Being Flood Prone as Defined by the National Flood Insurance Act of 1968 Form

What is the Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

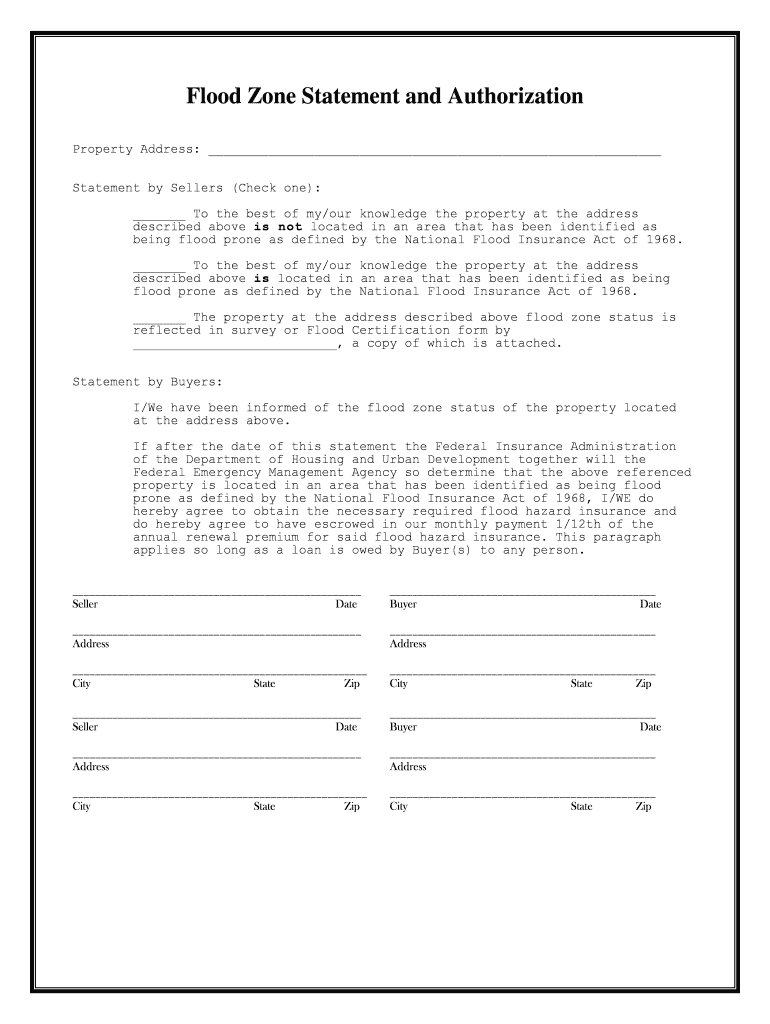

The term "being flood prone" refers to areas that have a significant risk of flooding as identified by the National Flood Insurance Act of 1968. This legislation was established to provide a framework for flood insurance and disaster relief. Properties located in flood-prone zones are often required to carry flood insurance, particularly if they are financed through federally backed loans. The Federal Emergency Management Agency (FEMA) plays a crucial role in mapping these flood zones and determining the level of risk associated with specific areas. Understanding this designation is essential for property owners and potential buyers, as it impacts insurance requirements and property values.

Steps to complete the Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

Completing the form related to being flood prone involves several key steps. First, gather necessary information about your property, including its location and any previous flood history. Next, access the appropriate form, which may be available through FEMA or relevant local authorities. Fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, review it for accuracy before submitting it. Depending on the requirements, you may need to provide additional documentation, such as proof of insurance or property assessments. Finally, submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

The legal use of the form related to being flood prone is governed by federal and state regulations. The National Flood Insurance Act of 1968 mandates that properties in designated flood zones must adhere to specific insurance requirements. This form serves as a declaration of the property’s flood risk status and is essential for compliance with federal laws. Failure to complete and submit the form can result in penalties, including ineligibility for federal disaster assistance. Additionally, accurate completion of the form is crucial for obtaining flood insurance, which protects property owners from financial losses due to flooding.

Key elements of the Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

Several key elements define the being flood prone status under the National Flood Insurance Act of 1968. These include the identification of flood zones, which are categorized based on risk levels, such as high-risk and low-risk areas. The form typically requires information about the property's location, flood zone designation, and any existing flood insurance policies. Additionally, it may request details regarding the property's construction and elevation above the base flood elevation. Understanding these elements is vital for property owners to assess their risk and comply with insurance requirements.

How to obtain the Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

To obtain the form related to being flood prone, individuals can visit the FEMA website or contact local government offices that handle flood insurance matters. The form may also be available through insurance agents who specialize in flood coverage. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change. Once obtained, follow the outlined steps to complete and submit the form accurately to ensure compliance with federal guidelines.

Examples of using the Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

Examples of using the form related to being flood prone include scenarios where property owners seek flood insurance or apply for disaster assistance following a flood event. For instance, a homeowner in a high-risk flood zone may need to complete the form to secure a mortgage that requires flood insurance. Additionally, after a flooding incident, property owners may need to submit the form to apply for federal aid to recover damages. These examples illustrate the form's importance in navigating both insurance and disaster relief processes.

Quick guide on how to complete being flood prone as defined by the national flood insurance act of 1968

Complete Being Flood Prone As Defined By The National Flood Insurance Act Of 1968 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Being Flood Prone As Defined By The National Flood Insurance Act Of 1968 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Being Flood Prone As Defined By The National Flood Insurance Act Of 1968 with ease

- Obtain Being Flood Prone As Defined By The National Flood Insurance Act Of 1968 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and electronically sign Being Flood Prone As Defined By The National Flood Insurance Act Of 1968 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to be flood prone as defined by the National Flood Insurance Act of 1968?

Being flood prone as defined by the National Flood Insurance Act of 1968 refers to areas that are at high risk of flooding. This designation helps determine eligibility for flood insurance and potential mitigation efforts. Understanding this definition is crucial for property owners to protect their investments and comply with federal regulations.

-

How can airSlate SignNow help businesses manage flood-related documents?

airSlate SignNow allows businesses to easily send and eSign documents related to flood insurance and management. With its intuitive interface, you can quickly prepare necessary paperwork without the hassle of traditional methods. This efficiency is vital for responding to the requirements outlined in Being Flood Prone As Defined By The National Flood Insurance Act Of 1968.

-

Are there any specific features in airSlate SignNow related to flood insurance documentation?

Yes, airSlate SignNow offers features tailored for managing flood insurance documentation. You can create templates for quick access to frequently used forms, ensuring compliance with the regulations regarding Being Flood Prone As Defined By The National Flood Insurance Act Of 1968. Additionally, it provides secure storage options for sensitive documents.

-

What are the pricing options for airSlate SignNow, and do they offer value for those impacted by flooding?

airSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs. Each plan provides competitive value, especially for those located in flood-prone areas as defined by the National Flood Insurance Act of 1968. Investing in an efficient document management solution can save time and money in the long run.

-

How does airSlate SignNow integrate with other tools for flood risk management?

airSlate SignNow seamlessly integrates with several popular tools and platforms that assist in flood risk management. This integration allows for streamlined workflows, ensuring that all necessary documentation complies with standards related to Being Flood Prone As Defined By The National Flood Insurance Act Of 1968. The ability to connect with existing systems enhances productivity.

-

What benefits can businesses expect from using airSlate SignNow in relation to flood insurance?

By utilizing airSlate SignNow, businesses can expect increased efficiency and accuracy in managing flood insurance documents. The platform ensures compliance with the requirements of Being Flood Prone As Defined By The National Flood Insurance Act Of 1968, making it easier to navigate the complexities of flood risk. Moreover, the eSignature feature accelerates the approval process.

-

Can airSlate SignNow assist with the renewal of flood insurance policies?

Indeed, airSlate SignNow can streamline the renewal process of flood insurance policies by providing easy-to-use templates and quick electronic signatures. This process is especially important for those identified as Being Flood Prone As Defined By The National Flood Insurance Act Of 1968, ensuring timely compliance with policy requirements. Efficient document management helps prevent lapses in coverage.

Get more for Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

- Ca form 3539 instructions

- Statement of no loss template form

- Osap request for an exceptional circumstances review form

- Ms medicaid dom 317 form

- Iapmo 2aa listing form

- Kansas sentencing guidelines journal entry of judgment form

- Physicians statement of good health for child care form

- Micro needling consent form patientpopmicroneedling consent form fill out and sign printable microneedling with skinpenpatient

Find out other Being Flood Prone As Defined By The National Flood Insurance Act Of 1968

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now