Revival Charter 2012-2026

What is the certificate of amendment?

The certificate of amendment is a legal document filed with the Delaware Division of Corporations to modify a corporation's existing charter. This document allows businesses to make changes to their articles of incorporation, such as altering the company name, changing the number of authorized shares, or adjusting the registered agent. It is essential for maintaining accurate corporate records and ensuring compliance with state regulations.

Steps to complete the certificate of amendment

Completing the certificate of amendment involves several key steps:

- Identify the specific changes needed in the articles of incorporation.

- Obtain the correct form from the Delaware Division of Corporations.

- Fill out the form accurately, ensuring all required information is included.

- Have the amendment approved by the board of directors or shareholders, as applicable.

- Submit the completed form along with any required fees to the Delaware Division of Corporations.

Required documents for filing

When filing a certificate of amendment, certain documents may be required to ensure compliance. These typically include:

- The completed certificate of amendment form.

- Payment for the filing fee, which varies based on the nature of the amendment.

- Any supporting documentation that may be necessary to validate the changes, such as board resolutions.

Filing methods for the certificate of amendment

The certificate of amendment can be submitted through various methods, including:

- Online submission via the Delaware Division of Corporations' website.

- Mailing the completed form to the appropriate office.

- In-person submission at the Delaware Division of Corporations office.

Penalties for non-compliance

Failing to file a certificate of amendment when required can lead to several penalties. These may include:

- Fines imposed by the state for late filings.

- Potential loss of good standing status for the corporation.

- Legal complications that may arise from operating under outdated corporate documents.

Legal use of the certificate of amendment

The certificate of amendment is legally binding and must comply with Delaware state laws. It is crucial to ensure that all changes made through this document are in accordance with both state regulations and the corporation's bylaws. Proper execution and filing of this document help maintain the integrity and legality of the business entity.

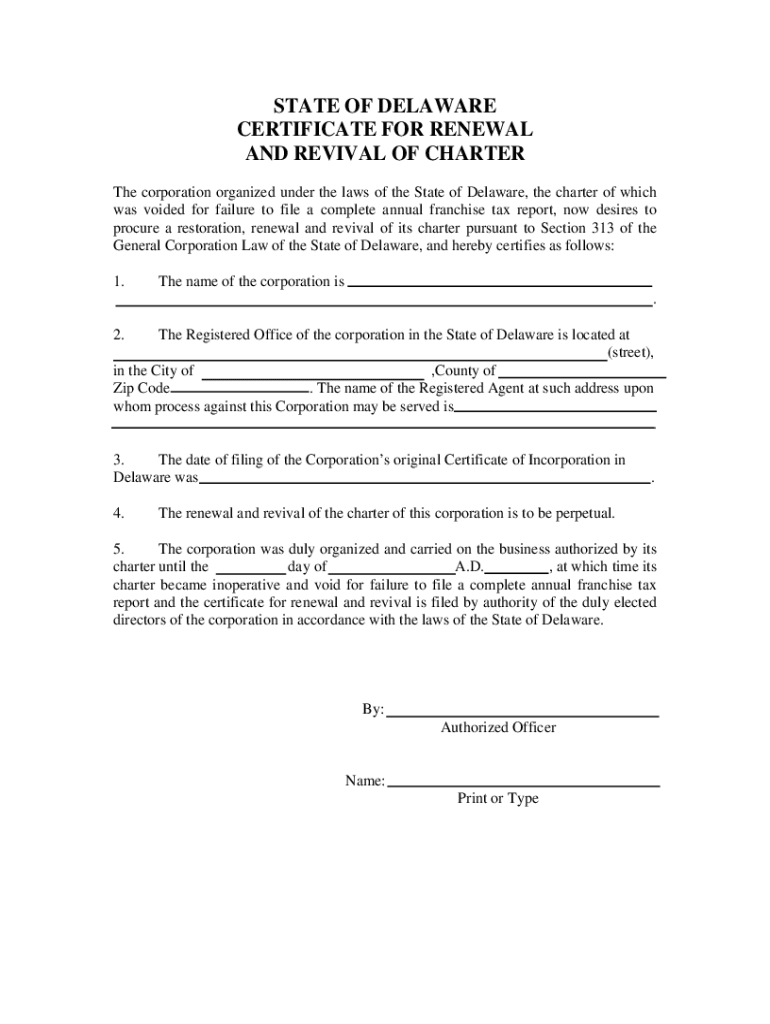

Quick guide on how to complete renewal for void division of corporations state of delaware corp delaware

Complete Revival Charter effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Revival Charter on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The easiest way to edit and eSign Revival Charter without hassle

- Locate Revival Charter and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Revival Charter and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What forms does a Delaware C-Corp operating in California have to file to the CA Secretary of State?

Initially: Statement and Designation by Foreign Corporation (Page on ca.gov) plus a certificate of good standing from DE.Within 90 days and annually thereafter: Statement of Information (Page on ca.gov).

-

For a very early stage tech startup, why does it help to register as a Delaware C corp instead of California C corp, considering the additional complexities of out-of-state agents?

Assuming that you reside and will do business in California, you should form your corporation on Delaware only if you expect to seek institutional (e.g., venture capital) funding, because such investors tend to prefer DE corporations.Otherwise, you should form the corporation in California. If you form it in Delaware, you will have to register it in CA, anyway, meaning that up-front and every year thereafter, you will have to pay two states, rather than one, for the corporation’s existence.

-

What are the forms needed in Delaware for out of state LLC dissolution? I live in New Jersey but I filed an LLC in Delaware.

Filling a Certificate of Cancellation in Delaware is how you close a Delaware LLC regardless of where you reside or do business. A Delaware Registered Agent can do this for you or you can do it yourself by mail with the Delaware Division of Corporations.Alternatively, you can just let it go and the state will mark it NOT in good standing when you miss your first franchise tax payment (June 1st each year).You can also ask your Registered Agent to resign on your LLC which will put it in NOT good standing and effectively it will be forgotten. If you do this the state will not come after you for the past due Franchise Tax but some agents will require that you pay their agent fee before they will file the document for you.Keep in mind, the state of Delaware does NOT keep any record of the members of any Delaware LLC so they will not penalize you in the future if you form another LLC in the future.Be sure when you file a cancellation that you have transferred all the assets from the LLC and closed your bank account FIRST, because once you have cancelled a Delaware LLC you cannot revive it.Notify the IRS AFTER you have received your copy of the Certificate of Cancellation from the agent or Delaware, because they will want to have a copy of the filed Certificate of Cancellation.The above is simply a description of the process in Delaware and is not to be taken as legal advice. If you want legal advice before cancelling a Delaware LLC you should contact a licensed attorney who is familiar with Delaware law.

-

What is the cheapest state (tax wise) where I should get the virtual mailbox for my Delaware C Corp? I am operating out of the US.

There is no state where simply having a virtual mailbox is going to create a tax obligation. That said I would suggest you avoid states that are particularly aggressive about claiming nexus such as California or New York. Having a mailing address in the state is likely to cause the assumption that you are doing business in the state where you receive mail and I always prefer that my clients not get into an argument with a state government even if you are likely to win the argument.My other observation would be you are concerned about cheapest state tax wise, then why did you ever register in Delaware in the first place?

-

I am the founder of a startup that is a Delaware C-Corp. I am still bootstrapping, have one co-founder and have had up until now only expenses. Do I have to fill some tax-related or general government related forms as I approach the end of the year?

Yes, in Delaware you need to pay Franchise Taxes annually. The size of this tax depends on your capital structure and assets. The Delaware Secretary of State explains how to calculate Franchise Taxes here: http://corp.delaware.gov/frtaxca... and provide an Excel-based calculator here: http://corp.delaware.gov/taxcalc.... Best case is that you only need to pay the minimum of $75 in Franchise Taxes and $50 in filing fees, i.e. total of $125, but this depends on your inputs to the calculator. Give the calculator a spin and see what it spits out. You'll also need to file the standard federal tax returns with the IRS, regardless of whether you are making a profit or not. For this you can use an online service provider like TurboTax or find a small, affordable tax account to do the paperwork. On a separate note: unless you are located in Delaware, you should be registered as a foreign entity in the state where you run your business from. This state will also have annual taxes and tax filings, the size of which varies by state. For example, in California Franchise Tax will run you a minimum of $800 per year regardless of whether you're making a profit or not (ouch!).

-

Who is responsible for the division of appropriations in the United States? How is it determined how much the state of Delaware receives?

Congress at some point in the past and present, make the appropriations.The laws that sets the amount that is spent, then its turned over to the executive branch, to execute it and codify it with rules, and regulations.

-

Is it possible for a German start-up to be incorporated as a C-Corp in Delaware, but be based out of Germany (e.g., Berlin)?

Yes, founders in Germany can form a C corporation in Delaware.The main reason for doing so probably would be an expectation that the corporation would seek institutional investment (such as venture capital) in the U.S.A secondary reason, depending on the nature of the business, might be to have a U.S. presence because many U.S. customers (especially purchasing departments of large corporations) prefer to buy from U.S. entities.

-

If I incorporate a C corp in Delaware with 10,000,000 shares at a par value of .001 using assumed par value cap method, how much will I pay in state franchise taxes to Delaware?

DE provides a link to a tax calculator (spreadsheet) at Franchise Tax Calculator** And Disclaimer.Assuming that the newly-formed corporation has modest assets, the franchise tax will be $350 (the minimum amount for this method).

Create this form in 5 minutes!

How to create an eSignature for the renewal for void division of corporations state of delaware corp delaware

How to create an electronic signature for your Renewal For Void Division Of Corporations State Of Delaware Corp Delaware online

How to make an eSignature for the Renewal For Void Division Of Corporations State Of Delaware Corp Delaware in Google Chrome

How to generate an eSignature for signing the Renewal For Void Division Of Corporations State Of Delaware Corp Delaware in Gmail

How to create an eSignature for the Renewal For Void Division Of Corporations State Of Delaware Corp Delaware right from your smart phone

How to generate an eSignature for the Renewal For Void Division Of Corporations State Of Delaware Corp Delaware on iOS devices

How to create an electronic signature for the Renewal For Void Division Of Corporations State Of Delaware Corp Delaware on Android devices

People also ask

-

What is Revival Charter and how does it work with airSlate SignNow?

Revival Charter is a comprehensive solution offered by airSlate SignNow that simplifies the process of sending and eSigning documents. It allows businesses to easily create, send, and manage electronic documents, ensuring a seamless workflow and enhanced productivity. With intuitive features, Revival Charter integrates seamlessly into your existing processes, making document handling easier than ever.

-

What are the key features of the Revival Charter solution?

The Revival Charter solution includes a variety of powerful features such as customizable templates, real-time tracking of documents, and automated reminders for signatures. Users can enjoy the benefits of secure cloud storage, advanced security measures, and integration with popular applications, enhancing overall efficiency in document management. These features make Revival Charter an excellent choice for businesses looking to streamline their operations.

-

How does Revival Charter improve business efficiency?

Revival Charter signNowly improves business efficiency by automating the document signing process, reducing the time spent on paperwork. With features like template creation and automated workflows, businesses can minimize manual tasks and focus on core activities. This leads to faster turnaround times and improved customer satisfaction, making Revival Charter a valuable asset for any organization.

-

Is Revival Charter cost-effective for small businesses?

Yes, Revival Charter is designed to be a cost-effective solution for small businesses seeking document management and eSigning capabilities. airSlate SignNow offers competitive pricing plans that cater to various budgets, ensuring that even smaller enterprises can access high-quality features without breaking the bank. By investing in Revival Charter, small businesses can achieve signNow savings on time and resources.

-

Can I integrate Revival Charter with other software my business uses?

Absolutely! Revival Charter is designed to integrate seamlessly with various popular software applications, enhancing your existing workflows. Whether you use CRM systems, project management tools, or cloud storage solutions, Revival Charter can connect with them to streamline your document processes and improve overall productivity.

-

What security measures does Revival Charter offer for document management?

Revival Charter prioritizes security with advanced features such as encryption, secure access controls, and audit trails to protect your sensitive documents. airSlate SignNow complies with industry standards and regulations to ensure that your data remains safe throughout the signing process. This commitment to security makes Revival Charter a trustworthy choice for businesses handling confidential information.

-

How does the signing process work with Revival Charter?

The signing process with Revival Charter is straightforward and user-friendly. Once a document is prepared, it can be sent out for eSignature via email or a shareable link. Signers can review and sign the document from any device, and once completed, both parties receive a copy, ensuring a smooth and efficient workflow.

Get more for Revival Charter

- Verification of creditor matrix kansas bankruptcy court form

- Agreement of sale for delaware scaor form

- Being flood prone as defined by the national flood insurance act of 1968 form

- First american title insurance company aws form

- Asset purchase agreement by and among strack and cases form

- We the undersigned purchasers of the above captioned property hereby certify form

- Indiana last will ampamp testament internet legal research group form

- I a notary public in and for said county in said state hereby certify that form

Find out other Revival Charter

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple