26 U S C 104 U S Code Title 26 Internal Revenue Code Form

What is the 26 U S C 104 U S Code Title 26 Internal Revenue Code

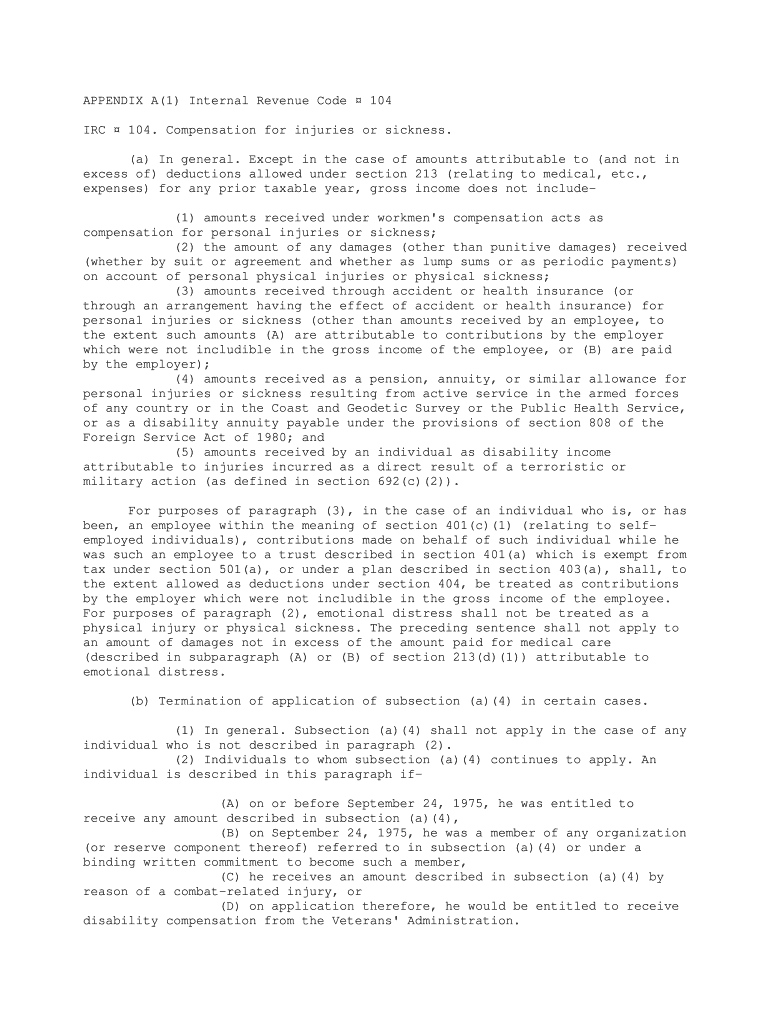

The 26 U S C 104 U S Code Title 26 Internal Revenue Code pertains to the treatment of certain types of income for tax purposes. Specifically, it addresses the exclusion from gross income of damages received on account of personal physical injuries or physical sickness. This section is crucial for individuals who receive compensation for injuries, as it clarifies the tax implications of such payments. Understanding this code is essential for ensuring compliance with tax regulations and for making informed financial decisions.

How to use the 26 U S C 104 U S Code Title 26 Internal Revenue Code

Utilizing the 26 U S C 104 U S Code Title 26 Internal Revenue Code involves understanding its provisions and applying them correctly when reporting income. Taxpayers who receive damages for personal injuries should determine if their compensation qualifies for exclusion under this code. It is advisable to consult a tax professional to ensure accurate reporting and compliance with IRS guidelines. Proper documentation of the nature of the damages and any related medical expenses is also essential for substantiating claims.

Steps to complete the 26 U S C 104 U S Code Title 26 Internal Revenue Code

Completing the requirements of the 26 U S C 104 U S Code Title 26 Internal Revenue Code involves several key steps:

- Identify the type of compensation received and confirm if it falls under the exclusion criteria.

- Gather necessary documentation, including legal agreements and medical records.

- Consult IRS guidelines to understand how to report the income accurately.

- Complete your tax return, ensuring that any excluded amounts are properly noted.

Legal use of the 26 U S C 104 U S Code Title 26 Internal Revenue Code

The legal use of the 26 U S C 104 U S Code Title 26 Internal Revenue Code is vital for individuals receiving compensation for personal injuries. This code provides a legal framework that allows certain compensatory damages to be excluded from taxable income. Compliance with this code ensures that taxpayers do not incur unnecessary tax liabilities on funds intended for recovery from injuries. Legal counsel may be beneficial to navigate complex cases and ensure that all aspects of the law are adhered to.

IRS Guidelines

The IRS provides specific guidelines regarding the application of the 26 U S C 104 U S Code Title 26 Internal Revenue Code. These guidelines outline what qualifies as excludable income and the documentation required to support claims. Taxpayers should familiarize themselves with these guidelines to ensure compliance and avoid potential audits. The IRS also emphasizes the importance of accurate record-keeping and reporting to substantiate claims for exclusions under this code.

Eligibility Criteria

Eligibility for the exclusions provided under the 26 U S C 104 U S Code Title 26 Internal Revenue Code primarily hinges on the nature of the damages received. To qualify, the compensation must be for personal physical injuries or physical sickness. Emotional distress claims may also qualify if they are directly linked to a physical injury. It is essential for taxpayers to assess their specific circumstances against these criteria to determine eligibility for exclusion.

Quick guide on how to complete 26 usc104 us code title 26 internal revenue code

Effortlessly Prepare 26 U S C 104 U S Code Title 26 Internal Revenue Code on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 26 U S C 104 U S Code Title 26 Internal Revenue Code on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Edit and Electronically Sign 26 U S C 104 U S Code Title 26 Internal Revenue Code with Ease

- Locate 26 U S C 104 U S Code Title 26 Internal Revenue Code and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign 26 U S C 104 U S Code Title 26 Internal Revenue Code and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of 26 U S C 104 U S Code Title 26 Internal Revenue Code in eSignature services?

The 26 U S C 104 U S Code Title 26 Internal Revenue Code is essential for understanding the tax implications of eSigning documents. This code outlines the specific tax treatment of income received, which can impact how businesses approach digital transactions and agreements. Understanding this law ensures compliance and can help in strategic tax planning.

-

How does airSlate SignNow comply with 26 U S C 104 U S Code Title 26 Internal Revenue Code?

airSlate SignNow is committed to ensuring that its eSignature solutions adhere to all relevant legal standards, including the 26 U S C 104 U S Code Title 26 Internal Revenue Code. We implement strict security measures and provide features that help users remain compliant when signing tax-related documents electronically. This compliance fosters trust and ensures that your documents are legally binding.

-

What pricing options does airSlate SignNow offer for businesses looking to eSign documents related to 26 U S C 104 U S Code Title 26 Internal Revenue Code?

airSlate SignNow provides a variety of pricing plans tailored to meet the needs of businesses of all sizes. These include basic to advanced packages, allowing you to choose a plan that aligns with your usage and compliance needs, particularly for documentation tied to the 26 U S C 104 U S Code Title 26 Internal Revenue Code. Our pricing is transparent, with no hidden fees, making it cost-effective for businesses.

-

What features does airSlate SignNow offer to support compliance with 26 U S C 104 U S Code Title 26 Internal Revenue Code?

airSlate SignNow offers features such as customizable templates, secure storage, and comprehensive audit trails, which are essential for maintaining compliance with the 26 U S C 104 U S Code Title 26 Internal Revenue Code. These features not only simplify the signing process but also ensure that all documentation is verifiable and in line with legal requirements. Easy access to compliance tools means peace of mind for users.

-

Can airSlate SignNow integrate with other platforms for handling documents related to 26 U S C 104 U S Code Title 26 Internal Revenue Code?

Yes, airSlate SignNow seamlessly integrates with various platforms, including CRM and accounting software, to manage documents related to the 26 U S C 104 U S Code Title 26 Internal Revenue Code efficiently. This integration streamlines the workflow, allowing for easy access to your documents while ensuring compliance. Users can enhance their eSignature experience and ensure all related processes are efficient and compliant.

-

What benefits does airSlate SignNow provide for businesses needing to manage tax-related documents under 26 U S C 104 U S Code Title 26 Internal Revenue Code?

The benefits of using airSlate SignNow for managing tax-related documents under 26 U S C 104 U S Code Title 26 Internal Revenue Code include time savings and increased efficiency. Our easy-to-use platform allows users to send, sign, and store documents digitally, reducing the time spent on paperwork. Additionally, features such as automated reminders and cloud storage enhance document management and compliance.

-

Is airSlate SignNow secure for handling sensitive tax documents related to 26 U S C 104 U S Code Title 26 Internal Revenue Code?

Absolutely, airSlate SignNow prioritizes the security of all your documents, especially those pertaining to sensitive tax matters under the 26 U S C 104 U S Code Title 26 Internal Revenue Code. Our platform employs advanced security protocols, including encryption and multi-factor authentication, to protect your data. We understand the importance of compliance and confidentiality when handling sensitive information.

Get more for 26 U S C 104 U S Code Title 26 Internal Revenue Code

Find out other 26 U S C 104 U S Code Title 26 Internal Revenue Code

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe