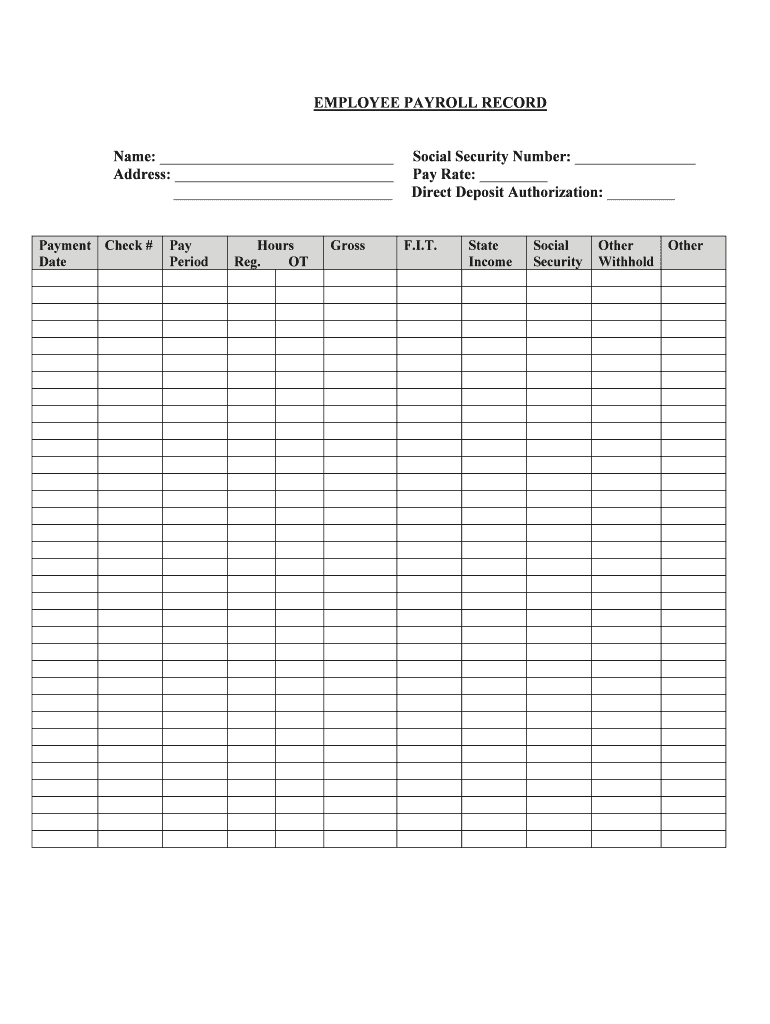

EMPLOYEE PAYROLL RECORD Form

What is the employee payroll record?

The employee payroll record is a crucial document that tracks the earnings, deductions, and net pay of employees within a business. This record serves as a formal account of each employee's compensation and is essential for both the employer and employee for various reasons, including tax reporting and financial planning. It typically includes details such as the employee's name, Social Security number, pay period, gross pay, deductions for taxes and benefits, and the final net pay amount. Maintaining accurate payroll records is not only a best practice but also a legal requirement under federal and state laws.

Steps to complete the employee payroll record

Completing the employee payroll record involves several key steps to ensure accuracy and compliance with legal standards. Here’s a simple process to follow:

- Gather employee information: Collect necessary details such as the employee's full name, Social Security number, and employment start date.

- Determine pay period: Specify the duration for which the employee is being paid, whether it’s weekly, bi-weekly, or monthly.

- Calculate gross pay: Based on the employee's hourly wage or salary, calculate the total earnings for the pay period.

- Deduct taxes and other withholdings: Subtract federal and state taxes, Social Security, Medicare, and any other deductions, such as health insurance premiums or retirement contributions.

- Record net pay: Document the final amount that the employee will receive after all deductions.

- Review and verify: Double-check all entries for accuracy to prevent errors that could lead to compliance issues.

Legal use of the employee payroll record

The employee payroll record must comply with various federal and state regulations to be considered legally binding. Under the Fair Labor Standards Act (FLSA), employers are required to maintain accurate payroll records for a minimum of three years. Additionally, the Internal Revenue Service (IRS) mandates that employers keep payroll records for at least four years after the tax due date or the date the tax was paid, whichever is later. These records are essential for tax audits, employee verification, and compliance with labor laws, ensuring that both employers and employees are protected in case of disputes.

Key elements of the employee payroll record

Essential components of an employee payroll record include:

- Employee identification: Full name and Social Security number.

- Pay period dates: Start and end dates of the pay period.

- Hours worked: Total hours worked during the pay period, including overtime if applicable.

- Gross pay: Total earnings before any deductions.

- Deductions: Itemized list of all deductions, including taxes and benefits.

- Net pay: Final amount paid to the employee after deductions.

How to obtain the employee payroll record

Employers typically generate employee payroll records using payroll software or accounting systems that automate the process. For employees seeking their payroll records, they can request copies from their employer’s human resources or payroll department. It is advisable for employees to keep personal copies of their payroll records for their own financial tracking and to ensure accuracy in their personal tax filings. In some cases, employees may also access their payroll records through employee self-service portals provided by their employers.

Examples of using the employee payroll record

Employee payroll records serve multiple purposes in a business context. For instance:

- Tax reporting: Employers use payroll records to report employee earnings and withholdings to the IRS.

- Loan applications: Employees may present payroll records as proof of income when applying for loans or mortgages.

- Dispute resolution: In case of wage disputes, payroll records provide documented evidence of earnings and deductions.

Quick guide on how to complete employee payroll record

Effortlessly Manage EMPLOYEE PAYROLL RECORD on Any Device

Managing documents online has gained signNow traction among companies and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the capabilities to create, modify, and eSign your documents swiftly and without interruptions. Handle EMPLOYEE PAYROLL RECORD on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign EMPLOYEE PAYROLL RECORD Seamlessly

- Locate EMPLOYEE PAYROLL RECORD and then click Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using specific tools offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all information carefully and then click the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing fresh copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign EMPLOYEE PAYROLL RECORD and ensure excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a paycheck signature sheet?

A paycheck signature sheet is a document that contains the necessary approvals for processing payroll. It typically includes the signatures of authorized personnel, ensuring that all payments are validated. Using airSlate SignNow, you can easily create and manage your paycheck signature sheets electronically, streamlining the payroll process.

-

How does airSlate SignNow handle paycheck signature sheets?

airSlate SignNow provides a user-friendly platform to create, send, and sign paycheck signature sheets online. You can easily customize the document according to your company's needs and collect signatures from authorized employees in real time. This simplifies your payroll processing and improves efficiency.

-

Is there a cost associated with using airSlate SignNow for paycheck signature sheets?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans include features for creating and managing paycheck signature sheets, along with other electronic signing capabilities. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for paycheck signature sheets?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage for your paycheck signature sheets. Additionally, you can track the status of your documents and ensure that all signatures are collected promptly, helping you stay organized and compliant.

-

What are the benefits of using airSlate SignNow for paycheck signature sheets?

Using airSlate SignNow for paycheck signature sheets accelerates the payroll process and enhances document security. It eliminates the need for paper-based signatures, reducing the risk of errors and improving compliance. Furthermore, you can access your documents anytime, anywhere, making it ideal for remote teams.

-

Can I integrate airSlate SignNow with other tools I use for payroll?

Yes, airSlate SignNow offers seamless integrations with various payroll and management tools. This allows you to connect your paycheck signature sheets with your existing systems, ensuring a smooth workflow. Integrating your tools helps streamline data sharing and reduces manual entries.

-

Is it easy to use airSlate SignNow for creating paycheck signature sheets?

Absolutely! airSlate SignNow is designed to be intuitive, enabling users to create paycheck signature sheets quickly and efficiently. With a simple drag-and-drop interface and pre-built templates, even those with minimal technical skills can manage their documentation effortlessly.

Get more for EMPLOYEE PAYROLL RECORD

Find out other EMPLOYEE PAYROLL RECORD

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT