Special Tax Notice Regarding Plan Payments NYCERS Form

What is the Special Tax Notice Regarding Plan Payments NYCERS

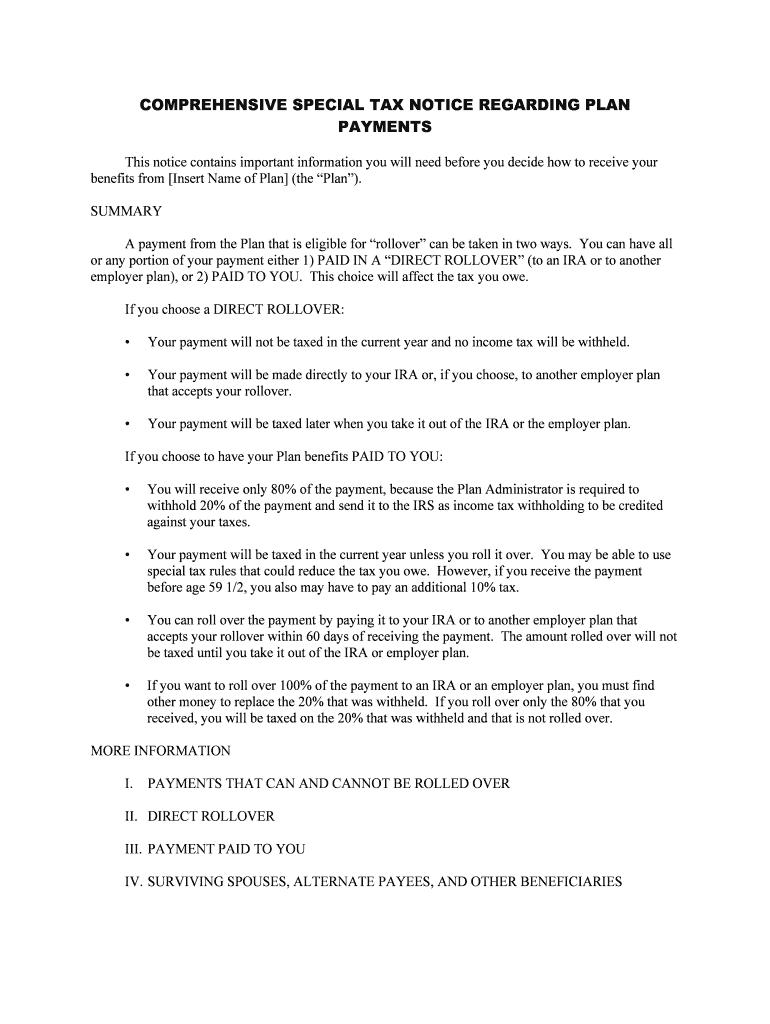

The Special Tax Notice Regarding Plan Payments from the New York City Employees' Retirement System (NYCERS) is a critical document that provides essential information to members about the tax implications of distributions from their retirement plans. This notice outlines the tax treatment of plan payments, including potential withholding and rollover options. Understanding this notice is vital for ensuring compliance with tax regulations and for making informed decisions regarding retirement funds.

Steps to Complete the Special Tax Notice Regarding Plan Payments NYCERS

Completing the Special Tax Notice Regarding Plan Payments requires careful attention to detail. Here are the steps to follow:

- Review the notice thoroughly to understand the tax implications of your plan payments.

- Gather necessary personal information, including your Social Security number and retirement account details.

- Fill out the required sections of the notice, ensuring accuracy in your entries.

- Sign and date the notice to validate your acknowledgment of the information provided.

- Submit the completed notice according to the instructions provided, either online or via mail.

Legal Use of the Special Tax Notice Regarding Plan Payments NYCERS

The Special Tax Notice Regarding Plan Payments is legally binding when completed correctly. It serves as an official record of your understanding of the tax implications associated with your retirement plan distributions. For the notice to hold legal weight, it must be filled out accurately and submitted in compliance with applicable regulations. This ensures that both you and the retirement system adhere to the necessary legal frameworks governing retirement distributions.

Key Elements of the Special Tax Notice Regarding Plan Payments NYCERS

This notice includes several key elements that members must understand:

- Tax Withholding Information: Details on how much tax may be withheld from your distributions.

- Rollover Options: Information on how to roll over your distributions to avoid immediate tax consequences.

- Eligibility Criteria: Guidelines on who qualifies for different types of distributions.

- Contact Information: Resources for additional questions or clarifications regarding the notice.

How to Obtain the Special Tax Notice Regarding Plan Payments NYCERS

Members can obtain the Special Tax Notice Regarding Plan Payments by visiting the NYCERS website or contacting their member services. The notice may also be provided during retirement planning sessions or when members request their retirement benefit information. Ensuring you have the most recent version of the notice is important for compliance and accurate tax reporting.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Special Tax Notice Regarding Plan Payments. Members should check the NYCERS website for specific dates related to tax filings and any updates that may affect their retirement distributions. Missing these deadlines can result in penalties or delayed processing of your retirement benefits.

Quick guide on how to complete special tax notice regarding plan payments nycers

Complete Special Tax Notice Regarding Plan Payments NYCERS effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, amend, and eSign your documents swiftly without any delays. Handle Special Tax Notice Regarding Plan Payments NYCERS on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Special Tax Notice Regarding Plan Payments NYCERS without hassle

- Locate Special Tax Notice Regarding Plan Payments NYCERS and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in several clicks from any gadget of your preference. Modify and eSign Special Tax Notice Regarding Plan Payments NYCERS and ensure excellent coordination at any juncture of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Special Tax Notice Regarding Plan Payments NYCERS?

The Special Tax Notice Regarding Plan Payments NYCERS outlines the federal tax implications and guidelines related to plan distributions. It is essential for members to understand how this notice affects their retirement benefits and tax obligations. By reviewing this notice, beneficiaries can make informed decisions about their plan payments.

-

How can airSlate SignNow help with the Special Tax Notice Regarding Plan Payments NYCERS?

airSlate SignNow simplifies the process of sending and eSigning documents, including the Special Tax Notice Regarding Plan Payments NYCERS. Our platform allows users to manage these important documents securely and efficiently. With easy access to templates and document tracking, you can ensure timely compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different needs, whether you are an individual or a business. Our subscription models provide cost-effective solutions for managing documents related to the Special Tax Notice Regarding Plan Payments NYCERS. Each plan includes features designed to enhance your document signing experience.

-

What features does airSlate SignNow provide for managing documents related to NYCERS?

Our platform includes a range of features such as customizable templates, secure cloud storage, and eSignature functionalities tailored for documents like the Special Tax Notice Regarding Plan Payments NYCERS. These features streamline the signing process and enhance efficiency. Users can easily collaborate and track the status of their documents in real-time.

-

Is airSlate SignNow compliant with federal regulations for tax documents?

Yes, airSlate SignNow is designed to comply with federal regulations, ensuring that the signing process for documents like the Special Tax Notice Regarding Plan Payments NYCERS adheres to legal standards. Our platform maintains high security and privacy standards, giving you peace of mind when handling sensitive financial information.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows seamless integration with various applications, enhancing your workflow for handling the Special Tax Notice Regarding Plan Payments NYCERS. Popular integrations include Google Drive, Dropbox, and CRM systems, enabling you to streamline document management and eSigning processes across platforms.

-

How does airSlate SignNow enhance workflow efficiency?

With airSlate SignNow, users can automate and streamline workflows related to the Special Tax Notice Regarding Plan Payments NYCERS. Our intuitive interface allows you to quickly send and receive documents, reducing turnaround time signNowly. This efficiency not only saves time but also helps in achieving compliance more effectively.

Get more for Special Tax Notice Regarding Plan Payments NYCERS

Find out other Special Tax Notice Regarding Plan Payments NYCERS

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed