Mw507 Calculator Form

What is the Mw507 Calculator

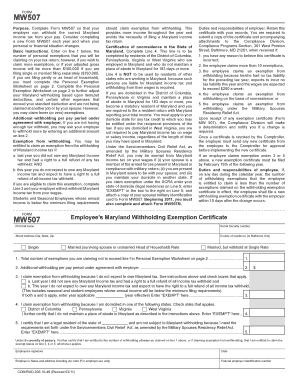

The Mw507 calculator is a tax form used in the United States, specifically for calculating the amount of Maryland state income tax withholding. This form is essential for employees and employers to ensure accurate tax deductions from wages. The Mw507 calculator helps individuals determine the correct amount of state tax to withhold based on their personal financial situation, including income level and exemptions. It is particularly useful for those who may have multiple jobs or varying income sources, allowing for precise withholding adjustments.

How to use the Mw507 Calculator

Using the Mw507 calculator involves a few straightforward steps. First, gather all necessary financial information, including your total income, any deductions, and the number of exemptions you claim. Next, input this data into the calculator, which will process the information to provide you with the recommended withholding amount. This amount ensures that you neither owe a large sum at tax time nor receive an excessive refund, which indicates over-withholding. The calculator is designed to be user-friendly, making it accessible for individuals with varying levels of tax knowledge.

Steps to complete the Mw507 Calculator

Completing the Mw507 calculator involves several key steps:

- Gather your financial documents, including pay stubs and previous tax returns.

- Determine your total annual income from all sources.

- Identify any deductions you qualify for, such as retirement contributions or health savings accounts.

- Input your personal information, including filing status and number of exemptions.

- Review the calculated withholding amount, ensuring it aligns with your financial goals.

- Save or print the results for your records and to share with your employer if necessary.

Legal use of the Mw507 Calculator

The Mw507 calculator is legally recognized as a tool for determining state tax withholding in Maryland. To ensure compliance with state tax laws, it is important to use the calculator accurately and keep records of your calculations. The results from the Mw507 calculator can be submitted to your employer, who is responsible for implementing the recommended withholding amounts. Proper use of this calculator helps prevent underpayment or overpayment of taxes, which can lead to penalties or unexpected tax liabilities.

IRS Guidelines

While the Mw507 calculator focuses on Maryland state tax withholding, it is essential to be aware of IRS guidelines that govern federal tax withholding. The IRS provides resources and publications that outline how to calculate federal income tax withholding, which may complement the results obtained from the Mw507 calculator. Understanding both state and federal requirements ensures comprehensive tax compliance and helps individuals manage their overall tax obligations effectively.

Filing Deadlines / Important Dates

When using the Mw507 calculator, it is crucial to be aware of important filing deadlines. Maryland state income tax returns are typically due on April fifteenth, aligning with federal tax deadlines. Additionally, if you are making estimated tax payments, be mindful of quarterly deadlines to avoid penalties. Staying informed about these dates helps ensure timely filing and payment of taxes, reducing the risk of financial penalties or interest charges.

Quick guide on how to complete mw507 calculator

Complete Mw507 Calculator seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Mw507 Calculator on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Mw507 Calculator effortlessly

- Find Mw507 Calculator and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Mark essential sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Mw507 Calculator and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw507 calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mw507 calculator and how does it work?

The mw507 calculator is a digital tool designed to simplify the process of calculating tax credits and deductions. By inputting your financial data, the mw507 calculator provides accurate estimates, helping businesses make informed decisions regarding their tax obligations. It's user-friendly and ensures that you can quickly assess your financial situation.

-

Is the mw507 calculator free to use?

Yes, the mw507 calculator is available for free, making it an accessible tool for businesses looking to manage their tax calculations effectively. You can utilize its features without any upfront costs, which adds to the cost-effectiveness of using airSlate SignNow's solutions. Additionally, free access means you can evaluate its effectiveness before committing to any services.

-

What features does the mw507 calculator offer?

The mw507 calculator includes dynamic input fields for various tax parameters, ensuring a tailored calculation based on your specific needs. It also comes with error-checking mechanisms to help you avoid common mistakes in your submissions. With its intuitive interface, the mw507 calculator enhances efficiency for users at all levels.

-

How can the mw507 calculator benefit my business?

Using the mw507 calculator can lead to signNow benefits for your business, particularly in optimizing tax outcomes. By providing accurate calculations, it promotes better financial planning and helps minimize liability. Consequently, leveraging the mw507 calculator can ultimately lead to greater savings and streamlined financial operations.

-

Can I integrate the mw507 calculator with other tools?

Yes, the mw507 calculator can be integrated with various accounting and financial software, enhancing its capabilities. This integration allows for seamless data transfer and increased accuracy in calculations without the need for manual entry. Such compatibility makes the mw507 calculator a versatile addition to any business ecosystem.

-

Is the mw507 calculator suitable for all business sizes?

Absolutely, the mw507 calculator is beneficial for businesses of all sizes, from small startups to large corporations. Its design accommodates various complexities in tax calculations, making it a valuable resource regardless of your business scale. This inclusivity ensures everyone can take advantage of accurate tax assessments and planning.

-

How secure is the mw507 calculator for my data?

The mw507 calculator prioritizes data security with robust encryption and privacy measures in place. Your sensitive financial information is adequately protected, ensuring compliance with industry standards. By using the mw507 calculator, you can feel confident that your data remains confidential and secure.

Get more for Mw507 Calculator

Find out other Mw507 Calculator

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF