Verify Income Form

What is the income verification form?

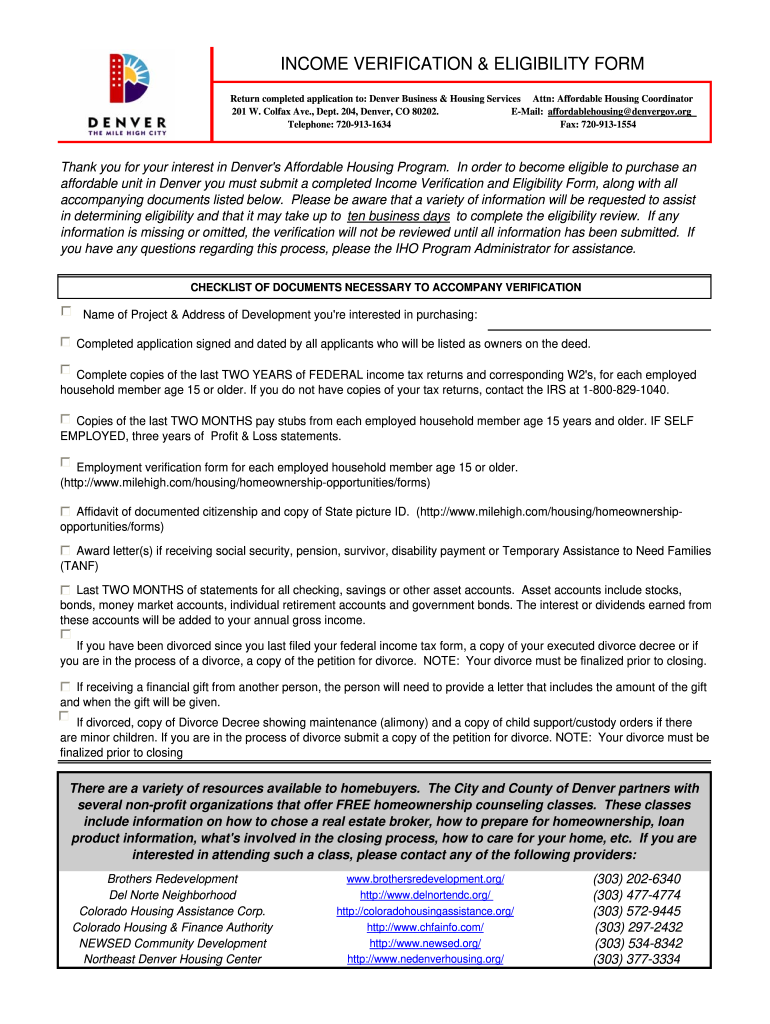

The income verification form is a crucial document used to confirm an individual's earnings and employment status. It is often required by financial institutions, landlords, or government agencies to assess eligibility for loans, housing assistance, or other benefits. In the context of the city of Denver, this form may specifically pertain to employment verification for residents seeking various services or benefits. The form typically includes details about the employee's job title, salary, and duration of employment.

Steps to complete the income verification form

Completing the income verification form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your employment details and income records. Next, fill out the form carefully, ensuring that all sections are completed accurately. If the form requires signatures, make sure to sign it digitally or physically as needed. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements of the requesting agency.

Required documents for income verification

To complete the income verification process, you may need to provide several supporting documents. Commonly required documents include recent pay stubs, tax returns, W-2 forms, or bank statements that reflect your income. If you are self-employed, you might need to submit profit and loss statements or 1099 forms. It's essential to check the specific requirements of the city and county of Denver to ensure you submit all necessary documentation for verification.

Legal use of the income verification form

The income verification form must be used in compliance with various legal standards and regulations. In the United States, it is important to adhere to privacy laws such as the Fair Credit Reporting Act (FCRA) and the Fair Housing Act (FHA). These laws protect individuals' rights regarding their personal information and ensure that any verification process is conducted fairly and transparently. Additionally, the form must be completed truthfully to avoid any legal repercussions.

Who issues the income verification form?

The income verification form can be issued by various entities, depending on the context in which it is used. Employers typically provide this form to their employees upon request, especially when verification is needed for loans or housing applications. In the city of Denver, government agencies or financial institutions may also have their own versions of the form that must be completed for specific programs or services. It is essential to ensure that you are using the correct form as required by the issuing authority.

Eligibility criteria for income verification

Eligibility criteria for income verification can vary based on the purpose of the verification. Generally, individuals seeking to verify their income must be current employees or have a consistent income source. Specific programs may have additional requirements, such as income thresholds or employment duration. It is advisable to review the criteria set by the relevant agency or institution in Denver to ensure compliance and successful verification.

Quick guide on how to complete income verification amp eligibility form city and county of denver denvergov

Explore the simpler approach for managing your Verify Income

The traditional methods of completing and approving documents require an excessive amount of time compared to contemporary document management solutions. Previously, you would hunt for the correct forms, print them, fill in all the information, and mail them. Nowadays, you can locate, complete, and sign your Verify Income all within a single browser tab using airSlate SignNow. Setting up your Verify Income has never been easier.

Steps to complete your Verify Income with airSlate SignNow

- Access the relevant category page to find your state-specific Verify Income. Alternatively, utilize the search bar.

- Confirm that the version of the form is accurate by viewing it.

- Click Get form to enter the editing mode.

- Fill in your document with the necessary information using the editing tools.

- Examine the added information and click the Sign button to authorize your form.

- Select the most suitable method to create your signature: generate it, draw it, or upload an image of it.

- Click DONE to preserve the changes.

- Download the document to your device or move to Sharing settings to send it electronically.

Robust online tools like airSlate SignNow simplify the processes of completing and submitting your forms. Give it a try to discover how quick document management and approval processes should truly be. You will save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

What's your opinion on school food?

Since I grew up in America, my answer is going to be centered on American school lunches.I think that they can be improved in two ways: Being more nutritionally dense, and having children be more involved with the school lunch process.A lot of current American school lunches while being filling, lack vital nutrients, and are instead very sodium laden.“A 2008 analysis of school lunches by the Institute of Medicine (IOM) concluded that American kids consume very few fruits and vegetables in their cafeterias—with potatoes accounting for a third of all vegetables consumed. IOM also found that kids were eating many refined grains and too much saturated fat and sodium. “How to Improve American School LunchesI would say this is a pretty accurate representation of a good to excellent American school lunch.Here's how school lunch in the US stacks up against what's served in the rest of the worldFrom my honest recollection, usually what would be served up regularly was square (never, circular, or triangular, mind you, this is very important, I can not emphasize this enough), square pizza. Some type of “different dish”, and chicken nuggets. Well actually, my memory is starting to fail me now, so I will link to what the current menu this month for my old elementary school is.Not too bad, but there could be room for improvement, a lot of pizza, chicken nuggets, which is all well and good, but these, these ghastly things.Okay, I am aware this is kind of a weird video, but it is an authentic representation of what I, and many other kids, ate in middle school and high school.Now, recently, I saw a video on the school lunch system “Kyushoku” in Japan.I thought the differences in nutrition were staggering. The Japanese lunch had rice, vegetables, and even fresh fish, which are very nutritionally dense.In addition, many of the ingredients are fresh, and students are more involved in the process of making the school lunch.8th grade students visiting a domestic farm where their school orders some of their produce from. For their work experience, they are separating edamame for tomorrow’s kyushoku.Which brings me to my next point; I believe we can improve American school lunches by having the children be more involved in the process of making their own lunches.Here, the students all take turns serving each other lunch. I think this is a very respectful and polite thing to do for others.In addition, these students are also required to clean up after themselves, and tidy up the area after they are done eating. I think this is a great lesson in discipline, responsibility, but also Home Economics. Learning how to properly clean a kitchen or living area is an often overlooked, yet fundamental skill that kids should learn early on.Another thing I appreciate is how varied the school lunches are. This school tries not to offer the same dish twice in a month. Although, kids being kids, often would request their favorites over and over again, in this case being curry. I don’t know if all schools in Japan offer such a diversity in options, but I think this is also a beneficial gift to the students in developing their taste palates, and helping to keep their bodies strong and healthy.The importance placed on school lunches comes from the view that school lunches are a part of the curriculum themselves."Japan's standpoint is that school lunches are a part of education," Masahiro Oji, a government director of school health education, told the Washington Post in 2013, "not a break from it."Japan's mouthwatering school lunch program is a model for the rest of the worldI can’t help agree, because eating healthy helps increase your learning skills, as well as mood. Fully integrating healthy meals can help with all other aspects of school life, including concentration, happiness levels, and even socialization.The average cost of these lunches are about 2 dollars a meal. With the school covering staff and kitchen costs, and parents covering ingredients. If the parents are low-income and cannot afford the everyday costs, they must apply for social welfare meal plans at the school. The child will still receive the exact same meals as other kids. The screenshots from the previous video is actually of an average public school, not an exceptionally rich one either. In fact, this school is in the poorest of Tokyo’s wards.From this, we can assume the lunches shown above are of the bare minimum requirements for a proper kyushoku, as more well-to-do families often have more time and money to spend on improving their children’s schooling experiences.All-in-all, without spending more money, we can still improve our school lunches in America bya) Including more fresh, domestically grown produce and poultry into every meal.b) Including our students more in the lunchtime process, from farm to lunch table.What’s also ironic is that the Kyushoku system got official after 1946, when G.H.Q recommended systematic health education, and the school lunch program in Japanese schools.The Japanese government took note, and starting providing school lunch to 250,000 children in the Tokyo metropolitan area. This later expanded to all over Japan.Much funding at the time came from relief aid provided by foreign governments and charities. When Japan later regained full independence in 1951, the funding stopped. The Minister of Finance wanted to get terminate school lunch subsidies. However, this was strongly opposed by many people in Japan, and in 1954, school lunch law was enacted, with school lunch being a part of the school curriculum.So I think it’s very cool that Japan once took America’s advice and greatly improved their school lunches. And now America can take advice from our friends over in Japan, and we can all improve our school lunches together!Thank you. :)Anmitsu at Hatsune (初音) - Kantaro: The Sweet Tooth Salaryman Episode 1Now please enjoy this refreshing photo of Anmitsu.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

-

How are some people able to finance or lease a car without a W-2?

I have never been asked for a W-2 when financing or leasing a car. Nor have I been asked for a physical pay stub. One fills out a credit application with all pertinent information (including Social Security number), and the Finance Manager then pulls a credit report (which also provides employer verification). If you meet their criteria, you get financed.If you’re actually asking whether independent contractors who get 1099’s can get financed, then income verification may be a bit more stringent.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the income verification amp eligibility form city and county of denver denvergov

How to generate an eSignature for your Income Verification Amp Eligibility Form City And County Of Denver Denvergov in the online mode

How to make an electronic signature for your Income Verification Amp Eligibility Form City And County Of Denver Denvergov in Chrome

How to generate an electronic signature for putting it on the Income Verification Amp Eligibility Form City And County Of Denver Denvergov in Gmail

How to generate an eSignature for the Income Verification Amp Eligibility Form City And County Of Denver Denvergov right from your smartphone

How to create an eSignature for the Income Verification Amp Eligibility Form City And County Of Denver Denvergov on iOS

How to create an eSignature for the Income Verification Amp Eligibility Form City And County Of Denver Denvergov on Android

People also ask

-

What does it mean to Verify Income through airSlate SignNow?

To Verify Income using airSlate SignNow means utilizing our platform to securely send and sign documents that confirm an individual's earnings. This process streamlines the verification of income for loans, rental applications, and other financial assessments, ensuring that all parties can trust the information provided.

-

How can airSlate SignNow help me Verify Income efficiently?

airSlate SignNow simplifies the income verification process by allowing users to send documents electronically and receive signed confirmations quickly. Our user-friendly interface enables businesses to manage income verification seamlessly, reducing the time spent on paperwork and increasing efficiency.

-

Is airSlate SignNow affordable for small businesses looking to Verify Income?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses needing to Verify Income without breaking the bank. Our cost-effective solutions allow you to choose a plan that fits your budget while still providing powerful features for document management.

-

What features does airSlate SignNow offer for income verification?

airSlate SignNow provides a variety of features to aid in income verification, including customizable templates, electronic signatures, and secure document storage. These tools help you Verify Income efficiently and ensure that all transactions are legally binding and compliant with regulations.

-

Can I integrate airSlate SignNow with other tools for income verification?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, allowing you to streamline your workflow for income verification. Whether you're using CRM systems or accounting software, our integrations help you manage your documentation processes more effectively.

-

How secure is the income verification process with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you Verify Income through our platform, your documents are protected with advanced encryption and secure cloud storage, ensuring that sensitive information remains confidential and secure throughout the verification process.

-

Can I track the status of my income verification requests?

Yes, airSlate SignNow allows you to track the status of all your income verification requests in real-time. This feature provides transparency and helps you stay informed about the progress of each document, ensuring timely completion and follow-up.

Get more for Verify Income

- Illinois statutes chapter 755 estates 54short term guardian form

- Appointment of short term guardian illinois free download form

- What is standby guardianship the legal aid society form

- Control number il p010 pkg form

- Identity theft hotline illinois attorney general form

- Control number il p017 pkg form

- Out of state drivers licenseillinois legal aid online form

- Step by step guide begin here illinoisgov form

Find out other Verify Income

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast