools I use?

Absolutely! airSlate SignNow seamlessly integrates with various business tools and platforms, such as CRM systems and financial software, enhancing your workflow when handling resolutions to make specific loans. This integration allows for a more streamlined experience, keeping all your documents and data connected.

-

What are the benefits of using airSlate SignNow for loan resolutions?

Using airSlate SignNow for your resolutions to make specific loans offers numerous benefits. The platform provides a secure, efficient, and user-friendly solution that accelerates the signing process, reduces paperwork, and enhances compliance. Furthermore, it ensures that all documents are safely stored and easily accessible.

-

Is it safe to eSign resolutions to make specific loans with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, utilizing encryption and robust authentication methods to protect your documents, including resolutions to make specific loans. Our compliance with industry standards guarantees that your sensitive information remains confidential and secure throughout the signing process.

Get more for RESOLUTION TO MAKE SPECIFIC LOAN

- I attorney appointed under the servicemembers civil relief act of 2003 50 u form

- In the superior court for the state of alaska at in the matter of the protective proceeding of protected person case no form

- Pub 12b alaska court records state of alaska form

- Dr 211 order re diligent inquiry and notice 1 15 domestic relations form

- Dl 140 alaska court records state of alaska form

- Dl 145 alaska court records state of alaska form

- Dr801 form

- Alaska felony pretrial form

Find out other RESOLUTION TO MAKE SPECIFIC LOAN

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple