26 U S Code104 Compensation for Injuries or Sickness Form

What is the 26 U S Code 104 Compensation For Injuries Or Sickness

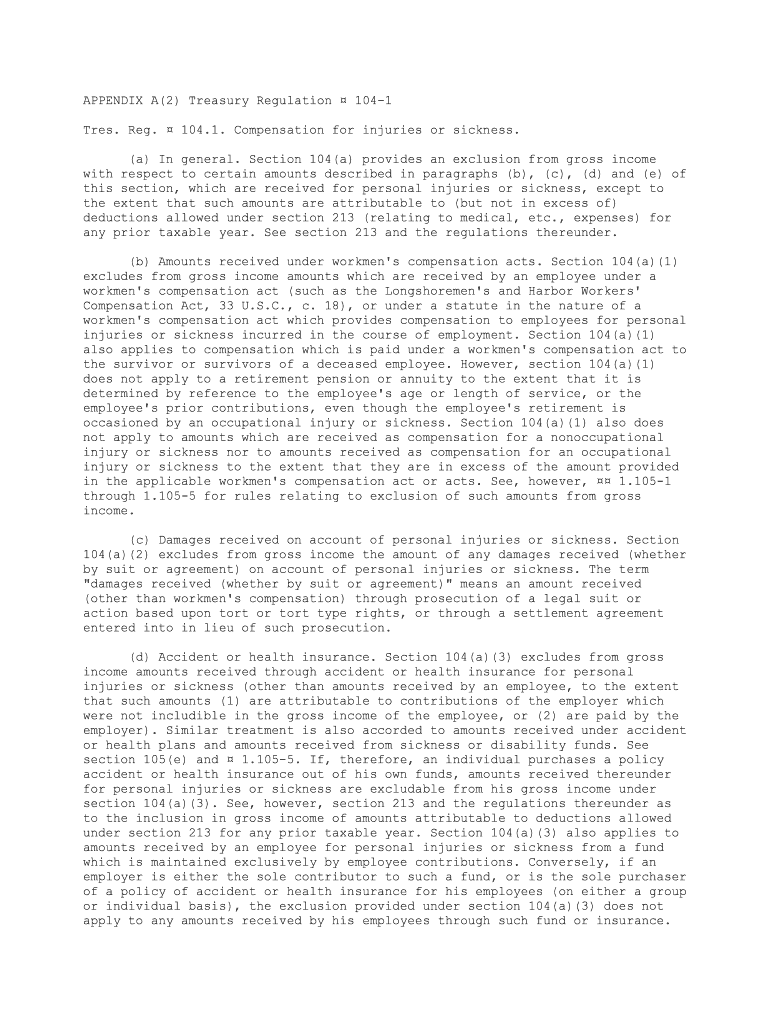

The 26 U S Code 104 Compensation For Injuries Or Sickness pertains to the tax treatment of certain types of compensation received due to personal injuries or sickness. Under this code, amounts received as compensation for physical injuries or sickness are generally excluded from gross income. This means that individuals do not have to pay federal income tax on these amounts, which can include payments from lawsuits, settlements, or insurance claims related to personal injury. Understanding this provision is essential for taxpayers who may be navigating the complexities of tax implications following an injury or illness.

How to use the 26 U S Code 104 Compensation For Injuries Or Sickness

Utilizing the 26 U S Code 104 involves accurately reporting any compensation received for injuries or sickness on your tax return. Taxpayers must ensure that they document the nature of the compensation and maintain records of any settlements or payments received. It is important to differentiate between compensatory damages, which may be excluded from income, and punitive damages, which are generally taxable. Taxpayers should consult with a tax professional to ensure compliance with IRS regulations and to maximize potential tax benefits.

Key elements of the 26 U S Code 104 Compensation For Injuries Or Sickness

Several key elements define the application of the 26 U S Code 104. These include:

- Physical injuries or sickness: The compensation must be related to a physical injury or sickness to qualify for exclusion from income.

- Compensatory damages: Only compensatory damages are excluded; punitive damages are taxable.

- Documentation: Proper documentation is necessary to substantiate the nature of the compensation received.

- Taxpayer status: The tax treatment may vary based on the taxpayer's circumstances, such as whether they are self-employed or an employee.

Eligibility Criteria

To qualify for the tax exclusion under 26 U S Code 104, individuals must meet specific eligibility criteria. The compensation must be for physical injuries or sickness, which may include conditions resulting from accidents or medical conditions. Additionally, the compensation must not be for emotional distress unless it is directly related to a physical injury. Understanding these criteria is vital for taxpayers to determine if their compensation qualifies for exclusion from taxable income.

IRS Guidelines

The IRS provides guidelines on how to report compensation received under 26 U S Code 104. Taxpayers are advised to refer to IRS Publication 4345, which outlines the tax treatment of damages received for personal physical injuries. This publication offers detailed information on what qualifies as compensatory damages and how to report them accurately on tax returns. Following these guidelines helps ensure compliance and reduces the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for tax returns can impact the reporting of compensation under 26 U S Code 104. Generally, individual tax returns are due on April 15 each year. However, if a taxpayer receives compensation after this date, they may need to file an amended return. It is essential to keep track of any changes in compensation and adhere to IRS deadlines to avoid late penalties. Taxpayers should also be aware of any extensions that may apply to their specific situations.

Quick guide on how to complete 26 us code104 compensation for injuries or sickness

Complete 26 U S Code104 Compensation For Injuries Or Sickness effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 26 U S Code104 Compensation For Injuries Or Sickness on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 26 U S Code104 Compensation For Injuries Or Sickness with ease

- Locate 26 U S Code104 Compensation For Injuries Or Sickness and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign 26 U S Code104 Compensation For Injuries Or Sickness and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 26 U S Code104 Compensation For Injuries Or Sickness?

The 26 U S Code104 Compensation For Injuries Or Sickness refers to a tax provision that excludes certain compensations from taxable income. This means that if you receive compensation for injuries or sickness, you may not have to pay taxes on that amount, depending on specific conditions. Understanding this code is crucial for ensuring compliance and maximizing your financial benefits.

-

How does airSlate SignNow help with documents related to 26 U S Code104 Compensation For Injuries Or Sickness?

airSlate SignNow streamlines the process of creating and signing documents related to 26 U S Code104 Compensation For Injuries Or Sickness. With our eSigning capabilities, you can securely sign and manage documents, ensuring they are legally binding and compliant with relevant regulations. This simplifies your workflow while providing peace of mind.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing plans tailored to different business needs. Our packages are designed to be cost-effective while providing all the essential features to manage your documents related to 26 U S Code104 Compensation For Injuries Or Sickness. You can choose a plan that aligns with your budget and required functionalities.

-

Can airSlate SignNow assist with compliance regarding 26 U S Code104?

Yes, airSlate SignNow provides tools that help ensure compliance with the 26 U S Code104. Our platform offers templates and workflows that are designed to meet the legal standards for documents and signatures, which is essential when dealing with compensation for injuries or sickness. This ensures your processes are streamlined and compliant.

-

What features does airSlate SignNow offer for handling complex documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and bulk sending, making it ideal for handling complex documents related to 26 U S Code104 Compensation For Injuries Or Sickness. This ensures that all necessary parties can sign and complete documents efficiently, reducing turnaround times and administrative burdens.

-

Are there integrations available with airSlate SignNow that facilitate handling 26 U S Code104 documents?

Absolutely! airSlate SignNow integrates with various third-party applications and platforms, enhancing its capabilities for managing documents related to 26 U S Code104 Compensation For Injuries Or Sickness. Whether you use CRM systems, cloud storage solutions, or project management tools, our integrations help streamline your workflow.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry-leading security standards to protect all information shared on our platform, especially for sensitive documents related to 26 U S Code104 Compensation For Injuries Or Sickness. This provides users with confidence in the safety and integrity of their data.

Get more for 26 U S Code104 Compensation For Injuries Or Sickness

Find out other 26 U S Code104 Compensation For Injuries Or Sickness

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online